Mixed Markets Asia-Europe Green

- Hong Kong: Hang Seng closed down -1.24%

- China CSI 300 -0.49%

- Taiwan KOSPI -0.55%

- India Nifty 50 market closed for holiday

- Australia ASX +1.15%

- Japan Nikkei +0.96%

- European bourses all in positive territory so far this morning

- USD -0.07%

TOP 5 STORIES OVERNIGHT

- UBS Joins Goldman, Morgan Stanley in Trimming China Stocks View -BBG

UBS Group AG joined other banking peers in lowering its forecast for Chinese stocks this year, citing slowing growth momentum in the world’s second-largest economy.

China stocks down sharply overnight

- Bearish bets on Asian currencies firm as weak China growth weighs

Investors increased bearish bets on most Asian currencies, as a stuttering post-pandemic recovery in China, the world’s second-largest economy, weighed on sentiment, a Reuters poll showed on Thursday.

Bearish bets on Thailand’s baht and the Malaysian ringgit rose to their highest since early November, while investors raised their short positions on the yuan , according to the fortnightly poll of 12 analysts.

The Malaysian currency remains tightly bound to the Chinese yuan, reflecting the country’s strong trade links with China, analysts at ING said in a note.

The yuan has weakened 4.8% so far this year as weak consumer and private sector demand has sapped momentum from the post-pandemic recovery in China.

“China is in need of a credible economic recovery plan to boost the confidence of consumers and investors, and it is likely that the government will communicate that soon to revive animal spirits before the labour market conditions deteriorate further,” said Fiona Lim, a senior FX strategist at Maybank.

Again watch these Asian currencies for hints on China’s recovery

- Europe’s financial stability risk remains ‘severe’ -EU watchdog-Reuters

Financial stability risk in the European Union remains at a “severe” level and the downturn in the housing market could become even more broad-based, the bloc’s financial risk watchdog said on Thursday.

High inflation, a drop in household’s disposable income, rapid rate hikes by the European Central Bank and notable bank failures overseas have challenged Europe’s financial sector this year, even if lenders remain relatively healthy.

“The European Systemic Risk Board (ESRB) concluded that financial stability risks in the EU remain severe,” the ESRB, headed by ECB chief Christine Lagarde, said in a statement.

“The end of the prolonged low interest rate environment has changed the risk landscape worldwide, with the full impact of the sharp rise in interest rates only being felt over time,” it added.

The ESRB seemed particularly concerned about the housing market, arguing that the cycle has reached a turning point or maybe even beyond that.

A falling number of transactions and credit market indicators suggest that the correction in residential real estate markets is likely to become more broad-based, it added.

- Inflation up in German states, pointing to national rise -Reuters

Inflation rose in five economically important German states in the month of June, preliminary data showed on Thursday, suggesting a bumpy road ahead for German inflation.

The inflation rate rose to 6.2% in North-Rhine Westphalia and Bavaria, while rising to 6.7% in Brandenburg, 6.1% in Hesse and 6.9% in Baden-Wuerttemberg.

The data from Germany, the euro zone’s biggest economy, comes as the European Central Bank is still looking for evidence that inflation has turned a corner. June inflation data for the bloc is due on Friday.

Central banks can not fix poor energy policies and supply-side inflation with rate rises

- The State of World Energy Explained in 4 Charts -BBG

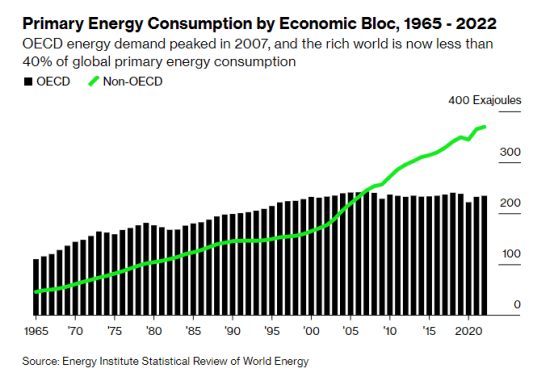

Energy demand is growing in non-OECD countries

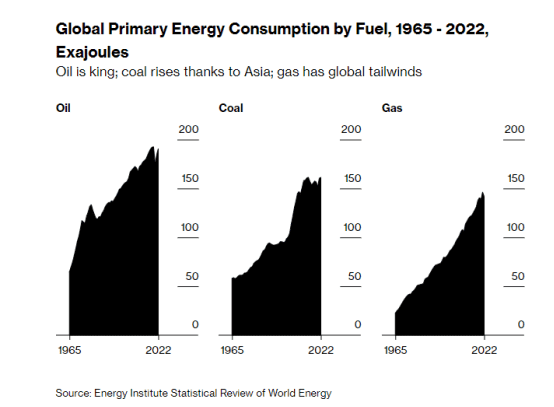

Oil is king. Or, coal is. (Or maybe gas)

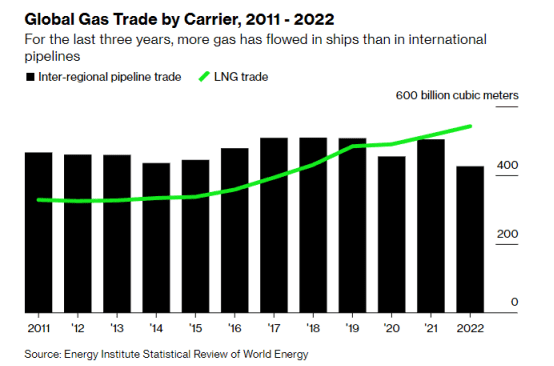

Global Gas Trade by Carrier, 2011 – 2022

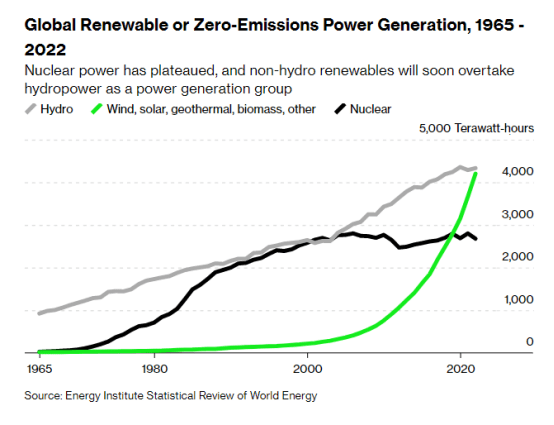

Global Renewable or Zero-Emissions Power Generation, 1965 – 2022