Pretty red out there

- Hong Kong: Hang Seng closed down -1.57%

- China CSI 300 -0.77%

- Taiwan KOSPI -0.55%

- India Nifty 50 +0.14%

- Australia ASX +0.49%

- Japan Nikkei -0.30%

- European bourses all in negative territory so far this morning

- USD +0.17%

TOP 5 STORIES OVERNIGHT

- German Carmakers Are Bleakest About Their Future Since 2008 – BBG

Manufacturers’ future view deteriorated again in June: Ifo

German automakers’ expectations are at their worst since the 2008 financial crisis due to inflationary pressures, sclerotic economic growth in Europe and punishing competition from Tesla Inc. as well as Chinese carmakers.

The future view by the likes of Volkswagen, Mercedes-Benz, and BMW deteriorated for a fifth month in June to minus 56.9 points, a slump from minus 10.3 points the month before, according to a survey by the Munich-based Ifo Institute published on Wednesday. That’s not far off 2008’s low of minus 67.8.

Deindustrialization of Germany continues

- Investors Slash Outlook for Asia Stocks on Fading China Optimism- BBG

Investors lowered their expectations of gains in Asian equities this year as optimism fades about the prospects of looser monetary policy and China’s economic outlook.

That’s the view of most of the 17 strategists and fund managers surveyed by Bloomberg News. The MSCI Asia Pacific Index is seen rising to 174 by year end, according to the average of 13 responses to a poll late last month. The forecast implies gains of 5% from Tuesday’s close, and compares with the 178.5 level predicted in a similar Bloomberg survey three months ago.

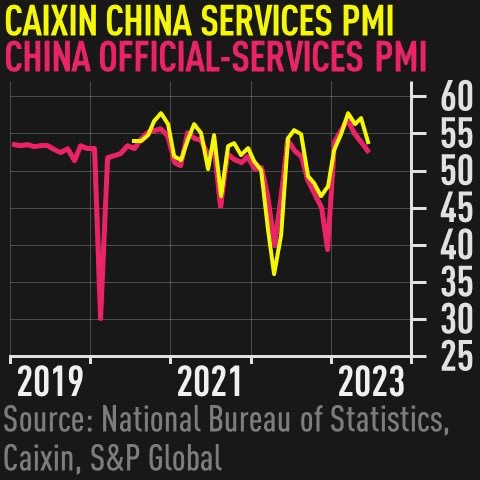

More bad data from China today as services came in weaker than expected

China Caixin Services PMI Jun: 53.9 (est 56.2; prev 57.1) – Caixin Composite PMI Jun: 52.5 (prev 55.6)

- OPEC Oil Seminar in Vienna today and tomorrow (this is not an OPEC meeting) but expect lots of headlines over the next days

Saudi Arabia says new oil cuts show teamwork with Russia is strong-Reuters

Russia-Saudi oil cooperation is still going strong as part of the OPEC+ alliance, which will do “whatever necessary” to support the market, Saudi Energy Minister Prince Abdulaziz bin Salman told a conference on Wednesday.

OPEC+, a group comprising the Organization of the Petroleum Exporting Countries and allies including Russia which pumps around 40% of the world’s crude, has been cutting oil output since November in the face of flagging prices.

OPEC says it does not have a price target and is seeking to have a balanced oil market to meet the interests of both consumers and producers.

Some quotes from Amena Bakr from Energy Intelligence:

Prince Abdulaziz says that the deal delivered in June was too big for the market to fully comprehend.

“The market will not be left unattended” said Prince Abdulaziz

- UPS, Teamsters accuse each other of walking away from contract talks -Reuters

The Teamsters Union said on Wednesday United Parcel Service “walked away” from negotiations over a new contract, a claim the shipping giant denied, lobbing its own accusation that the union had stopped negotiating.

The two sides traded salvos in early morning statements as they attempt to come to an agreement to prevent a strike when the current contract, which covers some 340,000 workers, expires at the end of the month.

UPS workers have already authorized a strike should the talks break down. Such a labor action would be the first since 1997 for UPS workers, in a strike that lasted 15 days.

Both the union and company officials have said before that they wanted a deal finalized to prevent a strike, which could put millions of daily deliveries at risk.

“The Teamsters have stopped negotiating despite UPS’s historic offer that builds on our industry-leading pay,” the company said, adding that the union should return to negotiations.

The union had earlier in the day said UPS made an offer that was unanimously rejected and that the company had “walked away from the bargaining table.”

“UPS had a choice to make, and they have clearly chosen to go down the wrong road,” said Sean O’Brien, general president at the Teamsters, which represents roughly 340,000 full- and part-time U.S. drivers, package handlers and loaders at the company.

The 1997 national strike disrupted the supply of goods, cost the company $850 million and sent some customers to rivals.

- ‘Top dog in Asia’: Nikkei’s stellar rise starts drawing big money-Reuters

A tailwind behind Japanese stocks is strengthening as large foreign funds who have been avoiding the market for decades start to reach into pockets deep enough to take the Nikkei back to its 1989 peak.

Their money was on the sidelines while the Nikkei 225 surged 27% in the first half of the year, as managers kept habitual below-benchmark weightings on Japan – settings that didn’t budge for years while the share index disappointed.

The best first-half gains in a decade, corporate reforms and continuing ultra-easy monetary policy supporting the economic recovery have led to a change in mindset.

The research arm of BlackRock, the world’s biggest asset manager, shifted its view on Japanese equities to neutral from underweight.

“We are looking for more evidence of corporate reform to support the enthusiasm for its equity markets that has gripped foreign investors so far this year,” wrote analysts at BlackRock Investment Institute, in its mid-year outlook report last week.

Looks like the chase is on for the Nikkei

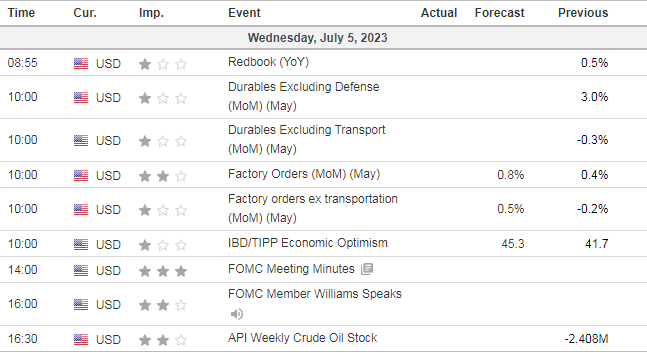

US DATA TODAY