Asia mostly green….Europe mostly red

- Hong Kong: Hang Seng -Market closed-holiday

- China CSI 300 -Market closed-holiday

- Taiwan KOSPI +0.59%

- India Nifty 50 +0.93%

- Australia ASX +0.20%

- Japan Nikkei -1.16%

- All European bourses broadly in negative territory so far this morning

- US indices slightly in negative territory so far this morning in pre-market, USD +0.11%

Overnight Data/News

- Japan Jibun Bank Services PMI Mar F: 55.0 (prev 58.2) – Jibun Bank Comp PMI Mar F: 52.9 (prev 54.5)

- Japan Jibun Bank Services PMI Mar F: 55.0 (prev 54.2) – Jibun Bank Comp PMI Mar F: 52.9 (prev 51.9)

- Australia AiG Manufacturing Index March: 5.6 (prev -6.4) – AiG Manufacturing Index March: -5.8 (prev -5.0)

- New Zealand RBNZ Hike Official Cash Rate 50 Bps To 5.25%, From 4.75%

- Australia pauses: RBA’s Gov Lowe: April Pause Doesn’t Imply Rate Hikes Are Over

- Russian S&P Global Composite PMI Mar: 56.8 (prev 53.1) – Russian S&P Global Services PMI Mar: 58.1 (prev 53.1)

- German Factory Orders (M/M) Feb: 4.8% (exp 0.3%; prevR 0.5%) – German Factory Orders WDA (Y/Y) Feb: -5.7% (exp -9.3%; prevR -12.0%)

- German S&P Global Services PMI Mar F: 53.7 (exp 53.9; prev 53.9) – German S&P Global Composite PMI Mar F: 52.6 (exp 52.6; prev 52.6)

- German Engineering Orders Down 17% In Dec-Feb Period Year On Year (Domestic Orders -14%, Foreign Orders -19%) – VDMA – In February Down 17% Year On Year (Domestic Orders -18%, Foreign Orders -16%)

- French Industrial Production (M/M) Feb: 1.2% (exp 0.5%; prevR -1.4%) – Industrial Production (Y/Y) Feb: 1.3% (exp -0.1%; prevR -1.62%) – Manufacturing Production (M/M) Feb: 1.3% (exp 0.3%; prevR -1.5%) – Manufacturing Production (Y/Y) Feb: 2.2% (prevR -0.5%)

- French S&P Global Services PMI Mar F: 53.9 (exp 55.5; prev 55.5) – French S&P Global Composite PMI Mar F: 52.7 (exp 54.0; prev 54.0)

- Spanish Industrial Output NSA (Y/Y) Feb: -0.8% (prevR 1.4%) – Industrial Output SA (Y/Y) Feb: -0.4% (exp 0.2%; prevR -0.2%) – Industrial Output (M/M) Feb: 0.6% (exp 0.4%; prevR -0.8%

- Spanish S&P Global Services PMI Mar: 59.4 (exp 57.5; prev 56.7) – Spanish S&P Global Composite PMI Mar: 58.2 (exp 56.0; prev 55.7)

- Italian S&P Global Services PMI Mar: 55.7 (exp 53.7; prev 51.6) – Italian S&P Global Composite PMI Mar: 55.2 (exp 53.2; prev 52.2)

- Italian Retail Sales (M/M) Feb: -0.1% (prev 1.7%) – Italian Retail Sales (Y/Y) Feb: 5.8% (prev 6.2%)

- Eurozone S&P Global Services PMI Mar F: 55.0 (exp 55.6; prev 55.6) – Eurozone S&P Global Composite PMI Mar F: 53.7 (exp 54.1; prev 54.1)

- UK S&P Global/CIPS Services PMI Mar F: 52.9 (exp 52.8; prev 52.8) – UK S&P Global/CIPS Composite PMI Mar F: 52.2 (exp 52.2; prev 52.2)

- US MBA Mortgage Applications: -4.1% (prev 2.9%) – US MBA Mortgage Applications 30-Year: 6.40% (prev 6.45%)

- POLL: Dollar’s Crown To Slip As Peers Catch Up In Rates Race – RTRS

- The two-year yield could rise more than 100 basis points above the 10 year, according to PGIM’s Greg Peters

- BoJ Could End Yield Curve Control In April, Ex-Official Says – BBG

- Europe’s Banks Ramp Up Bespoke Loan Trades To Reduce Risk – RTRS

- German Factory Orders Rise In Positive Sign For Manufacturing – BBG

- TotalEnergies, Iraq To Move Ahead On $10 Billion Investment Deal – BBG

- Germany May Avoid A Winter Recession With Early-Year Growth – BBG

- ECB’s Vasle: Core Inflation Is Clearly On An Upward Trend

- Risky Bank Debt Rebounds From Plunge After Credit Suisse Wipeout – FT

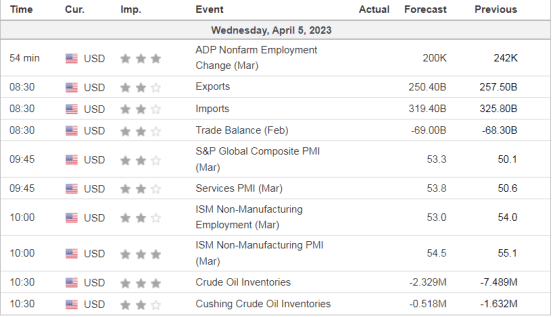

US DATA TODAY