Asia GREEN..Europe Mixed

- Hong Kong: Hang Seng closed up +1.41%

- China CSI 300 +2.32% !!!

- Taiwan KOSPI +0.17%

- India Nifty 50 -0.12%

- Australia ASX +0.73%

- Japan Nikkei +0.38%

- European bourses in mixed territory so far this morning

- USD -0.16%

TOP STORIES OVERNIGHT

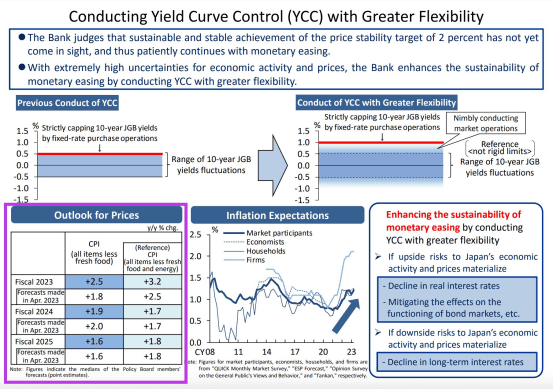

- BOJ hint at a tweak to YCC yesterday that sent global markets roiling yesterday, turned out to be sort of a nothing burger

Global Bonds Slip as Japan Loosens Grip on Yields-BBG

Having previously capped bond yields at 0.5% in a bid to stoke borrowing and its economy, the central bank said today it now regarded that level as a reference point rather than a rigid limit.

The move sent Japan’s 10-year yield to the highest level since 2014, amid speculation it marked the first step towards the end of extraordinary stimulus after the recent surge in inflation. It also triggered big swings in the yen, sending it as much as 1% higher at one point against the dollar.

Markets elsewhere reacted to the possibility that higher yields at home will persuade Japanese investors, who own sizable amounts of US, European and Australian bonds, to reduce overseas debt holdings.

Mostly all we saw was a knee jerk reaction, particularly in the YEN (JPY/USD) ..Yen is back flat on the day.

Ayesha Trariq (@AyeshaTariq) summed this up best:

“The BoJ tweaked their YCC last night / this morning. The vote for tweaking was 8-1. They still maintained their short-term target rate at -0.1% and the 10-year yield at 0%. So no rate cuts as I expected.

They’ve let the YCC limits remain at 0.5% but kept the limits flexible meaning the 10-year JGB yield can float above this rate. They declared offering to buy JGBs at 1%.

What does this flexibility mean? It simply means that if the 10-year JGB Yield goes above the 0.5% mark, the BoJ does not have to buy bonds to bring the rate back down again within the band. They will offer to buy at 1%. Remember: buying bonds will increase bond prices, lowering the rate.

Personally, the more interesting part of the meeting was the upward revision to their CPI forecast. This gives me a stronger signal that Japan is ready to amend monetary policy. Things should get interesting from here.”

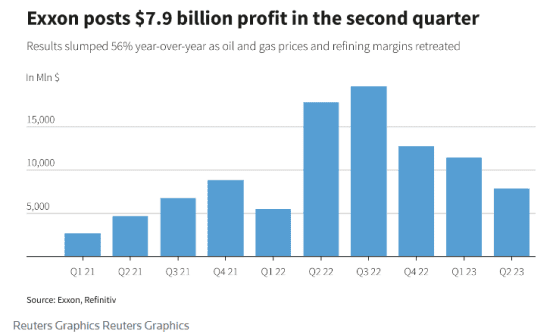

- Exxon posts 56% profit slump, joins peers in energy price hit -Reuters

Exxon Mobil Corp (XOM.N) on Friday reported a 56% slump in second-quarter profit, joining rivals hurt by a sharp drop in energy prices but delivering results in line with an earnings preview the oil major released earlier this month.

Results were inline, despite the flash headline.

XOM is down 0.5% in pre-market

- Chevron Profits Slide As Crude Prices Tumble, Sees Small Output Hit- The Street

CVX shares slipped lower Friday after the oil major posted softer-than-expected second quarter earnings and said near term output levels would decline amid planned improvements in upstream production.

