A lot of US data this morning!

Mixed Markets -China rebounds after huge losses last week

- Hong Kong: Hang Seng closed up +1.88%

- China CSI 300 +0.94%

- Taiwan KOSPI -0.03%

- India Nifty 50 +0.69%

- Australia ASX -0.30%

- Japan Nikkei -0.21%

- European bourses mixed so far this morning

- USD -0.15%

TOP 5 STORIES OVERNIGHT

Theme: Recession

- BOE Set to Tip UK Into Recession by Year End, Economists Say-BBG

The Bank of England will push the UK into recession by the end of the year in its battle to curb the worst inflation of any Group of Seven economy, according to Bloomberg Economics.

In an analysis published Tuesday, economists Dan Hanson and Ana Andrade say a shallow if protracted downturn is the price of taming an inflation rate that remains stubbornly close to double digits — despite 13 straight interest-rate increases since the end of 2021.

- German bond yield curve most inverted in nearly 31 years-Reuters

The German yield curve was at its most inverted in nearly 31 years on Tuesday as investors bet that a flagging economy would lead the European Central Bank to cut interest rates after they reach their peak around 4%.

Euro area borrowing costs barely moved after President Christine Lagarde said euro zone inflation had entered a new phase which could linger for some time, requiring the ECB to keep policy tight and avoid declaring an end to rate hikes.

“Markets have priced two more rate hikes from the ECB after the last policy meeting; I think they need more data to change their view,” said Massimiliano Maxia, senior fixed income specialist at Allianz Global Investors.

Germany’s 2-year government bond yield , most sensitive to expectations for policy rates, rose 1.5 basis points (bps) to 3.16%. Last Friday, it hit 3.282%, its highest level since March 9.

- A U.S. recession is coming this year, HSBC warns — with Europe to follow in 2024 -CNBC

The U.S. will enter a downturn in the fourth quarter, followed by a “year of contraction and a European recession in 2024,” according to HSBC Asset Management.

In its mid-year outlook, the British banking giant’s asset manager said recession warnings are “flashing red” for many economies, while fiscal and monetary policies are out of sync with stock and bond markets.

Global Chief Strategist Joseph Little said while some parts of the economy have remained resilient thus far, the balance of risks “points to high recession risk now,” with Europe lagging the U.S. but the macro trajectory generally “aligned.”

“We are already in a mild profit recession, and corporate defaults have started to creep up too,” Little said in the report seen by CNBC.

“The silver lining is that we expect high inflation to moderate relatively quickly. That will create an opportunity for policymakers to cut rates.”

All of this is weighing heavily on commodities so far today

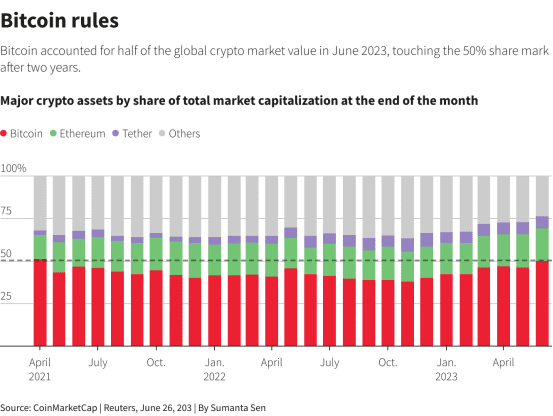

- Cryptoverse: Bitcoin bounces on BlackRock buzz-Reuters

Bitcoin, the currency created to subvert the financial establishment, has shaken off weeks of sickness with the support of Wall Street’s finest.

The original crypto coin has leapt 20% to two-month highs at $30,182 over the past 11 days after BlackRock, the world’s largest asset manager, revealed hopes for a spot bitcoin exchange-traded fund (ETF) in the United States.

BlackRock filed for a prospective spot bitcoin ETF on June 15, undeterred by the Securities and Exchange Commission’s (SEC) past record of rejecting every such application. The news helped bitcoin bounce out of the doldrums and snap two consecutive weeks of losses.

Satoshi Nakamoto’s rebel child is invigorated by the prospect of an ETF that offers investors exposure to spot bitcoin on a regulated U.S. stock exchange without the hassle of custody.

Bitcoin’s market value has grown to comprise nearly half of the $1.1 trillion overall crypto market, its highest share in over two years, according to data tracker CoinMarketCap.com. Its share was around 40% at the start of the year, up from a low of 34% in 2018.

- China starts to slow yuan’s one-way slide -Reuters

China set a stronger-than-expected trading band for its currency on Tuesday and state banks sold dollars against the yuan, market sources said, in the strongest sign yet the authorities are growing increasingly uncomfortable with its quickening slide.

The yuan has fallen about 4% on the dollar in two months as flagging consumer confidence and a soggy property market have sapped momentum from the post-pandemic recovery. It bounced about 0.4% on Tuesday, its best gain in almost two weeks.

State banks were selling dollars to buy yuan in the offshore spot market, according to four people familiar with the trades, and it appeared as the currency neared the psychologically important 7.25 per dollar level, two of the people said.

Analysts said that together the moves showed official unease at the yuan’s downward momentum and that they could slow but perhaps not halt a decline, given the dour economic outlook.

“They are sending more signals now they’re uncomfortable … they would like to slow the yuan weakness,” said Moh Siong Sim, a currency strategist at Bank of Singapore. “The speed has been too fast for their liking.”

The push back comes as investors sour on China, with data showing China’s vaunted rebound faltering. Still, the stuttering recovery has stoked expectations of stimulus to help offset growth worries.

This is helping push up China markets today (always watch the yuan against USD)

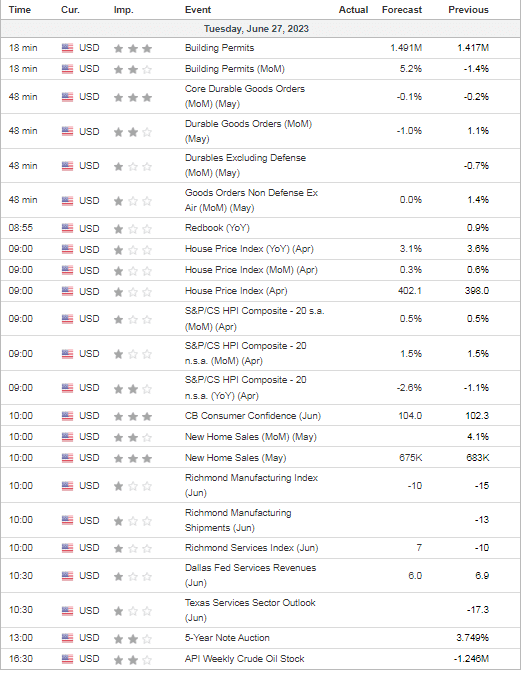

US DATA TODAY