Mixed markets Asia….RED in Europe

- Hong Kong: Hang Seng closed down -0.01%

- China CSI 300 -0.04%

- Taiwan KOSPI +0.35%

- India Nifty 50 -0.01%

- Australia ASX +0.69%

- Japan Nikkei -0.55%

- European bourses in negative territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

PBOC Drafts Policy to Give Private Firms More Access to Funding-BBG

The People’s Bank of China is drafting preliminary policies to give private businesses better access to funding as authorities ramp up efforts to boost economic growth.

Central bank leaders and officials from other financial watchdogs met with representatives from more than 10 banks as well as private companies, including property developers and manufacturers, on Wednesday, according to local media reports.

Authorities are pushing banks to boost lending to businesses, with the state-run Securities Times quoting Ma Jianyang, a deputy head of the PBOC’s financial market department, as saying they will make it a “clear goal” as they draft the policies that the share of loans to private firms in total lending should continue to rise. Authorities want to ensure the financial support for the sector matches the companies’ contribution to the economy, according to the report.

China markets unimpressed this this measure

Orsted plunges 20% on risk of $2.3 billion in US impairments -Reuters

Denmark’s Orsted (ORSTED.CO), the world’s largest offshore wind farm developer, said on Wednesday it may see U.S. impairments of 16 billion Danish crowns ($2.3 billion) due to supply chain problems, soaring interest rates and a lack of new tax credits.

Orsted’s share price tumbled 20% to its lowest level in more than four years and is down almost 70% from its 2021 peak.

“The situation in U.S. offshore wind is severe,” Chief Executive Mads Nipper told reporters on a conference call.

The company’s Ocean Wind 1, Sunrise Wind, and Revolution Wind projects are adversely impacted by several supplier delays, which may trigger impairments of up to 5 billion crowns, the company said in a statement.

Orsted said the company’s discussions with “senior federal stakeholders” on obtaining more U.S. tax credits for its offshore wind projects had not progressed as expected, which in turn could lead to impairments of another 6 billion crowns.

On top of this, the increase in long-dated interest rates in the United States affected both offshore as well as some onshore wind projects and will cause impairments of around 5 billion crowns, Orsted said.

“Today’s announcement flags risks in the U.S. portfolio and does not do anything to improve the downbeat investor sentiment on the stock,” analysts at Bernstein said in a note to clients.

Offshore wind hitting brick wall of reality? It can not survive without massive tax credits, supply chain problems and rising rates. Looks like this sector will go through consolidation very soon

Gabon army officers say they have seized power after election in oil-rich country-Reuters

Military officers in oil-producing Gabon said they had seized power on Wednesday, after the Central African state’s election body announced that President Ali Bongo had won a third term.

A dozen senior officers appeared on television channel Gabon 24 to declare that the election results were cancelled, borders were closed and state institutions were dissolved. They said they represented all Gabon’s security and defence forces.

Hundreds of people took to the streets of the capital Libreville to celebrate in the morning following the overnight announcement, which appeared to have been filmed from the presidential palace, according to the television images.

If successful, the coup would be the eighth in West and Central Africa since 2020. The latest one, in Niger, was in July. Military officers have also seized power in Mali, Guinea, Burkina Faso and Chad, erasing democratic gains since the 1990s.

The West is losing their pull in Africa, this has big impacts as far and critical minerals for energy transition are concerned for the West

Energy fears spur German industrials to seek investments abroad-FT

Nearly a third of German industrial companies are planning to boost production abroad rather than at home amid increasing concern over the country’s future without Russian gas, according to a closely watched annual survey.

The annual “Energy Transition Barometer” by the German Chamber of Commerce and Industry (DIHK) found that 32 per cent of companies surveyed favoured investment abroad over domestic expansion. The figure was double the 16 per cent in last year’s survey.

The chamber asked 3,572 of its members about the effect of energy issues on their business outlook as Europe’s largest economy attempts to transition away from using gas and other fossil fuels.

Achim Dercks, the chamber’s deputy managing director, said “large parts” of the German economy were concerned about a lack of energy supply “in the medium and long term”.

The DIHK pointed in particular to challenges around the expansion of Germany’s power grid. Three-quarters of the 12,000 kilometres of new power lines needed to support the country’s electric ambitions had not even been approved for construction, it said.

The survey found that 52 per cent of companies responding thought that Germany’s energy transition was having a negative impact on business. The figure was the highest captured by the barometer since publication started in 2012.

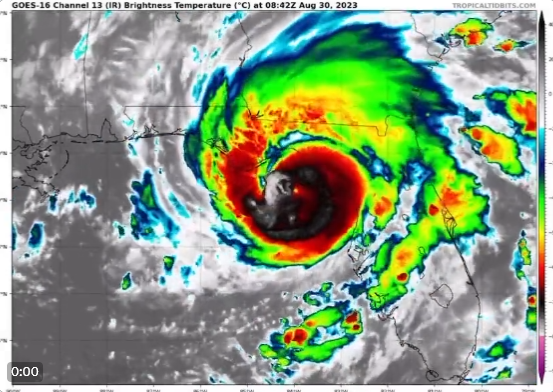

5am EDT 30 Aug: Idalia has become an extremely dangerous Category 4 hurricane, and is nearing landfall in Florida Big Bend region this morning. Catastrophic & life-threatening impacts from Storm Surge & Winds expected as Idalia moves ashore.

DeSantis extended an emergency declaration to cover 49 counties, with mandatory evacuation orders for several on the Gulf Coast. President Joe Biden approved federal emergency declarations for Florida, allowing the Department of Homeland Security and the Federal Emergency Management Agency to coordinate relief efforts. Georgia Governor Brian Kemp also declared an emergency Tuesday.-BBG

STAY SAFE ALL!

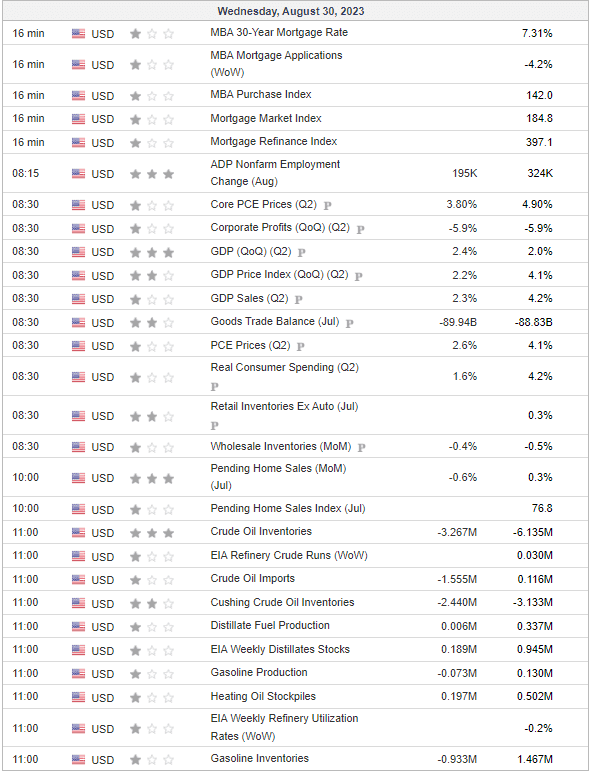

US DATA TODAY