Markets broadly down

- Hong Kong: Hang Seng closes down -1.03%

- China CSI 300 -1.06%

- Taiwan KOSPI -1.04%

- India Nifty 50 +0.07%

- Australia ASX -0.12%

- Japan Nikkei -0.59%

- European bourses weak and in negative territory across the board with the exception of Athens, Austria, and Italy

- US indices also down across the board this morning in pre-market , USD up +0.14%

Overnight data/news

- Germany: German retail sales post shock fall in December

Dec Retail Sales -5.3% m/m -6.6% y/y vs. expected -0.5%/-2.6%

Dec Import Prices -1.6% m/m 12.6% y/y vs. expected -2.5%/11.8% - UK UK public inflation expectations cool again: Citi/YouGov survey

1-yr Inflation Expectations fall to 5.4% from 5.7%

Long-run Inflation Expectations fall to 3.5% y/y, close to long-term average - UK grocery price inflation rises to record 16.7% y/y – Kantar

- Japan Dec prov. Industrial Production -0.1% m/m -2.8% y/y vs. expected -1.2%/-4.0%

Q4 Industrial Production -3.1% q/q, biggest fall since Q2 2020

Dec Retail Sales 1.1% m/m 3,8% y/y vs. expected 0.8%/3.1%

Dec Large Scale Retail Sales 3.,6% y/y

Dec Unemployment Rate 2.5% as expected

Dec Jobs To Applicants Ratio 1.35 vs. expected 1.36

Jan Consumer Confidence 31.0 vs. expected 30.4 (Dec 30.3) - China economic activity swings back to growth in January

Jan NBS Manufacturing PMI 50.1 as expected (Dec 47.0)

Jan NBS Services PMI jumps back to 54.4 vs. expected 52.0(Dec 41.6)

Dec Industrial Profits y.t.d. -4.0% y/y vs. prior -3.6%

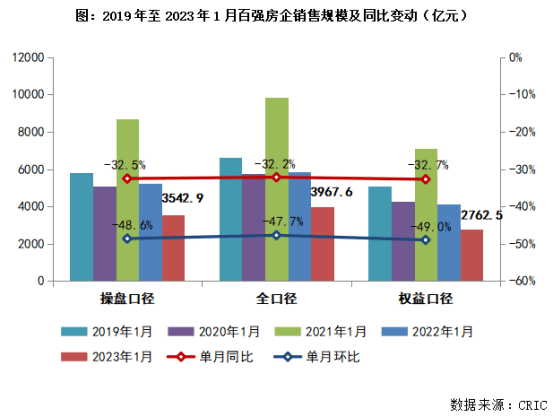

China’s property sector turmoil to weigh on future growth

China Top 100 Developers See Jan Sales -32.5% Year on Year: CRIC

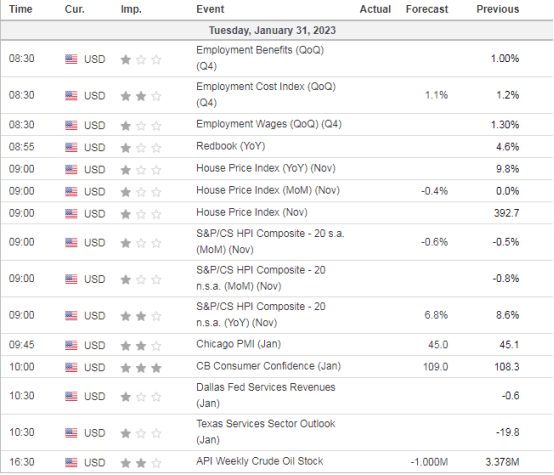

US DATA TODAY

COMMODITY HEADLINES OVERNIGHT

Metals

Gold slips ahead of Fed, but on pace for third monthly gain

Copper prices ease with Fed meeting, China rebound in focus

Iron ore dips as traders weigh China demand

Chinese-owned copper mine in Peru may halt production over unrest -2% of global production

Energy

Oil slips on rate hike worries, Russian export flows

OPEC+ seen sticking with oil output policy at Feb. 1 meeting – delegates

Venezuela tightens oil prepayment rules, documents show