We have GREEN today

- Hong Kong: Hang Seng closed up +0.42%

- China CSI 300 +0.74%

- Taiwan KOSPI +0.44%

- India Nifty 50 +0.60%

- Australia ASX -0.13%

- Japan Nikkei +0.64%

- All European bourses in positive territory so far this morning

- US indices in positive territory so far this morning in pre-market USD -0.87%

Overnight Data/News

- China PBoC Sets Yuan Mid-Point At 6.9207 / Dollar VS Last Close 6.9270

- China PBoC Injects 93B Yuan Of 7 Day Reverse Repo At 2%; Injecting A Net 59B Yuan In Open Market Ops

- China Industrial Profits YTD (Y/Y) Mar: -21.4% (prev -22.9%)

- Australia Export Price Index (Q/Q) Q1: 1.6% (est -2.6%; prev -0.9%) – Import Price Index (Q/Q) Q1: -4.2% (est 0.5%; prev 1.8%)

- Japan Leading Index CI Feb F: 98.0 (prev 97.7) – Coincident Index Feb F: 98.6 (prev 99.2)

- Norwegian Retail Sales W/Auto Fuel (M/M) Mar: 0.0% (est 0.3%; prev 0.2%)

- Spanish Retail Sales SA (Y/Y) Mar: 9.5% (est 3.5%; prev 4.0%) – Spanish Unemployment Rate Mar: 13.26% (est 13.00%; prev 12.87%) – Spanish Retail Sales (Y/Y) Mar: 9.7% (prev 3.5%)

- Italian Consumer Confidence Index Apr: 105.5 (est 105.0; prev 62.8) – Italian Manufacturing Confidence Apr: 103.0 (est 104.0; prevR 104.1) – Italian Economic Sentiment Apr: 110.5 (prevR 110.1)

- Eurozone Consumer Confidence Index Apr F: -17.5 (prev -17.5) – Eurozone Economic Confidence Apr: 99.3 (est 99.9; prevR 99.2) – Eurozone Industrial Confidence Apr: -2.6 (est 0.0; prev -0.2) – Eurozone Services Confidence Apr: 10.5 (est 9.5; prev 9.4)

- US Growth Set To Have Cooled In First Quarter As Fed Pushed Rates Higher – FT

- Bank Turmoil Seen Crimping Credit At Double Powell’s Estimate – BBG

- Microsoft Cuts Production Of Surface Accessories Amid PC Slump – Nikkei

- Deutsche Bank Posts Better-Than-Expected Profit; Flags Job Cuts – RTRS

- Russia Says OPEC+ Sees No Need For Further Oil Output Cuts – RTRS

- Germany In Talks To Limit The Export Of Chip Chemicals To China – BBG

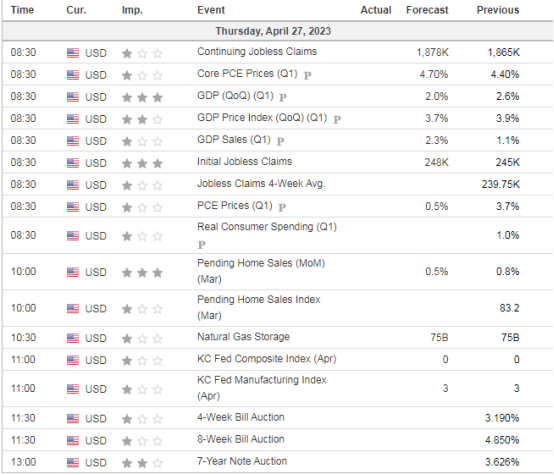

US DATA TODAY