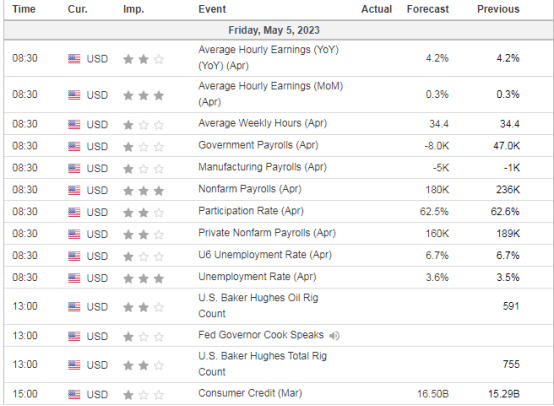

Non-farm payroll day!

Asia mixed…Europe Green

- Hong Kong: Hang Seng closed up +0.50%

- China CSI 300 -0.33%

- Taiwan KOSPI -0.02%

- India Nifty 50 -1.03%

- Australia ASX -0.01%

- Japan Nikkei +0.62%

- All European bourses all in positive territory so far this morning

- US indices in positive territory, so far this morning in pre-market USD -0.10%

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 6.9114 (prev fix 6.9054 prev close 6.9128)

- PBoC To Inject CNY3Bln Via 7 Day Reverse Repos At 2.0% In Open Market Ops

- Chinese Caixin Services PMI Apr: 56.4 (exp 57.0; prev 57.8) -Caixin Composite PMI Apr: 53.6 (prev 54.5)

- German Factory Orders (M/M) Mar: -10.7% (est -2.3%; prev 4.8%) – German Factory Orders WDA (Y/Y) Mar: -11.0% (est -3.1%; prev -5.7%)

- Norwegian Industrial Production (M/M) Mar 2.1% (prevR 0.1%) – Norwegian Industrial Production WDA (Y/Y) Mar -5.4% (prev -6.0%) – Norwegian Ind Prod Manufacturing (M/M) Mar -0.4% (prev 0.0%) – Norwegian Ind Prod Manufacturing WDA (Y/Y) Mar -0.3% (prev 1.5%)

- Swiss CPI (Y/Y) Apr: 2.6% (est 2.8%; prev 2.9%) – Swiss CPI (M/M) Apr: 0.0% (est 0.2%; prev 0.2%) – Swiss CPI EU Harmonised (M/M) Apr: 0.3% (prev 0.0%) – Swiss CPI EU Harmonised (Y/Y) Apr: 2.6% (prev 2.7%) – Swiss CPI Core (Y/Y) Apr: 2.2% (est 2.3%; prev 2.2%)

- French Industrial Production (M/M) Mar: -1.1% (est -0.4%; prevR 1.4%) – French Industrial Production (Y/Y) Mar: -0.1% (est 1.1%; prevR 0.9%) – French Manufacturing Production (M/M) Mar: -1.1% (est 0.0%; prev 1.3%) – French Manufacturing Production (Y/Y) Mar: 0.7% (prevR 1.8%)

- Spanish Industrial Output NSA (Y/Y) Mar: 5.3% (prevR -0.7%) – Spanish Industrial Output SA (Y/Y) Mar: 4.5% (prevR 0.1%) – Spanish Industrial Production (M/M) Mar: 1.5% (est 0.3%; prevR 0.7%)

- German HCOB Construction PMI Apr: 42.0 (prev 42.9)

- Italian Retail Sales (M/M) Mar: 0.0% (est -0.5%; prev -0.1%) – Italian Retail Sales (Y/Y) Mar: 5.8% (prev 5.8%)

- US Seeks Meeting With China Defense Minister After Being Spurned – BBG

- US Economy Set To Have Added Jobs At Slowest Pace Since 2020 – FT

- ECB’s Villeroy De Galhau: There Will Likely Be Several More Hikes

- Bank of Canada may hike rates further if inflation gets stuck,

Macklem says

US DATA TODAY