Pretty RED out there

- Hong Kong: Hang Seng closed down -0.49%

- China CSI 300 +0.88%

- Taiwan KOSPI -0.49%

- India Nifty 50 -0.68%

- Australia ASX -1.24%

- Japan Nikkei -1.61%

- European bourses all in negative territory so far this morning

- USD +0.16%

TOP STORIES OVERNIGHT

Ackman Says He’s Short 30-Year Treasuries as Supply Ramps Up -BBG

Bill Ackman is making sizable bets on declines for 30-year US Treasuries as a hedge on the impact of higher long-term rates

An increasing supply of Treasuries will be needed to fund the current budget deficit, future spending plans and higher refinancing rates, Ackman said. He is making the investment via options, rather than shorting bonds outright.

“There are few macro investments that still offer reasonably probable asymmetric payoffs and this is one of them,” Ackman said. “The best hedges are the ones you would invest in anyway even if you didn’t need the hedge. This fits that bill, and also I think we need the hedge.”

The US curve 10-years and beyond has been weighed by refunding debt sales of $103 billion next week, up from $96 billion in May, in the first boost to the so-called quarterly refunding since 2021. This includes $23 billion of 30-year bonds scheduled for Aug. 10.

The 30-year yield could reach 5.5% if long-term inflation holds at 3% instead of 2%, according to Ackman. The yield was up 1 basis point to 4.19% in Asia trading.

“There are many times in history where the bond market reprices the long end of the curve in a matter of weeks, and this seems like one of those times,” he said.

5.5% !!!! WOOZER

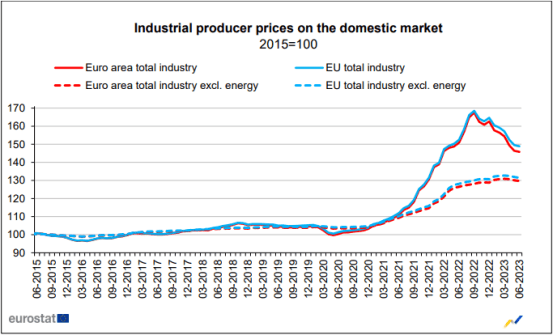

Industrial producer prices down by 0.4% in both the euro area and the EU-Eurostat

Down by 3.4% in the euro area and by 2.4% in the EU compared with June 2022

In June 2023, industrial producer prices fell by 0.4% in both the euro area and the EU, compared with May 2023, according to estimates from Eurostat, the statistical office of the European Union. In May 2023, prices decreased by 1.9% in both the euro area and the EU.

In June 2023, compared with June 2022, industrial producer prices decreased by 3.4% in the euro area and by 2.4% in the EU

BOJ Intervenes for Second Time This Week to Slow Yield Spike-BBG

The Bank of Japan came into the market for the second time this week to slow gains in benchmark sovereign bond yields, underscoring its determination to curb sharp moves in rates even as it makes room for them to rise.

The buying operation Thursday also highlighted the challenge investors face interpreting a rates regime that is built on gray lines to let the BOJ be flexible rather than provide clarity for markets. The impact was also felt immediately in the currency market, with the yen weakening. It triggered mild choppiness in the Tokyo stock market, which remained lower.

“Two observations do not make a pattern, but for now five basis points increments could be the BOJ’s tolerance for movements higher in the 10-year Japan government bond yield,” said David Forrester, a strategist at Credit Agricole in Singapore. “Such a slow grind higher would help limit yen downside against the dollar in an environment of rising US Treasury yields.”

While the central bank adjusted policy on Friday to allow scope for 10-year yields to rise to 1%, its actions this week make it clear that it won’t tolerate a rapid move to that level.

The yen swung from a gain to a loss that made it the biggest laggard versus the dollar among Group-of-10 currencies.

