Asia GREEN…Europe Mixed

- Hong Kong: Hang Seng closed up +0.83%

- China CSI 300 +0.21%

- Taiwan KOSPI +0.09%

- India Nifty 50 +0.32%

- Australia ASX -0.55%%

- Japan Nikkei +0.89%

- European bourses all in mixed territory so far this morning

- USD +0.10%

TOP STORIES OVERNIGHT

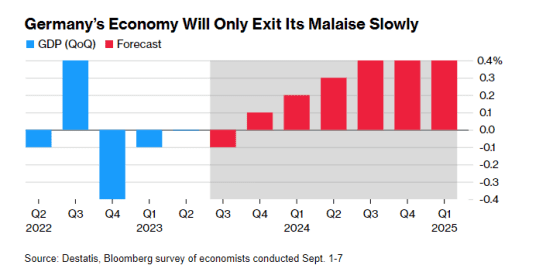

German Labor Market Shows Signs of Cracking as Economy Struggles-BBG

German companies are thinking twice about hiring staff amid an increasingly uncertain economic environment, according to a study by the Ifo Institute.

A gauge measuring firms’ willingness to take on employees fell to its lowest level since February 2021 this month. Many in manufacturing, construction and trade plan to make do with fewer workers. The services sector is losing labor-market traction, too.

“The robust expansion of employment seen over the past few months has come to a standstill,” said Klaus Wohlrabe, head of surveys at Ifo. “Due to a lack of orders, companies are being rather cautious about filling vacant positions.”

COMMENTS: Germany is in trouble

Britain gives go-ahead for biggest new North Sea oilfield in years-Reuters

Britain has given the go-ahead for one of its biggest new oil and gas projects in years, Equinor’s (EQNR.OL) North Sea Rosebank field, saying energy security was the priority despite opposition from environmentalists.

Wednesday’s announcement comes after Prime Minister Rishi Sunak watered down interim plans for the government’s 2050 net zero emissions target, a move that critics said could also encourage other countries to rein in their climate ambitions.

Energy Security Minister Claire Coutinho said Rosebank would be less emissions-intensive than older oil and gas developments.

“We will continue to back the UK’s oil and gas industry to underpin our energy security, grow our economy and help us deliver the transition to cheaper, cleaner energy,” she said.

COMMENTS: Countries may be starting to wake up and realize that energy security is important. Good news for oil equities

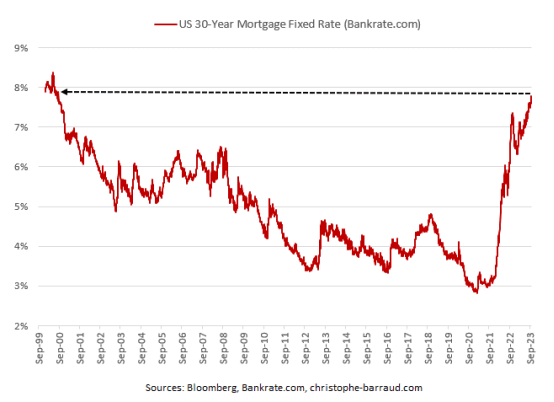

According to Bankrate.com‘s data, US 30-Year fixed-rate mortgage reached 7.78%, the highest rate since August 2000

*This situation is expected to have a significant effect on closed sales from September to November.

Treasury ‘Term Premium’ Gauge Positive for First Time Since 2021-BBG

A key measure of how much bond investors are compensated for holding long-term debt turned positive for the first time since June 2021, reflecting steep increases in longer-maturity Treasury yields.

The Federal Reserve Bank of New York’s gauge of the 10-year term premium became positive on Monday, after having been negative for most of the past seven years. The index estimates the amount by which Treasury yields exceed the expected path of short-term rates.

The US yield curve is steepening on expectations that the Fed is nearly done raising its policy rate, with the 10-year Treasury yield exceeding 4.5% for the first time since 2007. The trend has been aided by growth in the supply of US debt to finance wide government deficits.

The increase in the gauge underscores the potential that interest rates will indeed stay higher for longer, along with concerns about the credibility of fiscal policy, according to analysts at HSBC Plc.

The “rising term premium reflects views that the longer-run equilibrium policy rate will be higher in the future,” analysts led by Steven Major, global head of fixed-income research at the bank, wrote in a note Wednesday. “The rising risk premium in US Treasuries perhaps reflects tail-risk hedging against a situation” where more debt leads to higher yields, as has occurred in some emerging markets, they wrote.

COMMENTS: Bonds are slightly up this morning..good news for equity markets

US small cap stocks wilt in the heat of higher interest rates-FT

Small and midsize US stocks are struggling under the strain of high interest rates, as the Federal Reserve’s pledge to hold borrowing costs higher for longer threatens the weaker balance sheets of smaller companies.

The Russell 2000 small-cap index has fallen 11 per cent since its peak in July, while the S&P 500 is down 7 per cent over the same period. The small-cap index has fallen 7 per cent in September alone, leaving it more than 27 percentage points below its all-time high in 2021, compared with 11 percentage points for the S&P.

The underperformance highlights how smaller stocks are acutely feeling the effects of the Fed’s rate increases, at a time when some market watchers are questioning whether the transmission of interest rates to the economy has been blunted.

A key factor behind the small-cap decline is fast-rising interest costs at smaller companies, analysts say. Interest expenses for the S&P 600, another small-cap index, hit a record high in the latest batch of second-quarter earnings, according to data compiled by Ned Davis Research.

“This is new, uncharted territory for small caps,” said Ed Clissold, Ned Davis’s US strategist, adding that smaller companies face the prospect of either rates staying high or the economy heading into recession.

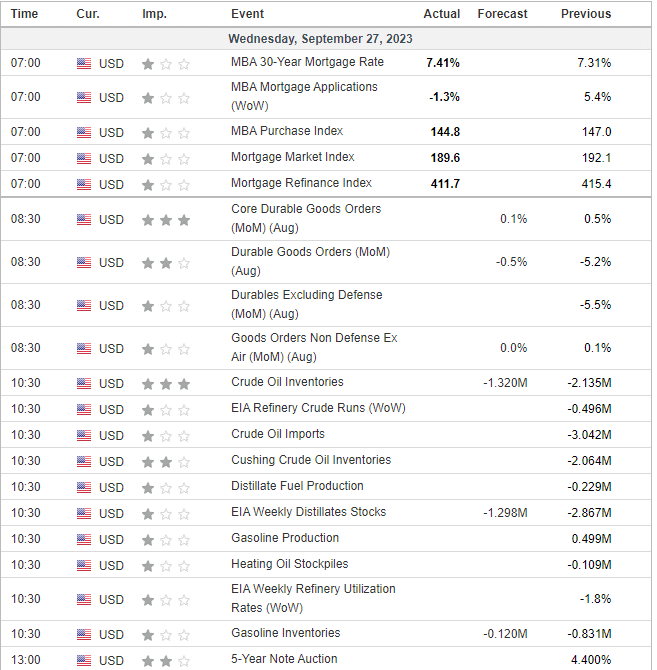

US DATA TODAY