Asia mixed…Europe GREEN

- Hong Kong: Hang Seng closed up +0.12%

- China CSI 300 -0.12%

- Taiwan KOSPI -0.67%

- India Nifty 50 +0.68%

- Australia ASX +0.34%

- Japan Nikkei +0.96%

- European bourses all in positive territory so far this morning

- USD +0.11%

TOP 5 STORIES OVERNIGHT

- Libor’s Demise Means No More Rigging, But Less Flexibility-BBG

The interest rate once dubbed the most important number in finance finally dies this week.

A seminal event occurs at the end of this week: Dollar Libor will finally die. The big question is does its replacement, the Secured Overnight Financing Rate, make the global financial system safer, or just exposed to different risks?

The London interbank offered rate, set daily by panels of banks, was once dubbed the most important number in finance. It was a suite of borrowing costs, covering a range of maturities for the world’s major currencies. Hundreds of trillions worth of everything was tied to Libor, from floating-rate notes to residential mortgages to auto loans.

As the stench of price-rigging became overwhelming and as wholesale funding markets between banks dried up, Libor’s demise became inevitable. It had lost all credibility, as mark-to-market became mark-to-made-up. Three-month dollar Libor was so enmeshed in the financial system that its termination date was extended by 18 months to give lenders and borrowers more time to adapt to its abolition.

In futures and options derivatives, the main venue for hedging and speculation of shorter-maturity interest rates, the transition has been more successful in the US than in the UK. SOFR futures volumes, traded on the Chicago Mercantile Exchange, are comparable with how active Eurodollar contracts used to be. This matters as these are the most actively traded futures contracts globally. The CME has been proactive in offering lower fees and more flexible trading sizes to encourage market-maker activity. The Intercontinental Exchange has struggled with the UK’s equivalent SONIA contracts, where liquidity has never matched the levels of sterling Libor.

Secured Overnight Financing Rate (SOFR) is the US version of Libor (London interbank rate) and gives more power to the Federal Reserve.

- Nestle Puts KitKat Carbon Neutrality in Greenwashing Graveyard-BBG

Nespresso maker joins EasyJet, Gucci renouncing carbon offsets

Critics say ‘carbon neutral’ claims can mislead consumers

Nestle SA has abandoned pledges to make major brands including KitKat and Perrier carbon neutral, joining a nascent corporate pushback against programs that let polluters compensate for their own greenhouse gas emissions by investing in efforts to reduce them elsewhere.

Carbon-offset programs don’t really reduce businesses’ impact on the climate, critics say, even though the label does have appeal for well-meaning consumers.

The Swiss food company also dropped plans to make plant-based meal lines Sweet Earth Foods and Garden Gourmet carbon neutral.

Carbon offsets are misleading and lead to higher consumer prices, good to see companies waking up

- EU to take next step towards launching digital version of euro-France24

The ECB is set to give the formal green light to a digital euro in October and the expectation is that it will be available from 2027 onwards.

The EU will take the next crucial step on Wednesday towards launching a digital version of the euro, a controversial project that has come under attack from the public, politicians and banks before it even exists.

ECB has a difficult battle to win over Europeans. A public consultation showed that the number one priority when it comes to the digital euro is privacy.

To calm people’s fears, the ECB has stressed it would not attempt to control how people can spend the digital currency or use it for surveillance, as critics claim is the case in China. (YEAH OK)

CBDC IS HERE DANGER DANGER!!

- Low water again hampers Rhine river shipping in Germany-Reuters

HAMBURG, June 28 (Reuters) – Low water levels after recent dry weather are again preventing cargo vessels from sailing fully loaded on the Rhine river in Germany with surcharges added to the usual freight prices, commodity traders said on Wednesday.

Low water is hampering shipping on most of the river south of Duisburg and Cologne, including the chokepoint of Kaub, traders said.

Shallow water means vessel operators impose surcharges on freight rates to compensate for vessels not sailing fully loaded, increasing costs for cargo owners.

This led to price spikes in oil and products last year as well as grains, as this is the main shipping lane to Europe from Rotterdam, so definitely something to keep an eye on

- FTX begins talks to relaunch international cryptocurrency exchange – WSJ

Bankrupt FTX is moving ahead with efforts to revive its flagship international cryptocurrency exchange, the Wall Street Journal reported on Wednesday citing CEO John Ray.

The company “has begun the process of soliciting interested parties to the reboot of the FTX.com exchange,” Ray said, according to the Journal’s report.

The failed crypto company has been holding talks with investors about backing a potential restart of the FTX.com exchange through structures such as a joint venture, the report added citing people familiar with the discussions.

UNBELIEVABLE!

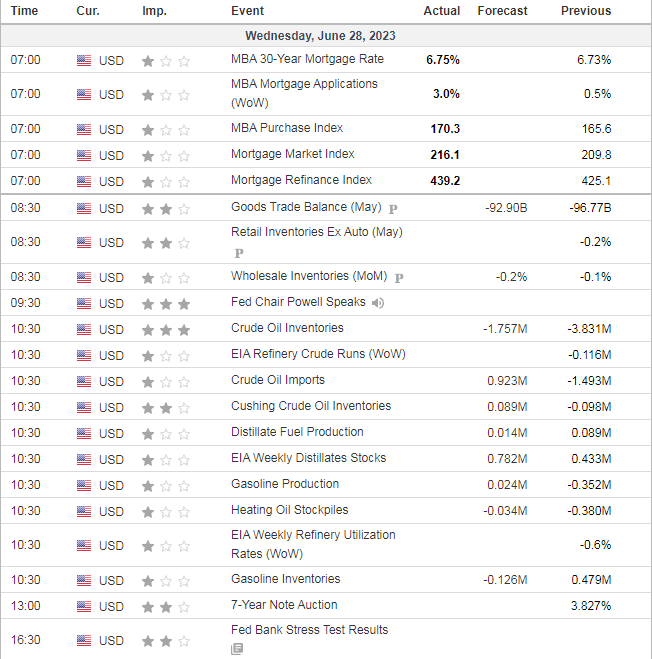

US DATA TODAY