Asia Mixed…Europe GREEN

- Hong Kong: Hang Seng closed Down -2.08%

- China CSI 300 -0.68%

- Taiwan KOSPI -0.08%

- India Nifty 50 +1.04%

- Australia ASX +0.42%

- Japan Nikkei +0.41%

- European bourses in POSITIVE territory so far this morning

- USD +0.14%

TOP STORIES OVERNIGHT

Oil Climbs Again With OPEC+ Meeting and Fed Signals in Focus-BBG

Oil added to its biggest gain in a week as traders counted down to a high-stakes OPEC+ meeting on supply, and weighed signs that the Federal Reserve is done raising interest rates.

Global benchmark Brent climbed above $82 a barrel, after rallying by more than 2% on Tuesday. Prices firmed on expectations across markets that the Fed has finished with policy tightening and may start cutting borrowing costs next year, with recent dollar weakness also providing support.

The price move pulled oil out of a holding pattern ahead of an OPEC+ meeting that’s set to take place Thursday. The producer group is due to meet online and set policy for 2024, but has yet to resolve a dispute over output quotas for some African members, according to delegates.

COMMENTS: Meeting will not be delayed and is expected to be tomorrow

German shares touch 4-month highs on signs of easing inflation-Reuters

German shares led gains in Europe on Wednesday after data pointed to easing inflation in the most populous state in the country, boosting expectations that the European Central Bank will cut interest rates next year.

The German DAX rose 1.0% to touch a four-month high after data showed consumer prices in the state of North Rhine-Westphalia fell 0.3% month-on-month in November and were up 3.0% year-on-year.

The preliminary inflation figure for Germany will be released later in the day, while overall euro zone inflation numbers will be published on Thursday.

European bond yields fell, with the benchmark 10-year German bond yield falling to a more than three-month low of 2.4%. [GVD/EUR]

The continent-wide STOXX 600 index rose 0.5%, with rate-sensitive real estate stocks rallying over 2%.

Traders priced in interest rate cuts of over 105 basis points (bps) in 2024 from around 95 bps the day before and also discounted a 90% chance of a first 25 bps rate cut in April 2024.

“The ECB is going to come under increasing pressure going forward to cut rates. Growth in the euro-zone is flat, if not already in recession and inflation is heading in the right direction,” said Stuart Cole, chief macro economist at Equiti.

COMMENTS: This is boosting markets across Europe

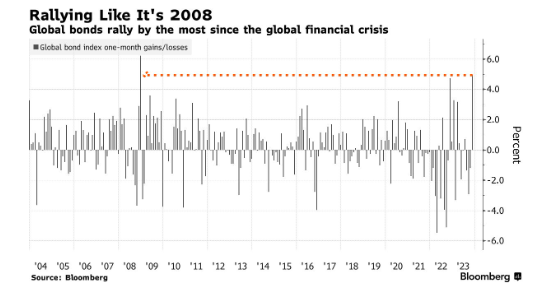

Global Bonds Head for Best Month Since 2008 Financial Crisis-BBG

Global bonds are soaring at the fastest pace since the 2008 financial crisis.

A Bloomberg gauge of global sovereign and corporate debt has returned 4.9% in November, heading for the biggest monthly gain since it surged 6.2% in the depths of the recession in December 2008.

November’s rally is being driven by increasing speculation the Federal Reserve and its global peers have largely finished hiking interest rates and will start cutting next year. Markets price a full percentage point of reductions in the US next year, with the cycle starting in June.

Fed Governor Christopher Waller helped bolster rate-cut bets on Tuesday, when he said the current level of policy looks well positioned to slow the economy and bring down inflation. Some investors, including billionaire Bill Ackman, say the easing will start even earlier than traders anticipate.

“Waller has been a hawkish tilting member, so for him to sound dovish has been significant,” said James Wilson, a senior portfolio manager at Jamieson Coote Bonds Pty in Melbourne. “It sounds like the Fed is all but done in their hiking cycle.”

