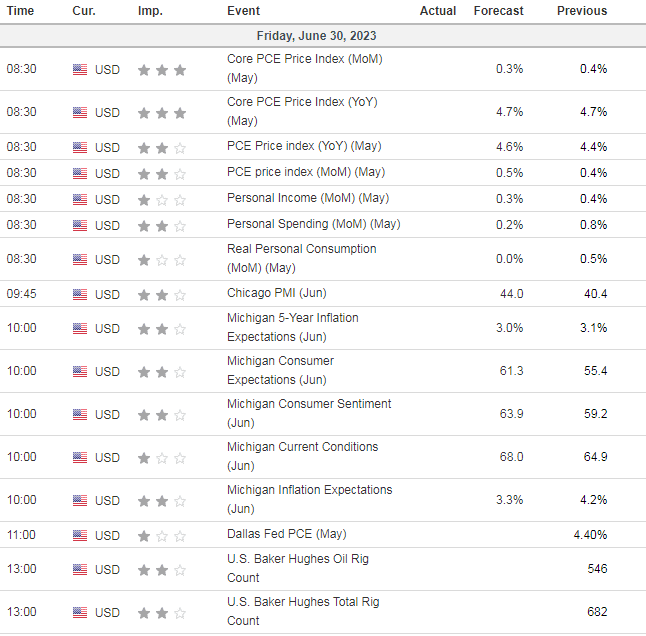

Last day of Q2–US data dump at 8:30AM ET

A lot of Green out there today

- Hong Kong: Hang Seng closed down -0.09%

- China CSI 300 +0.54%

- Taiwan KOSPI +0.56%

- India Nifty 50 +1.94%

- Australia ASX +0.07%

- Japan Nikkei +0.22%

- European bourses all in positive territory so far this morning

- USD +0.05%

TOP 5 STORIES OVERNIGHT

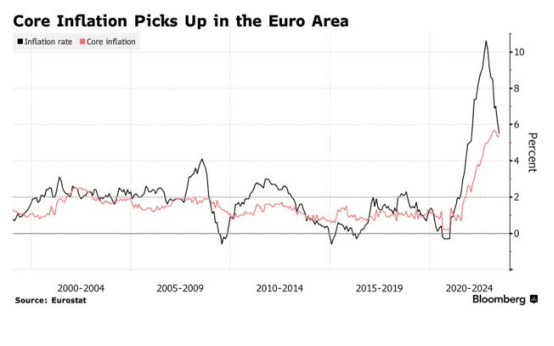

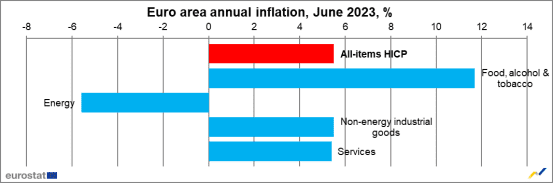

- Euro-Area Core Inflation Quickens Again in Setback for ECB -BBG

Underlying gauge rises to 5.4%, overshadowing headline slowing

Euro-area core inflation re-accelerated in June, a setback for the European Central Bank that may reinforce its determination to raise interest rates next month.

The measure of underlying consumer-price gains, which excludes items like fuel and food, came in at 5.4% — just below the median estimate in a Bloomberg survey of economists — as the cost of services picked up markedly.

The deterioration may eclipse an improvement in the headline inflation gauge. That moderated noticeably to 5.5% from 6.1%, reaching the lowest level since before the war in Ukraine broke out, after energy costs fell.

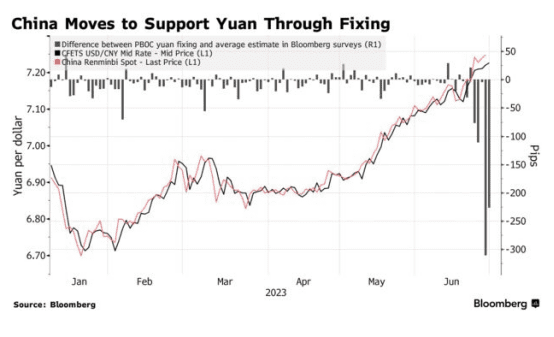

- China’s PBOC Sticks With Yuan Support as Currency Losses Deepen – BBG

China took steps to slow a decline in the yuan for a fourth time this week, as its weakness intensified on souring sentiment toward the world’s second-largest economy.

