Mixed Markets

- Hong Kong: Hang Seng closed down -0.55%

- China CSI 300 -0.61%

- Taiwan KOSPI -0.19%

- India Nifty 50 -0.32%

- Australia ASX +1.22%

- Japan Nikkei +0.57%

- European bourses in mixed territory so far this morning

- USD +0.33%

TOP STORIES OVERNIGHT

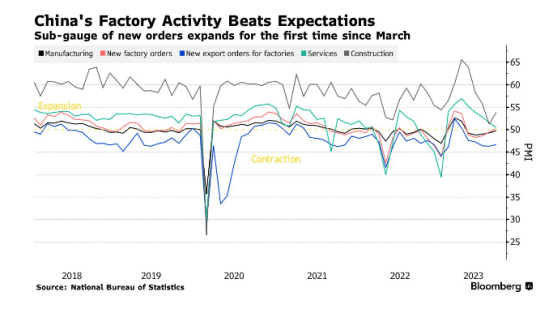

China’s Factory Activity Sparks Hope Slump Is Bottoming Out-BBG

China’s manufacturing contraction eased slightly in August and a gauge of new orders improved, providing some hope that the worst of the sector’s slump may be ending.

The official manufacturing purchasing managers’ index rose to 49.7, topping estimates and edging closer to the 50 level that would signal activity has stopped contracting.

While market reaction to the figures was muted, they offered tentative evidence that targeted efforts to shore up the economy are having some effect. The nation’s manufacturers have been struggling for months because of a slump in global demand and subdued domestic spending. Policymakers have so far been reluctant to roll out massive stimulus, with some economists suggesting the official annual growth target of about 5% is at risk.

Iron ore jumps to five-week high on improved China data, stimulus-Reuters

Iron ore futures rallied on Thursday to their highest levels in five weeks, underpinned by better-than-expected economic data and the latest batch of stimulus measures in China, the world’s largest consumer of the steelmaking ingredient.

The benchmark iron ore SZZFU3 on the Singapore Exchange was 1.37% higher at $116 a metric ton, the highest since July 26.

The most-traded iron ore futures on China’s Dalian Commodity Exchange (DCE) DCIOcv1 were up 3.11% at 845.5 yuan a metric ton, as of 0215 GMT, their highest since Aug. 1.

“The latest flurry of macroeconomic stimulus largely boosted sentiment … and attention needed to be paid to the low inventories in the industrial chain,” analysts at Huatai Futures said in a note.

“If steel consumption improves further, demand for iron ore from steelmakers will be sustained.”

Iron ore is seen a a measure of China economy

Gabon Coup: BW Energy, Tullow Oil say oil production still normal – Report -Nairametrics

Oil and gas companies, Tullow Oil and BW Energy which have active operations in Gabon, have said there have been no disruptions to their oil production activities following the August 30 coup which occurred in Gabon, after the military took overpower from Ali Bongo, whose family has been in a “democratic” government for the last four decades.

This is according to a report from S&P Global Commodity Insights. In the report, it was stated that some oil majors have confirmed that production is still ongoing undisrupted in the country.

S&P wrote that Knut Sæthre, the CFO of BW Energy, whose Gabon assets are currently producing 27,500 barrels per day said the company is monitoring the situation, however, all offshore operations are continuing as normal.

Meanwhile, Tullow Oil, which produced 14,900 barrels per day in Gabon in 2022 also told S&P that its operations are “currently unaffected by the ongoing coup and production continues as normal.

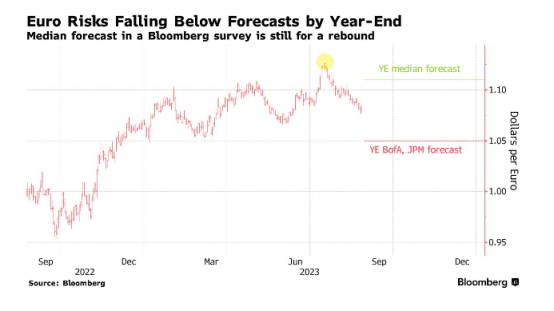

Traders Are Bailing on the Euro as Talk of Stagflation Heats Up-BBG

Traders are abandoning the euro at pace as speculation grows the European Central Bank will struggle to tighten monetary policy further, even with inflation running far above target.