COMMENTS: This is also helping the equity markets

Global growth to slow but avoid a hard landing -OECD-Reuters

The global economy will slow slightly next year but the risk of a hard landing has subsided despite high levels of debt and uncertainty over interest rates, the Organisation for Economic Cooperation and Development said on Wednesday.

Global growth is set to moderate from 2.9% this year to 2.7% in 2024 before picking up in 2025 to 3.0%, the Paris-based policy forum said in its latest Economic Outlook.

Growth in advanced economies that make up the OECD’s 38 members was seen headed for a soft landing, with the United States holding up better than expected so far.

“Our central projections are for a soft landing, but that cannot be taken for granted,” OECD chief economist Clare Lombardelli told a news conference.

“Monetary policy needs careful calibration to bring inflation to targets while minimising the impact on growth. These judgements are now harder than earlier in the cycle and the risks of policy errors are greater,” she added.

The OECD forecast U.S. growth would slow from 2.4% this year to 1.5% next year, revising up its estimates from September when it predicted U.S. growth of 2.2% in 2023 and 1.3% in 2024.

Though the risk of a hard landing in the United States and elsewhere had eased, the OECD said that the risk of recession was not off the table given weak housing markets, high oil prices and sluggish lending.

COMMENTS: the “soft landing” list is growing…which spooks me

Bill Ackman Bets Fed Will Cut Interest Rates as Soon as First Quarter-BBG

Billionaire investor Bill Ackman is betting the Federal Reserve will begin cutting interest rates sooner than markets are predicting.

The Pershing Square Capital Management founder said such a move could happen as soon as the first quarter. Traders are fully pricing in a rate cut in June, with the chance of a cut happening in May priced at about 80%, according to swaps market data.

The Fed began aggressively raising rates in March 2022, leading to the fastest pace of rate increases in 40 years. The central bank has yet to cut rates even as US inflation has broadly slowed this year.

“What’s happening is the real rate of interest, which is what impacts the economy, keeps increasing as inflation declines,” Ackman said in an upcoming episode of The David Rubenstein Show: Peer-to-Peer Conversations.

Ackman said that if the Fed keeps rates in the roughly 5.5% range when inflation trends below 3%, “that’s a very high real rate of interest.”

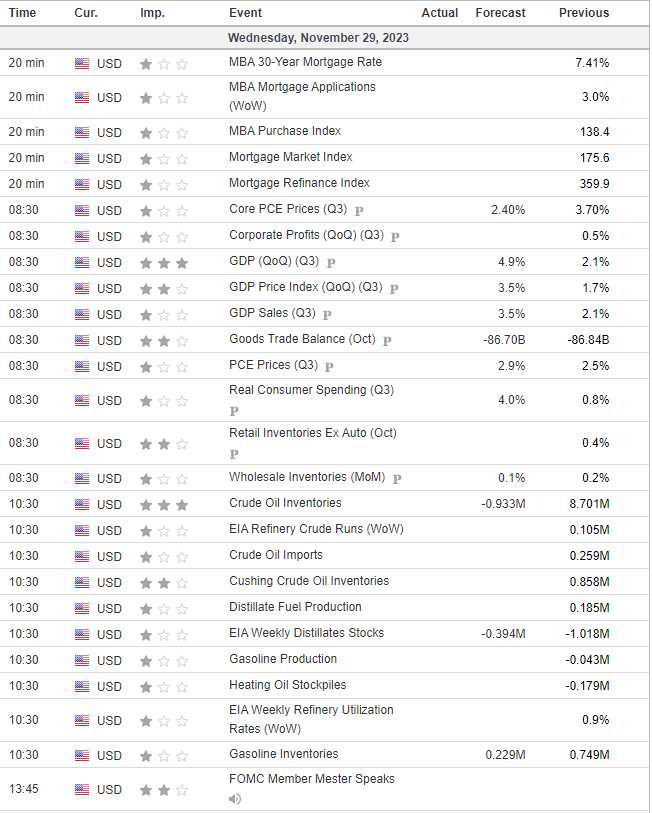

US DATA TODAY