The central bank set its so-called fixing for the managed currency at a stronger-than-expected level on Friday, after the offshore yuan extended a seven-month low. The move came after reports that regulators have stepped up scrutiny of currency trading and cross-border capital flows, in a bid to stabilize the yuan.

“It goes hand in hand with the macro fundamentals of the Chinese economy, so it will be very hard to reverse the trend but what they can do is try to slow down the pace of weakness,” Selena Ling, head of treasury research and strategy at Oversea-Chinese Banking Corp, said on Bloomberg Radio.

So far this is not helping, again keep an eye on this yuan

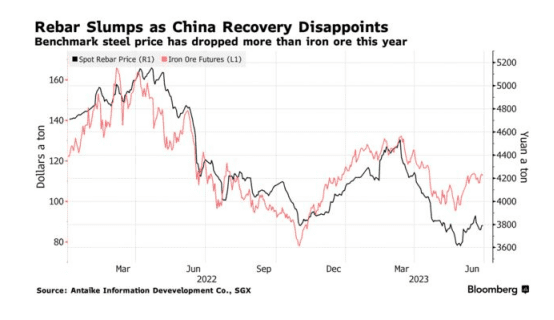

- China Steelmakers Issue Stark Warning About Second-Half Outlook -BBG

China’s leading steelmakers warned the industry faces a very challenging second half as demand disappoints, profitability lags, and pressure to cut costs mounts in the world’s top producer.

Representatives from China Baowu Steel Group Co., Ansteel Group Co., Hesteel Co. and Hunan Iron & Steel Group Co. said they are “not optimistic” about the coming six months, the China Iron & Steel Association said after the four companies attended a meeting organized by the industry body this week.

“The peak inflection point for steel demand has emerged, while the problems of insufficient end-user consumption, and ongoing thin margins are particularly prominent,” the CISA said in a statement, citing the quartet of companies.

This will weigh on sentiment across all industrial metals, and broader commodity markets

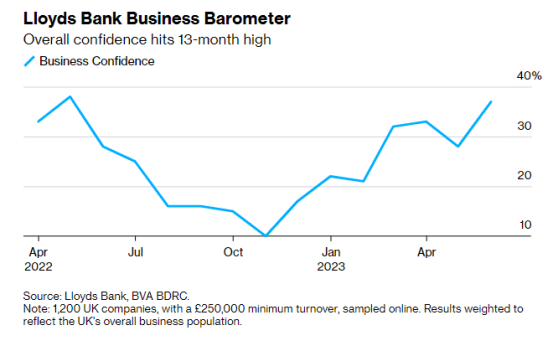

- UK Business Confidence Rebounds to a 13-Month High, Lloyds Says -BBG

UK business confidence rose to a 13-month high in June as firms shrugged off another Bank of England interest-rate increase, a survey by Lloyds Banking Group Plc found.

Lloyds’ Business Barometer showed optimism increasing 9 percentage points to 37%, rebounding from a dip in May. Executives said they were more confident about their own trading prospects and the wider economy.

The poll of 1,200 firms was conducted from June 1 to June 15, weeks after the BOE delivered a 12th consecutive rate hike in a bid to tame inflation. On June 22, however, the BOE stepped up its campaign with a larger-than-expected half-point rise to 5%, the highest since 2008.

This is in sharp contrast to the US, where confidence is on the decline

- Argentina’s Central Bank Allows Banks to Open Accounts in Yuan- BBG

The lack of dollar supply drives companies to adopt yuan

Argentina’s central bank will allow the country’s commercial banks to open customer accounts in yuan, as it seeks to address an acute shortage of dollar reserves and encourages local companies to make payments abroad in the Chinese currency.

According to a statement published on its website, the central bank on Thursday said it had granted banks permission to take deposits in yuan, while it’s increasing its yuan sales almost daily to finance imports.

The move follows last week’s approval by the country’s securities regulator, known locally as the CNV, to permit issuance of securities in the local market that settle in Chinese yuan. The trend highlights both Argentina’s dire financial situation and China’s ambitions for the yuan.

Use of the Chinese currency in Argentina’s foreign exchange market is at a record thanks to an expanded swap line with Beijing and as dollar liquidity has dried up. The share of yuan in the foreign exchange market has already reached a record 28% of total transactions in a trading day, according to data from Mercado Abierto Electrónico.

One rapidly declining currency for another…LOL

US DATA TODAY