Mixed Markets

- Hong Kong: Hang Seng closes down -1.36%

- China CSI 300 -0.95%

- Taiwan KOSPI +0.47%

- India Nifty 50 +1.38%

- Australia ASX +0.24%

- Japan Nikkei -0.24%

- European bourses broadly down across the board with the exception of UK, Germany tech, Spain, and Switzerland

- US indices down across the board this morning, Nasdaq the weakest in pre-market due to poor earnings of mega caps last night after the close, USD down -0.13%

Overnight News/Data

- UK BoE’s Pill says important not to raise interest rates too high

- France Dec Industrial Production 1.1% m/m 1.4% y/y vs. f’cast 0.2%/0.9%

- Dec Manufacturing Output 0.3% m/m vs. f’cast 0.2%

- China Jan services activity expands for first time in five months Caixen PMI jumps to 52.9 vs. December 48.0

- Japan Services activity at 3-mth high at 52.3 vs. flash 52.4 – PMI

- Turkey annual inflation well above forecast near 58%

- Jan CPI 6.65% m/m 57.68% y/y vs. expected 4.0%/53.8%

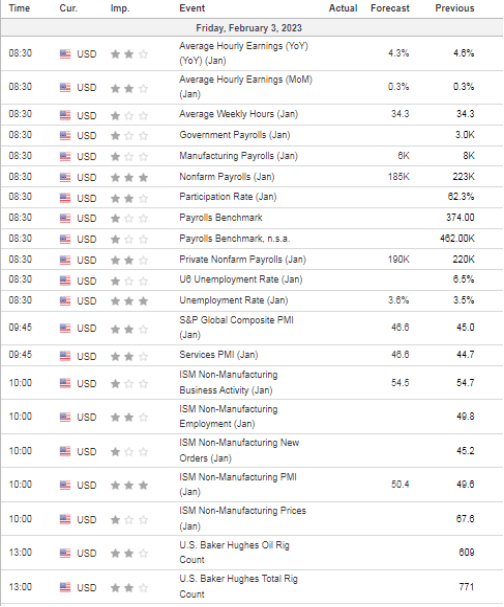

US DATA TODAY

COMMODITY HEADLINES OVERNIGHT

Metals

Copper set for weekly decline on slow China demand, firm dollar

Colombia’s mining royalties hit record $1.32 bln in 2022 -industry group

Energy

US natgas eases to 21-month low with warmer weather coming next week

China boosts imports of fuel oil blended from Russian barrels

Shell 2022 profit more than doubles to record $40 bln

ConocoPhillips joins Big Oil’s parade of bumper profits but shares fall

US diesel stocks start the year critically low: Kemp

TotalEnergies, Iraq see further delays to $27 bln energy deal

Pemex Deer Park, Texas refinery nears full restart -sources

Peru offers oil and gas exploration blocks, technical agreements