Poor manufacturing data out of Asia, particularly China today pressuring commodities and market sentiment….

Sea of RED

- Hong Kong: Hang Seng closed down 1.94%!!

- China CSI 300 -1.02%

- Taiwan KOSPI -0.32%

- India Nifty 50 -0.59%

- Australia ASX -0.11%

- Japan Nikkei -0.80%

- European bourses in all in negative territory so far this morning

- US indices in negative territory so far in pre-market, USD up +0.33%

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 7.0821 (prev fix 7.0818 prev close 7.0788)

- Chinese Manufacturing PMI May: 48.8 (exp 49.5; prev 49.2) – Non-Manufacturing PMI May: 54.5 (exp 55.2; prev 56.4) – Composite PMI May: 52.9 (prev 54.4)

- Australian CPI (Y/Y) Apr: 6.8% (exp 6.4%; prev 6.3%)

- Japanese Housing Starts (Y/Y) Apr: -11.9% (exp -0.8%; prev -3.2%) – Annualised Housing Starts Apr: 0.771M (exp 0.868M; prev 0.877M)

- German Import Price Index M/M Apr: -1.7% (est -0.5%, prev -1.1%) – German Import Price Index Y/Y Apr: -7.0% (est -5.8%, prev -3.8%)

- – France CPI Y/Y MayP: 5.1% (est 5.5%, prev 5.9%) – France CPI M/M MayP: -0.1% (est 0.3%, prev 0.6%) – France CPI EU Harmonized Y/Y MayP: 6.0% (est 6.4%, prev 6.9%) – France CPI EU Harmonized M/M MayP: -0.1% (est 0.3%, prev 0.7%)

- France PPI Y/Y Apr: 7.0% (prevR 12.8%) – France PPI M/M Apr: -5.1% (prevR 1.9%)

- Turkey GDP Y/Y Q1: 4.0% (est 3.5%, prev 3.5%)

- Italy GDP Final Q/Q Q1: 0.6% (est 0.5%, prev 0.5%) – Italy GDP Final Y/Y Q1: 1.9% (est 1.8%, prev 1.8%)

- Italy CPI EU Harmonized Y/Y MayP: 8.1% (est 7.5%, prev 8.7%) – Italy CPI EU Harmonized M/M MayP: 0.3% (est -0.3%, prev 0.9%) – Italy CPI Y/Y MayP: 7.6% (est 7.4%, prev 8.2%) – Italy CPI M/M MayP: 0.3% (est -0.1%, prev 0.4%)

- Portugal GDP Q/Q Q1F: 1.6% (est 1.6%, prev 1.6%) – Portugal GDP Y/Y Q1F: 2.5% (est 2.5%, prev 2.5%)

- Portugal CPI EU Harmonized Y/Y MayP: 5.4% (est 6.0%, prev 6.9%) – Portugal CPI EU Harmonized M/M MayP: -0.4% (prev 1.3%) – Portugal CPI Y/Y MayP: 4.0% (prev 5.7%) – Portugal CPI M/M MayP: -0.7% (prev 0.6%)

- US MBA Mortgage Applications: -3.7% (prev -4.6%) – US MBA 30YR Mortgage Rate: 6.91% (prev 6.69%)

- Fed’s Mester Sees No ‘Compelling’ Reason To Wait For Fresh Rate Rise – FT

- Wall Street Prepares To Take On Established Crypto Companies – FT

- Summers Sees Higher Fed Interest Rates, Increased US Taxes – BBG

- PMI shows China factory activity falls faster than expected … RTRS

- French Inflation Slows More Than Expected To Weakest In A Year – BBG

- ECB’s Muller Sees More Than One More Quarter-Point Rate Hike – BBG

- European Shares Touch Two-month Low On Dismal China data – RTRS

- ECB’s Inflation Fight Exposes Fragilities In Financial System – BBG

- JP Morgan Expects Conservatives To Govern Spain After Snap – BBG

- French Inflation Slows to Weakest in a Year But Italy Overshoots – BBG

- Inflation Dips In German States, Pointing To National Drop – RTRS

- House GOP Debt Limit Negotiator McHenry: We Have The Votes To Pass Debt-Limit Bill Today – CNBC

- US Mortgage Rates Hit Near Seven-Month High During Debt Impasse – BBG

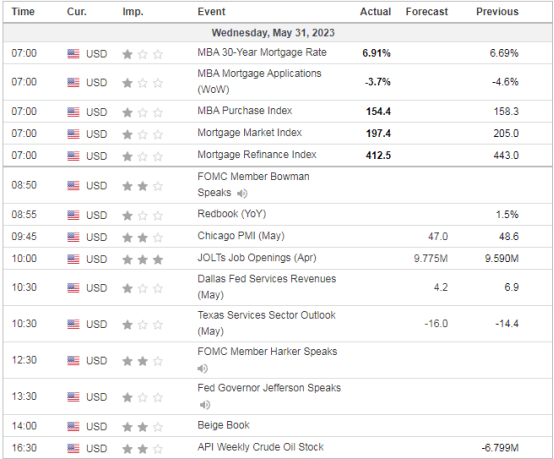

US DATA TODAY