Markets GREEN led by China

- Hong Kong: Hang Seng closed UP +2.08%

- China CSI 300 +1.37%

- Taiwan KOSPI +0.16%

- India Nifty 50 +1.07%

- Australia ASX -0.64%

- Japan Nikkei +1.21%

- European bourses in positive territory so far this morning

- USD -0.03%

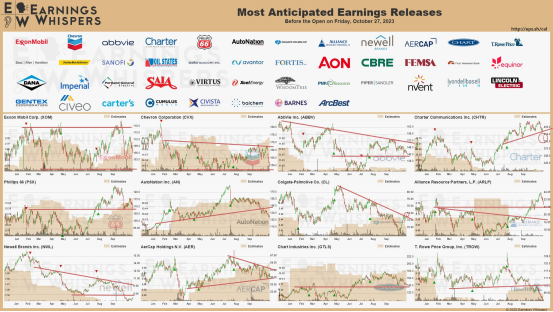

NOTABLE EARNINGS TODAY

$XOM$CVX$ABBV$CHTR$PSX$AN$CL$ARLP$NWL$AER$GTLS$TROW$SWK$BAH$SNY$STEL$AVTR$FTS$OIS$SAIA$CBTRE$POR$IMO$AON$DAN$EQNR$FHB$FMX$XEL$VRTS$WT$CMLS$CRI$CVEO$ARCB$B$BCPC$LECO$LYB$NVT$GNTX$CIVB$PIPR$PNM

TOP STORIES OVERNIGHT

Japan’s Biggest Firms Set for $9.3 Billion Bonanza From Weak Yen-BBG

Ten of Japan’s biggest companies are likely to pocket an extra 1.4 trillion yen ($9.3 billion) in profits this fiscal year if the yen continues to hover around the 150 mark to the dollar, a Bloomberg calculation shows.

The calculation is based on figures from 10 of the Japan’s 30 largest firms by market capitalization that specify the impact of exchange-rate movements on their earnings.

Many of Japan’s largest businesses are exporters that benefit from a weaker yen. The biggest beneficiary among the 10 companies from a weaker currency is Toyota Motor Corp. The automaker says it gains 45 billion yen in operating profit for every 1 yen of additional weakness against the dollar.

As China’s stock market steadies, risks around ‘Snowball’ derivatives recede-Reuters

China’s efforts this week to put a floor under its tumbling stock market have eased market concerns around a potential implosion of an estimated $27 billion of “Snowball” structured products and other forms of leveraged bets.

The benchmark CSI300 Index (.CSI300) has rallied 3% from Monday’s 4-1/2-year lows after state fund Central Huijin Investment started buying exchange-traded funds (ETFs) and the government approved extra sovereign borrowing to stimulate a frail economy.

Snowball is a distinct and popular Chinese market derivative that offers bond-like coupons to investors as long as the underlying assets in the product trade within a specified range.

It gained popularity in 2021, as the pandemic and weak economy forced brokerages and investors to get into innovative structured products betting on market volatility.

A Snowball typically has a knock-in level, and brokers need to liquidate their hedges which are usually long positions in stock index futures, if the stock market falls to that level.

COMMENTS: Latest efforts this week to stimulate the economy and quell the markets finally seem to be working…so far

Global hedge funds are boosting their presence in the long-shunned Indian market-Reuters

Global hedge funds are making a beeline to set up shop in India, a market long-shunned by international investors, tempted both by its growing depth and liquidity and its emergence as an alternative to investing in China.

Some funds highlight India’s economic opportunity, its rich pool of local talent and stable regulatory environment, while the spurt in trading volumes has also made it easier to hedge positions or pursue typical long-short equity strategies.

India’s stock market valuation has doubled in just three years to as much as $3.8 trillion in September, and that depth is enabling it to substitute China in global portfolios as investors flee battered mainland markets.

COMMENTS: Been waiting for this to happen

Oil jumps over $2 on fears of escalating Middle East conflict-Reuters

Oil prices rose by more than $2 a barrel on Friday as investors priced in fears of an escalation of conflict in the Middle East which could disrupt oil supplies, after reports that the U.S military had struck Iranian targets in Syria.

Two U.S. fighter jets struck weapons and ammunition facilities in Syria on Friday in retaliation for attacks on U.S. forces by Iranian-backed militia.

Iranian Foreign Minister Hossein Amirabdollahian said at the United Nations on Thursday that if Israel’s offensive against Hamas did not stop, the United States will “not be spared from this fire”.

Intensifying conflict could also impact shipments from Saudi Arabia, the world’s largest oil exporter, and other large producers in the Gulf.

“(It) remains incredibly difficult even for the most knowledgeable regional watchers to make high conviction calls about the trajectory of the current crisis, as the red lines that could bring more players onto the battlefield remain largely indiscernible,” RBC Capital analyst Helima Croft said.

Prices could jump 20% in the less likely scenario of an interruption of trade through the Strait of Hormuz where 17% of global oil production transits, the bank said.

COMMENTS: I do not think the Suez or Strait of Hormuz will close, but certainly as more countries are engaged in this conflict, greater risk to oil

Oil Majors Earnings

$EQNR Equinor

EPS. vs Forecast 0.9171 / 0.7369

Rev. vs Forecast 25.74B / 23.76B

Market Cap: 98.96B

$XOM Exxon Mobil

Adj EPS: $2.27 (est $2.36) –

Revenue: $90.76B (est $94.35B) –

Boosts Qtr Div To 95C/Share From 91c (est 94c) – Production 3,688 KOEBD, Est 3,720

$CVX Chevron

Q3 Non-GAAP EPS of $3.05 misses by $0.64.

Revenue of $54.08B (-18.8% Y/Y) beats by $1.08B.

Capex in the third quarter of 2023 was up over 50% from the year-ago period

$E ENI

Adj net income EU1.82b, est EU1.61b ∙

Adj OP EU3.01b, est EU2.87b ∙

Exploration & Production Adj OP EU2.61b, est EU2.54b Plenitude Power Adj OP EU219m, est EU123.5m

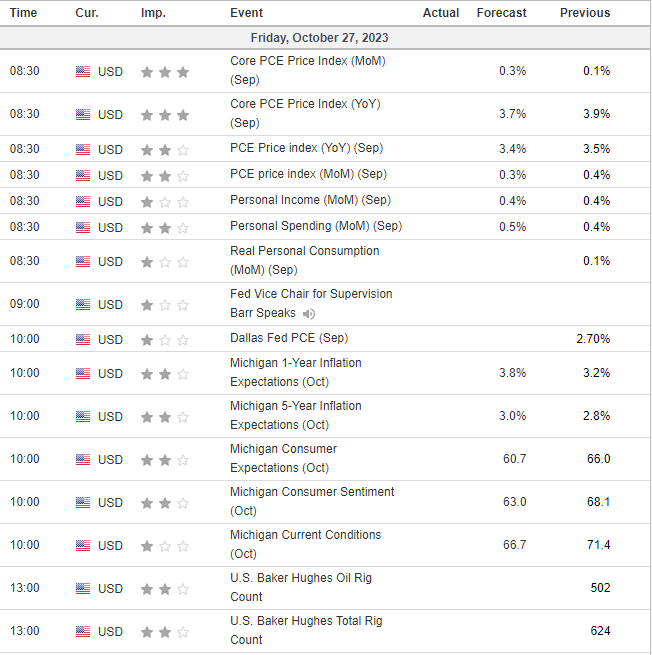

US DATA TODAY