Pretty GREEN …Quiet night

- Hong Kong: Hang Seng closes down -0.66%

- China CSI 300 +0.31%

- Taiwan KOSPI +0.33%

- India Nifty 50 +0.22%

- Australia ASX +0.58%

- Japan Nikkei +0.38%

- All European bourses all in positive territory so far this morning except Spain and Austria

- US indices also in positive territory so far this morning in pre-market, USD -0.18%

Overnight Data/News

- China PBoC Sets Yuan Mid-Point At 6.8699 / Dollar VS Last Close 6.8770

- China PBoC Injects 2 Bln Yuan Of 7 Day Reverse Repo At 2%; Draining A Net 276 Bln Yuan In Open Market Operations

- German Trade Balance SA Feb: €16.0B (est €17.0B; prevR €16.0B) – German Exports SA (M/M) Feb: 4.0% (est 1.8%; prevR 2.7%) – German Imports SA (M/M) Feb: 4.6% (est 1.0%; prevR -2.1%)

- Spanish Unemployment Change Mar: -48.8K (prev 2.6K)

- Eurozone PPI (M/M) Feb: -0.5% (est -0.5%; prev -2.8%) – PPI (Y/Y) Feb: 13.2% (est 13.2%; prevR 15.1%)

- Bank Of England’s Tenreyro: With Bank Rate Moving Further Into Restrictive Territory, I Think A Looser Stance Is Needed To Meet The Inflation Target

- Germany Forecast To Skirt Recession – RTRS

- Brussels Calls On China To Use Its Influence With Russia To Rein In War – FT

- China’s Housing Market Has Plenty Of Space But Not Enough Buyers – WSJ

- Iraq Northern Oil Exports Expected To Resume On Tuesday Following Deal Signing – RTRS Sources

- Sterling Hits 10-Month High As Recession Fears Ease – FT

- LME Group Unveils Plans to Strengthen Metals Market

- Gold’s ETF and retail interest surges- The U.S. Mint reported coin sales of 187.5koz, its best-selling March in at least a decade. Total metal held in trust across the gold ETPs is set to mark the first month of inflows in 10 months

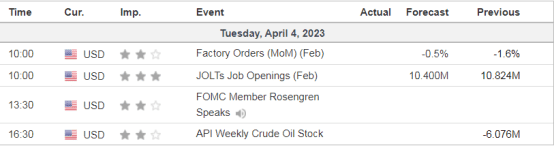

US DATA TODAY