Data Thursday showed euro-area inflation stopped slowing in August, but the market is betting the ECB’s cycle of interest-rate hikes is as good as over. After a string of poor economic figures and comments from ECB member Isabel Schnabel on the dire outlook, traders are favoring a pause at the next meeting.

Concern that Europe faces stagflation — a combination of weak economic activity and high inflation — has led many bulls to capitulate and dragged the euro lower. It fell as much as 0.5% to $1.0865 on Thursday, taking losses from a peak in July to almost 4%.

Analysts have cut their median forecast for the currency for the first time in six months, while firms including Bank of America Corp. and JPMorgan Chase & Co. see it falling toward $1.05, a level last seen during the banking crisis in March. BNP Paribas Asset Management says it could reach $1.02.

“The economy is clearly weakening, but core inflation remains stuck. If the weakness we have seen so far is not enough to bring inflation down, the economy needs to weaken even more,” said Athanasios Vamvakidis, head of G-10 FX strategy at Bank of America. “That’s the main concern for the euro.”

Driest August in a Century Stokes More India Crop Curb Fears-BBG

India received the lowest August rains since at least 1901, prompting concerns about weaker crop output and the potential for more export restrictions following the South Asian nation’s curbs on rice.

The country received 162.7 millimeters of rainfall this month, 36% lower than normal, according to data compiled by the India Meteorological Department. Total rainfall during June-August was 10% below average, the figures show.

Monsoon rains irrigate about half of India’s farmland and are crucial for crops such as sugar and soybeans. Erratic weather has hurt some harvests since last year, forcing the nation to restrict exports of wheat and rice to cool domestic retail inflation that surged to a 15-month high in July. The government has also imposed stockpile limits on some crops.

September rains will be crucial to make up the shortfall as the monsoon nears its end, especially given the onset of El Niño, which can bring drier conditions. Some main rice-growing regions in the nation’s east have had poor rainfall, hurting prospects of the biggest monsoon-sown food grain crop in the area, according to the weather office. The cane areas in the western and southern parts have also seen lower rainfall, it said.

Any decline in production of wheat, rice and sugar in the world’s second-biggest grower could put more stress on global food supplies and boost prices of major commodities. Rice prices in Asia are hovering near a 15-year high and sugar prices in New York are up more than 25% this year.

Watch grains

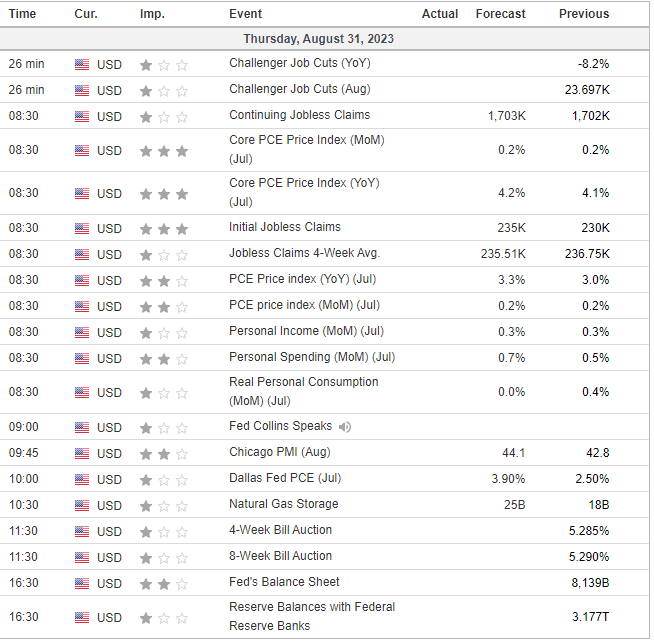

US DATA TODAY