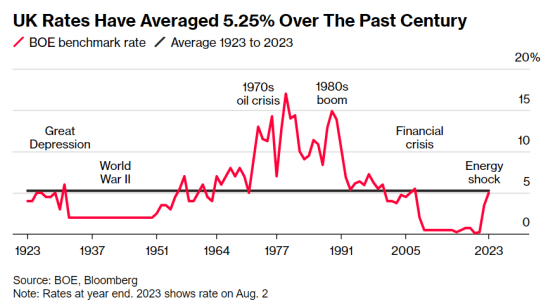

BoE is expected to hike rates to 5.25% today, here is how that rate compares to historical norms -BBG

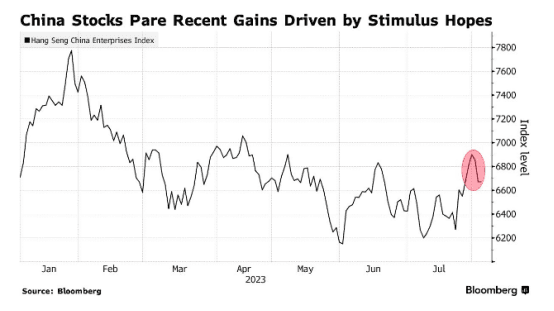

China Rally Is Just an Opportunity to Sell for Many Global Funds-BBG

Morgan Stanley says take profits, downgrades China equities

US and European long-only fund managers net sold in July: MS

US and European long-only fund managers were net sellers of Chinese and Hong Kong stocks in July, according to Morgan Stanley, which is now advising clients to take profits on the recent rally and has downgraded China to equalweight. The FTSE China A50 Index is the only one of 10 major global benchmarks tracked by Citigroup Inc. on which investors had a short position end-July.

That’s even as key indexes in China and Hong Kong capped their best month since January after the Politburo meeting, where top leaders signaled more support for the troubled real estate sector alongside pledges to boost consumption. The Hang Seng China Enterprises Index, which tracks major Chinese shares listed in Hong Kong, climbed in afternoon trading on Thursday. Still, the gauge is down for this week amid a risk-off global backdrop, following its 6.1% surge over the previous five sessions.

Beijing is fighting an uphill battle in trying to revive an economy that has continued to lose steam, but for now has offered more words than action. It vowed to boost consumption and support private enterprises, but stopped short of handing out cash to families or offering tax breaks to businesses. Officials asked localities to roll out policies to stabilize the property market but provided no details.

“The July Politburo meeting signaled policy easing, but key issues including LGFV debt, the property and labor markets and the geopolitical situation need to improve significantly, in our view, for sustainable inflows and further re-rating,” Morgan Stanley equity strategists including Jonathan Garner and Laura Wang wrote in an Aug. 2 note.

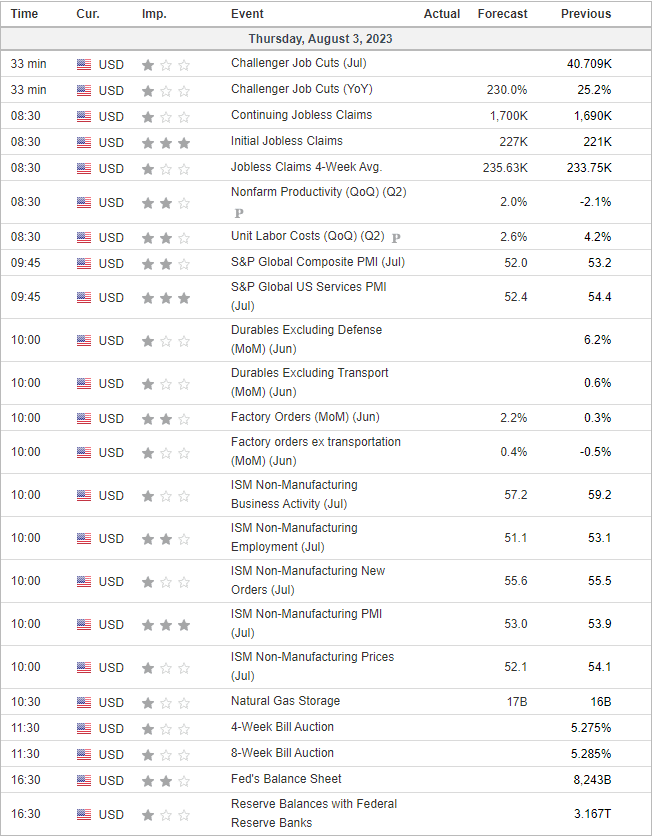

US DATA TODAY