Pretty RED out there

- Hong Kong: Hang Seng closed down -1.48%

- China CSI 300 -0.58%

- Taiwan KOSPI -1.31%

- India Nifty 50 -0.03%

- Australia ASX +0.12%

- Japan Nikkei -1.31%

- European bourses all in negative territory so far this morning

- USD -0.04%

TOP STORIES OVERNIGHT

China Evergrande Misses Payments on $547 Million Onshore Bond-BBG

The mainland unit of China Evergrande Group said it missed principal and interest payments totaling several billion yuan, adding further uncertainty to the fate of the giant developer at the center of the country’s property crisis.

Hengda Real Estate Group failed to repay 4 billion yuan ($547 million) in principal plus interest due on Sept. 25, the company said in a Shenzhen stock exchange filing Monday.

China Evergrande canceled key creditor meetings that had been set for this week and said it must reassess its proposed restructuring. The company faces an Oct. 30 hearing at a Hong Kong court on a winding-up petition, which could potentially force it into liquidation.

COMMENTS: This is what was pressuring Asian markets today, in particular Hong Kong.

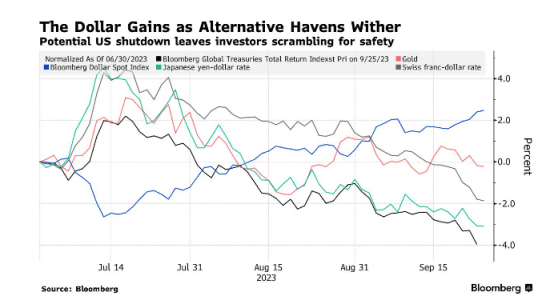

US Dollar Emerges as Best Haven From American Government Shutdown Fears-BBG

The greenback is once more proving it’s the only haven that matters.

Treasuries are cratering — and sending other bond markets down — as a looming shutdown underscores the potential that US fiscal profligacy will spur issuance. With the Federal Reserve determined to keep interest rates higher for longer, investors are finding few places to hide apart from the world’s reserve currency.

The rout in US sovereign securities is actually spurring dollar demand, by helping to drive up the interest rates that buyers of the currency can receive — and keep them elevated. Investors are facing an unprecedented third straight year of losses as the $25.5 trillion Treasuries market is wracked by liquidity concerns, ever-tighter Fed policy, increased US government issuance, and the volatility created as investors get forced out of large futures bets.

“The US dollar is a high yielding, high growth, safe haven — an unusual and powerful combination,” said Andrew Ticehurst, a rates strategist at Nomura Inc. in Sydney. “We expect USD strength to continue, driven by growth divergences, higher rates and potential further risk-off moves ahead.”

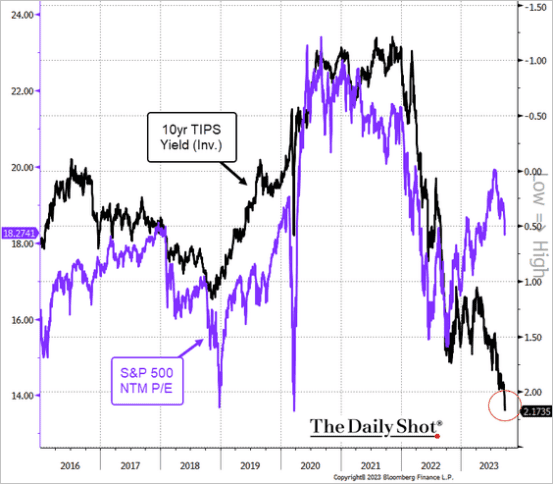

Rising real yields weigh on stock valuations.-Soberlook

COMMENTS: The bond market is the tail wagging the dog (stock market)

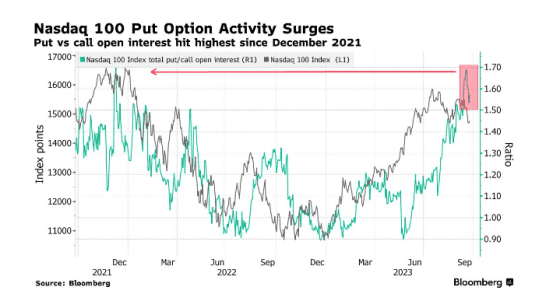

Short Positions Pile Up in Nasdaq Futures, Citi Strategists Say-BBG

Investors are souring on the technology-heavy Nasdaq 100 Index, building short positions in the futures market, according to Citigroup Inc. strategists.

