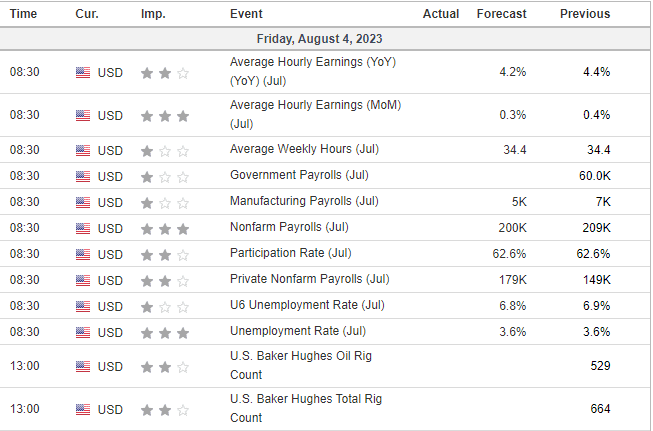

Non-Farm payroll Friday!

Mostly GREEN!

- Hong Kong: Hang Seng closed up +0.61%

- China CSI 300 +0.39%

- Taiwan KOSPI -0.10%

- India Nifty 50 +0.64%

- Australia ASX -0.61%

- Japan Nikkei +0.58%

- European bourses in positive territory so far this morning

- USD flat

TOP STORIES OVERNIGHT

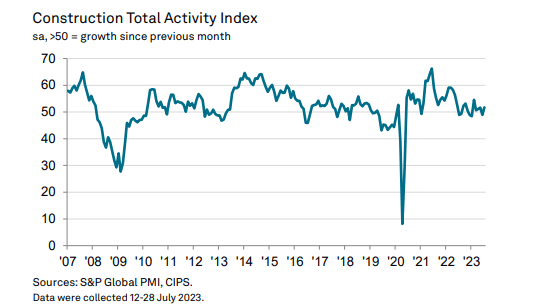

S&P Global / CIPS UK Construction PMI

Total construction output returns to growth in July

Fastest upturn in supplier performance since March 2009

July data signalled a renewed expansion of overall construction output, following the marginal decline seen during the previous month. This was led by the strongest rise in commercial building since February and another solid contribution to growth from civil engineering activity. Meanwhile, latest data signalled another sharp reduction in residential construction activity

The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index® (PMI®) – a seasonally adjusted index tracking changes in total industry activity – posted 51.7 in July, up from 48.9 in June and the highest level for five months.

Robust increases in commercial building (index at 54.4) and civil engineering (53.9) were offset by a steep fall in house building (43.0).

Interesting that commercial real estate is doing well in the UK and horribly in the US

Falling Eurozone Inflation Puts ECB Rates Peak Within Sight-Fitch

Fitch Ratings-London-04 August 2023: The headline rate of inflation in the eurozone fell to 5.3% in July from 5.5% in June, and Fitch Ratings expects it will fall to around 4% by year-end. Energy prices have made the biggest contribution to reducing the annual rate of headline inflation from its October 2022 peak, and moderating food price inflation will continue to help lowering it heading into 2024. Core inflation, at 5.5%, has since overtaken headline inflation, making further falls more reliant on declining core inflation.

Inflation momentum (as measured by the annualised three-month on three-month change in the seasonally adjusted price level) is fading across nearly all main categories except energy, where prices are falling but at a slower rate than in 2Q23. Services inflation, with a 44% weight in the HICP, stands out as the most persistent component. The annual rate of services inflation reached a new high of 5.6% in July. Price increases have reflected rising wages (a focus of policymakers), energy costs and rebalancing of demand. Momentum in services prices is still high at 5.6% but is also starting to decline.

Moreover, momentum in core goods prices is falling rapidly owing to the reversal of supply shocks, the easing of supply-chain issues and lower input costs, setting up a period of low core goods inflation.

We expect core inflation to resume its downward path in August. Though inflation remains well above target and there may be shocks to come, the ECB will probably not need to raise its near-term inflation forecasts further in September. Even some hawks on the ECB Governing Council have advocated pausing interest rate rises, making it less likely that the terminal rate (for the MRO refinancing rate) will exceed our June forecast of 4.5%.

