Eurozone inflation this morning headline down, core comes in hot m/m

Green again….

- Hong Kong: Hang Seng closes UP +0.45%

- China CSI 300 +0.31%

- Taiwan KOSPI +0.97%

- India Nifty 50 +1.56%

- Australia ASX +1.06%

- Japan Nikkei +0.46%

- All European bourses broadly in positive territory so far this morning except German tech and Austria

- US indices mixed so far this morning in pre-market,nasdaq weakest USD +0.34%

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 6.8717 (prev fix 6.8886 prev close 6.8710)

- PBoC To Inject CNY189Bln Via 7 Day Reverse Repos At 2.0% In Open Market Ops

- Chinese Manufacturing PMI Mar: 51.9 (exp 51.6; prev 52.6) -Non-Manufacturing PMI Mar: 58.2 (exp 55.0; prev 56.3) -Composite PMI Mar: 57.0 (prev 56.4)

- Japanese Housing Starts (Y/Y) Feb: -0.3% (exp -0.5%; prev 6.6%) -Annualised Housing Starts Feb: 0.859M (exp 0.861M; prev 0.893M)

- UK GDP (Q/Q) Q4 F: 0.1% (est 0.0%; prev 0.0%) – UK GDP (Y/Y) Q4 F: 0.6% (est 0.4%; prev 0.4%)

- UK Private Consumption (Q/Q) Q4 F: 0.2% (est 0.1%; prev 0.1%) – UK Government Spending (Q/Q) Q4 F: 0.5% (est 0.8%; prev 0.8%) – UK Gross Fixed Capital Income(Q/Q) Q4 F: 0.3% (est 1.5%; prev 1.5%) – UK Exports (Q/Q) Q4 F: -1.4% (est -1.0%; prev -1.0%)

- UK Nationwide House PX (M/M) Mar: -0.8% (est -0.3%; prev -0.5%) – UK Nationwide House PX NSA (Y/Y) Mar: -3.1% (est -2.2%; prev -1.1%)

- German Import Price Index (M/M) Feb: -2.4% (est -1.0%; prev -1.2%) – German Import Price Index (Y/Y) Feb: 2.8% (est 4.2%; prev 6.6%)

- German Retail Sales (M/M) Feb: -1.3% (est 0.5%; prevR 0.0%) – German Retail Sales NSA (Y/Y) Feb: -7.0% (est -5.1%; prevR -4.0%)

- French Consumer Spending (M/M) Feb: -0.8% (est -0.1%; prevR 1.7%) – French Consumer Spending (Y/Y) Feb: -4.1% (est -3.6%; prevR -3.6%)

- French PPI (M/M) Feb: -0.9% (prevR 2.5%) – French PPI (Y/Y) Feb: 15.7% (prevR 17.6%)

- Italian Industrial Sales WDA (Y/Y) Jan: 8.6% (prev 14.9%) – Italian Industrial Sales (M/M) Jan: -1.1% (prev 0.7%)

- Italian CPI EU Harmonised (Y/Y) Mar P: 8.2% (est 8.8%; prev 9.8%) – CPI EU Harmonised (M/M) Mar P: 0.8% (est 1.5%; prevR 0.1%) – CPI NIC Incl. Tobacco (Y/Y) Mar P: 7.7% (est 8.2%; prevR 9.1%) – CPI NIC Incl. Tobacco (M/M) Mar P: -0.3% (est 0.0%; prevR 0.2%)

- Eurozone CPI Core (Y/Y) Mar P: 5.7% (est 5.7%; prev 5.6%) – Eurozone CPI Estimate (Y/Y) Mar: 6.9% (est 7.1%; prev 8.5%) – Eurozone CPI (M/M) Mar P: 0.9% (est 1.1%; prev 0.8%)

- Eurozone Unemployment Rate Feb: 6.6% (est 6.6%; prevR 6.6%)

- Japan Tightens Chip Gear Exports As US Seeks To Contain China – BBG

- RBA Pause Bet Bolstered By Strongest Aussie Bond Sale Since 2021 – BBG

- Fuel-Tanker Demand Is Booming As Asia, Middle East Refine More Oil – BBG

- Dealmaking At 10-Year Low In First Quarter As Bank Crisis Hits Confidence – FT

- Citi Strategists Raise US Stocks To Overweight From Underweight -Cut European Stocks To Neutral

- S&P Affirms Japan ‘A+/A-1’ Ratings; Outlook Stable

- Russian Oil Price Cap To Stay At $60, European Governments Told – BBG

- BofA Bull & Bear Indicator Drops Sharply To 2.3 From 3.0 Last Week, On Weaker Credit Flows & Worsening Breadth In Stocks – BofA

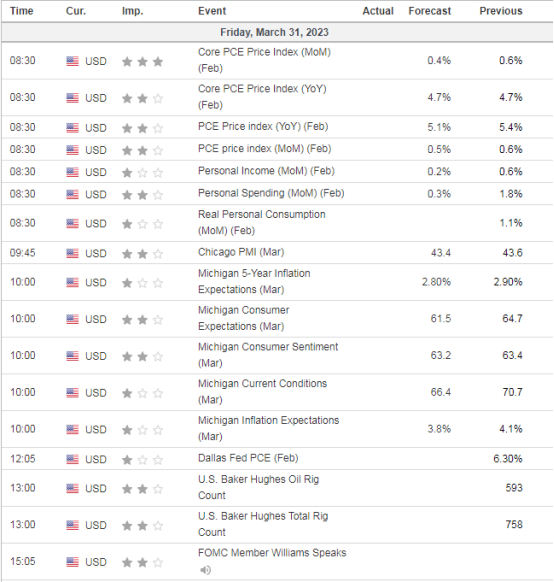

US DATA TODAY