Positioning in the Nasdaq 100 is now one-sided net short at $8.1 billion, with all long positions unwound, a team led by Chris Montagu wrote in a note. Meanwhile, there’s a modest net short position in S&P 500 futures but $15 billion of long positions are still outstanding.

The bets against the tech sector reflect growing investor concern that interest rates will stay higher for longer. The Nasdaq 100, at its 2023 peak in July, was up 45% for the year. It’s since slipped 6.8% as investors realized the Fed wouldn’t be cutting rates any time soon. Bond yields have marched higher, weighing on the appeal of the sector with lofty valuations.

“Despite the extended selloff, net positioning in all markets is not overly extended. Neither are profits/losses very large,” Montagu wrote. “This leaves positioning relatively light and generally reflecting the apparent bearish sentiment globally.”

COMMENTS: As Mike Green noted in last Wednesday’s spaces, put protection has never been so cheap.

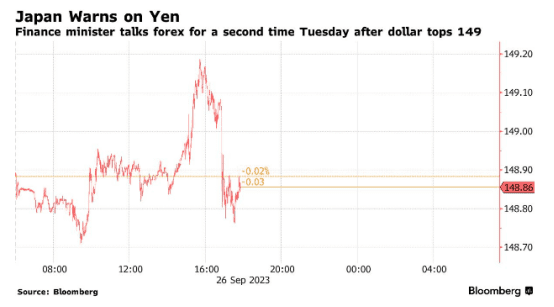

Japan Warns Again on Yen After Dollar Breaches 149 Mark-BBG

Japan’s finance minister issued his second salvo of warnings to players in foreign-exchange markets in a day after the yen reached its lowest against the dollar since October, the month authorities last intervened to prop up the currency.

“As I said at the morning press conference, I’m watching market trends with a high sense of urgency,” Finance Minister Shunichi Suzuki said Tuesday afternoon.

While his comments in the morning triggered little reaction, his warning in the afternoon — with European traders now at their desks — sparked a strengthening of the yen back to 148.77 against the dollar from 149.19 about an hour earlier.

COMMENTS: Always keep an eye on the Yen and possible BOJ intervention, a lot of carry trades could unwind.

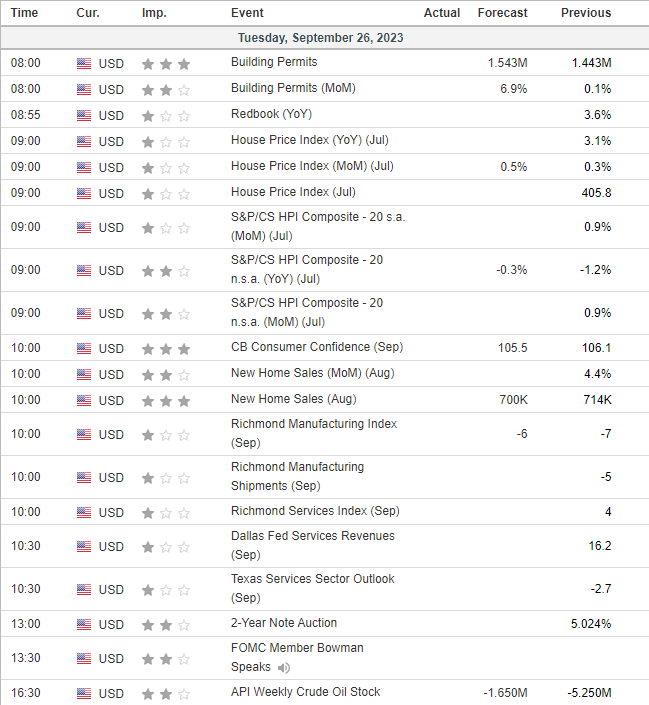

US DATA TODAY