Another day of GREEN (so far….)

- Hong Kong: Hang Seng closes UP +0.58%

- China CSI 300 +0.81%

- Taiwan KOSPI +0.38%

- India Nifty 50 +0.76%

- Australia ASX +0.23%

- Japan Nikkei -0.31%

- All European bourses all in positive territory so far this morning

- US indices also in positive territory so far this morning in pre-market, USD FLAT

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 6.8886 (prev fix 6.8771 prev close 6.8866)

- PBoC To Inject CNY239Bln Via 7 Day Reverse Repos At 2.0% In Open Market Ops

- Spanish CPI (M/M) Mar P: 0.4% (est 0.7%; prev 0.9%) – Spanish CPI (Y/Y) Mar P: 3.3% (est 3.9%; prev 6.0%) – Spanish CPI EU Harmonised (M/M) Mar P: 1.1% (est 1.6%; prev 0.9%) – Spanish CPI EU Harmonised (Y/Y) Mar P: 3.1% (est 3.7%; prev 6.0%)

- Spanish Retail Sales SA (Y/Y) Feb: 4.0% (prev 5.5%) – Spanish Retail Sales (Y/Y) Feb: 3.5% (prev 7.1%)

- Italian Unemployment Rate Feb: 8.0% (est 7.9%; prevR 8.0%)

- Italian PPI (M/M) Feb: -1.3% (prev -9.9%) – Italian PPI (Y/Y) Feb: 10.0% (prev 11.6%)

- Eurozone Economic Sentiment Mar: 99.3 (prev 99.8)

- Eurozone Consumer Confidence Mar F: -19.2 (prev -19.2) – Eurozone Industrial Sentiment Mar: -0.2 (est 0.5; prevR 0.4) – Eurozone Services Sentiment Mar: 9.4 (est 10.0; prev 9.5)

- Eurozone Cons Inflation Expec Mar: 18.9 (prev 17.7) – Eurozone Selling Price Expec Mar: 18.7 (prev 23.8)

- China’s Premier Li: Urged To Ensure Stability Of Global Supply Chain -Urges To Maintain World Order Under UN Framework

- ECB’s Frank Elderson: “If The Inflation Forecasts Are Met, Rates Will Have To Be Raised” – El Pais

- Russia Detains Wall Street Journal Reporter On Spying Charges – BBG

- EU Von Der Leyen Our relationship with China is one of the most intricate and important. How we manage it will be a determining factor for our future economic prosperity and national security-speech

- Fraud in UK public spending soars under poor oversight

– National Audit Office (NAO) watchdog

– NAO: govt accounts pointed to fraud of £21.0 Bln in FY 2020/21

and FY 2021/22 vs. £5.5 Bln previous two years - AT1 Yields Near Record Show Lasting Damage From Credit Suisse

CHART OF THE DAY

Spec positioning in WTI futures and options contracts is at its net-shortest since January 2016, when prices were hanging out around $26/bbl at the bottom of that 2014-16 cycle– via Rory Johnston

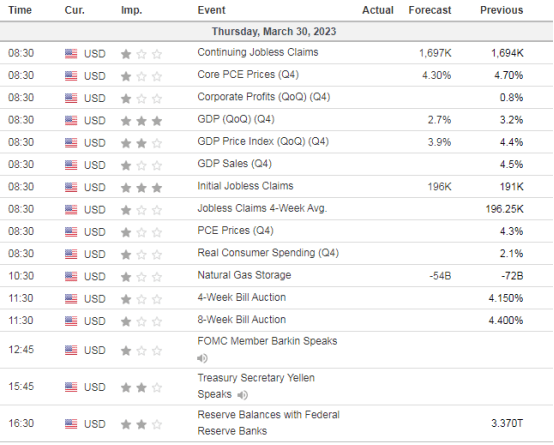

US DATA TODAY