Chevron said adjusted earnings for the three months ending in December came in at $5.8 billion, or $3.08 per share, down nearly than 50% from the same period last year but just inside the revised Street consensus forecast of $3.13 per share.

Group revenues, the company said, fell 29.2% from last year to $47.2 billion, just ahead of analysts’ estimates of a $46.9 billion tally.

Earlier this week, Chevron had warned investors that adjusted net income would fall to $5.8 billion, or $3.80 per share, as crude, which traded north of $100 per barrel for much of the quarter last year following Russia’s invasion of Ukraine, eased to the mid-$70 per barrel range over the three months ending in June.

No surprise again, given the fall in oil and gas prices

CVX down 0.5% in premarket

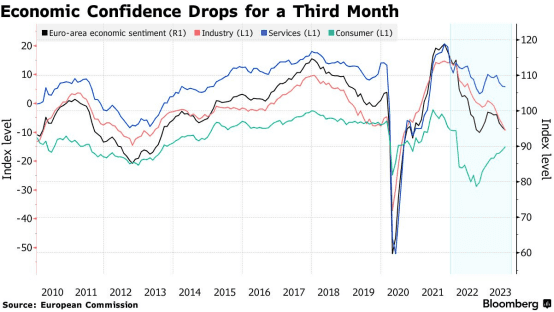

Euro-Area Economic Confidence Slows on Industry, Services-BBG

Euro-area economic confidence slowed more than anticipated this month, adding to concerns that growth in the region is stalling.

A sentiment gauge published by the European Commission slid to 94.5 from 95.3 in June. That’s the third monthly decline and worse than the median forecast in a Bloomberg survey of economists.

Sub-indicators for services and industry both decreased, while consumer expectations improved for a fourth month.

This has European markets grumpy today

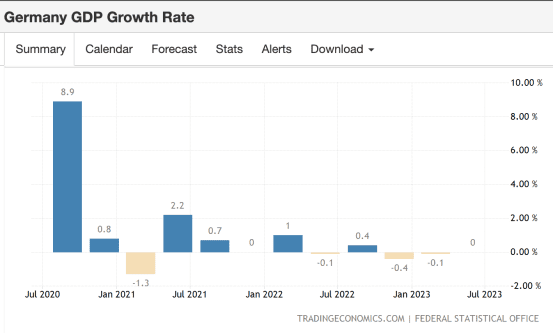

- Germany Exits Recession But GDP Only Stagnated Last Quarter -BBG

Gross domestic product was unchanged from the previous three months, falling short of the 0.1% growth estimated by economists. Revised figures for the prior quarters revealed the slump was shallower than initially thought, however.

Germany has already suffered a yearlong slump in manufacturing and its outlook for the coming months is bleak. Survey indicators signal rapidly weakening demand — including in the services sector that’s so far held up.

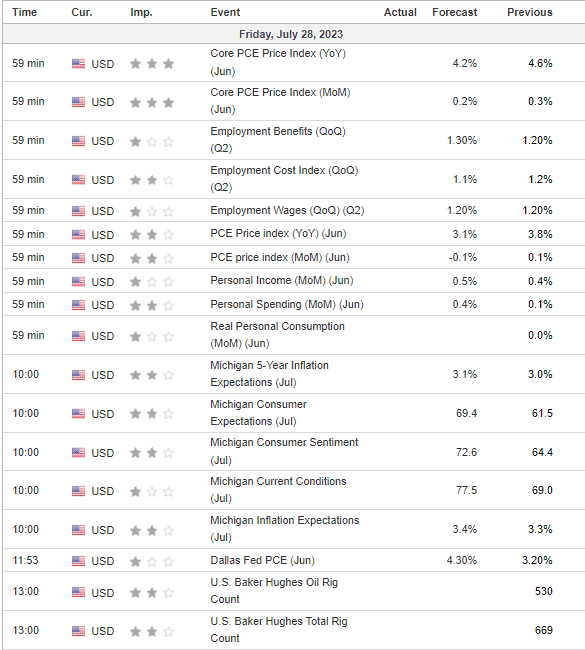

US DATA TODAY