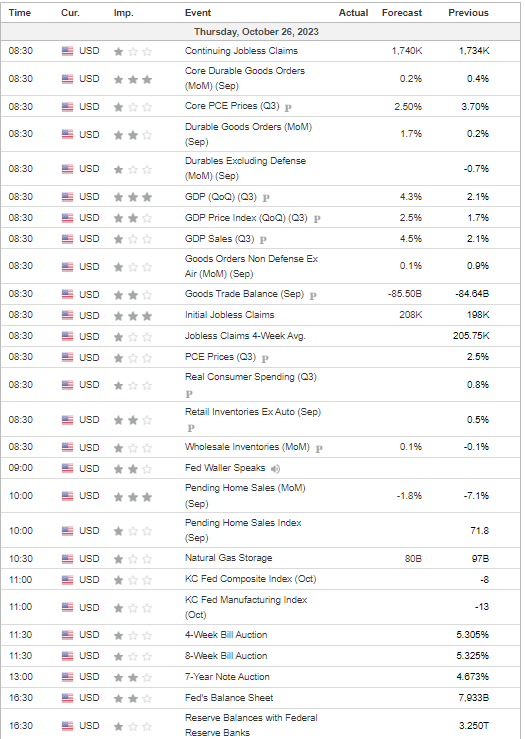

US GDP 8:30 AM ET

Pretty RED out there

- Hong Kong: Hang Seng closed down -0.24%

- China CSI 300 +0.28%

- Taiwan KOSPI -2.71%

- India Nifty 50 -1.41%

- Australia ASX +0.01%

- Japan Nikkei -1.10%

- European bourses all in NEGATIVE territory so far this morning

- USD +0.18%

NOTABLE EARNINGS TODAY

$NRDS$TBBK$SHYF$MBLY$BPMC$HTZ$OSTK$VC$OLN$ULCC$PMT$HZO$RCL$UPS$HSY$AMZN$ENPH$INTC$CMG$F$DXCM$LUV$MO$VLO$NOC$MRK$MA$SKX$COF$TSCO$NEM

TOP STORIES OVERNIGHT

Shanghai copper climbs to two-week high on upbeat demand outlook-Reuters

Copper prices in Shanghai climbed to a two-week peak on Wednesday, underpinned by better demand outlook following top consumer China’s decision to roll out fresh stimulus measures to support the economy.

The most-traded December copper contract on the Shanghai Futures Exchange SCFcv1 rose 1.1% to 66,900 yuan ($9,149.34)per metric ton by 0351 GMT, the highest since Oct. 10.

Market confidence was also boosted in October by strong demand for copper, the metal used for construction, power and transportation sectors.

COMMENTS: This is promising

UPS Cuts Forecast After Profit Misses Estimates on Higher Costs-BBG

United Parcel Service Inc. reduced its annual profit target on a spike in costs from a new union labor contract and weaker package demand.

Adjusted earnings came to $1.57 a share, down 47% from a year ago, UPS said Thursday in a statement. Analysts had expected $1.52 after slashing the estimate by about 40 cents due to the impact of a new labor agreement that took effect Aug. 1. Sales dropped about 13% to $21.1 billion. Analysts had forecast $21.5 billion.

“While unfavorable macro-economic conditions negatively impacted global demand in the quarter, our US labor contract was fully ratified in early September and volume that diverted during our labor negotiations is starting to return to our network,” Chief Executive Officer Carol Tomé said in the statement.

The courier also has pledged to cut 2,500 management jobs and lean on automation to boost worker efficiency.

COMMENTS: UPS is considered a leading economic indicator for how the US economy is doing

US GDP Data to Show Temporary Boost from Summer-Spending Frenzy-BBG

US economic activity probably expanded at a nearly 5% annualized rate over the last three months amid a bevy of temporary tailwinds, according to Bloomberg Economics.

The first official look at gross domestic product for the July-to-September period, due Thursday from the Bureau of Economic Analysis, is set to show strength in consumer spending alongside slower growth in business investment, Bloomberg economist Eliza Winger said Wednesday in a preview of the numbers.

A frenzy of summer spending on travel and entertainment drove real GDP growth to an unsustainable pace in the third quarter,” Winger said. “The Fed’s tightening cycle is taking time to hit the real economy, but we believe higher mortgage rates, credit-card debts and business-loan defaults will hit growth this quarter.”

A growth rate near 5% in the third quarter would mark an acceleration over what’s already been a strong year for the US economy, which has expanded by at least 2% in each of the last four quarters. The surprising resilience has kept the Fed on a tightening path despite slowing inflation.

Bloomberg Economics projects a shallow recession will begin in the fourth quarter. Their 4.9% prediction for the third-quarter report comes in above the 4.5% median estimate in a Bloomberg survey of outside forecasters.

COMMENTS: US GDP out today…important day

US 10 year yield back near 5% puts more pressure on stocks-Reuters

U.S Treasury yields were heading back towards 5% on Thursday, dragging shares around the world to multi-month lows in the middle of a busy week for corporate earnings, with an ECB meeting and the release of U.S. GDP to come later in the day.

A rebound in U.S. home sales and an auction of five-year notes that showed weak demand were the latest trigger for concern in the bond market, which saw the U.S. 10 year Treasury yield rise 11 basis points on Wednesday.

That move continued on Thursday, with the benchmark yield reaching 4.989%, challenging the 5.021% – the highest since 2007 – hit earlier in the week.

“The Treasury market is clearly very much top of mind, the big back up in yields yesterday appeared to have quite a negative impact on equities as well, so how that evolves and how it reacts to data we have this week will be the big swing factor for global markets,” said Kiran Ganesh global head of investment communications at UBS Wealth Management.

U.S. third quarter GDP, released later today, is unlikely to provide help for the bond market as it is expected to show the U.S. economy grew at its fastest quarterly pace in two years, and so offer nothing to derail expectations the Fed will keep rates high for longer.

COMMENTS: Yields governing the market

Army Briefly Raids Gaza as War Fears Jolt Markets-BBG

Israel’s military said it made a limited ground raid into northern Gaza with infantry and tanks before withdrawing, as it kept up airstrikes on the besieged territory. A series of Israeli incursions have previously sought to gather intelligence on Hamas and hostages.

COMMENTS: Markets jittery on war fear

US DATA TODAY