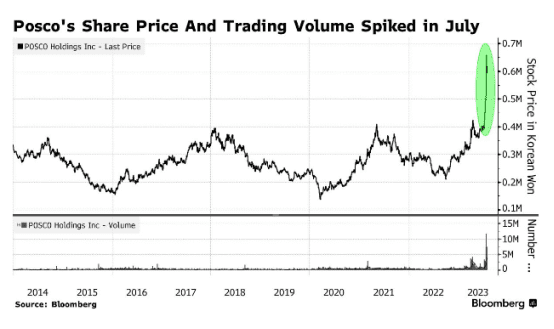

Craze for Anything EV Send Steelmaker on $18 Billion Ride-BBG

The frenzy surrounding all things EV has transformed a sleepy South Korean stock into one of the world’s best performing large and mid-cap names. But headwinds are emerging.

The winning streak in steelmaker Posco Holdings Inc. may grind to a halt after shares jumped 65% in July on bets that the firm’s $92 billion spending plan would give it a foothold in the fast-growing green industry. Analysts see expensive valuations as a deterrent following a rally that added almost $18 billion to the stock’s market value last month. Posco shares are headed for their biggest weekly drop since mid-May, down 4%.

The gains are not simply a story of how a traditional coal-heavy steel producer is winning over investors amid efforts to expand into green businesses.

“Despite us being a believer of its long term transformation story, we believe excessive optimism has run ahead of fundamentals,” Morgan Stanley analysts Young Suk Shin and Michael Koh wrote this week, downgrading the stock to underweight from equal-weight. “At current valuation, we see Posco as one of the most expensive steel stocks regionally.”

UAW Demands 40% Pay Hike in Labor Talks With Detroit Automakers-WSJ

United Auto Workers union is pressing for the substantial wage increase for factory workers at GM, Ford and Stellantis

The United Auto Workers union is pressing the Detroit car companies to give its factory workers a 40% pay hike in the next labor contract, an increase that would be the largest in recent memory.

The UAW is negotiating new four-year labor agreements for about 150,000 hourly workers at General Motors, Ford Motor and Jeep-maker Stellantis.

Currently, unionized factory workers at the Detroit car companies start at about $18 an hour. The top wage, achieved over a period of years, is about $32 an hour.

The 40% pay hike would be a general increase over the life of the next four-year contract, although it is still not clear how exactly it would be applied, the people say.

Exclusive-China, Saudi in talks for ETF cross-listings to bolster financial ties-sources -Reuters

China and Saudi Arabia’s stock exchanges are in talks to allow exchange-traded funds (ETFs) to list on each other’s bourses, three sources familiar with the matter said, as the countries look to deepen financial ties amid warming diplomatic relations.

The talks are in the early stages, said the sources, and could mark a major first step by Beijing and Riyadh towards broadening cooperation beyond energy, security, and sensitive technology sectors.

The Shenzhen Stock Exchange, one of the two major bourses in the Chinese mainland, is in negotiations with the Saudi Tadawul Group, operator of the Saudi Stock Exchange, for ETF Connect, as the programme is called, two of the sources said.

For China, an ‘ETF Connect’ tie-up with Saudi Arabia will be the first such beyond East Asia and affirm a commitment to open up its trillions of dollars worth of financial markets to international investors.

Some of China’s biggest ETF operators have been notified in recent months about the possibility of a cross-listing agreement with Saudi Arabia and some are considering the option, one of the sources said.

The China Securities Regulatory Commission, the Shenzhen Stock Exchange and the Tadawul Group did not respond to Reuters’ requests for comment. The sources declined to be named as they were not authorised to speak to the media.

The cross-listing of ETFs will allow investors in China and Saudi Arabia to trade funds tracking specific stocks or bond indexes listed on each other’s stock exchanges.

Dedollarization crowd is going to eat this up. It means little imho.

US DATA TODAY