Mixed Markets

- Hong Kong: Hang Seng closes down -2.06%!!!

- China CSI 300 -0.74%

- Taiwan KOSPI -0.09%

- India Nifty 50 +0.25%

- Australia ASX +0.48%

- Japan Nikkei +0.11%

- European bourses in mostly negative territory so far this morning

- USD +0.37%

TOP STORIES OVERNIGHT

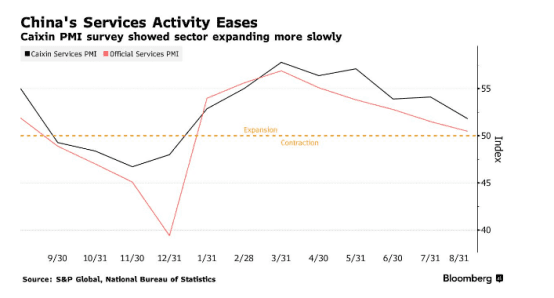

China Services Ease in Knock to Recovery, Survey Shows-BBG

A private survey of China’s services sector showed activity expanded at the slowest rate this year in August, as the economy’s darkened outlook and ongoing property turmoil hold people back from spending.

The Caixin services purchasing managers’ index fell to 51.8 last month from 54.1 in July, Caixin and S&P Global said in a statement Tuesday. While the reading was still above the 50 line that separates expansion from contraction, it was the weakest pace since December.

COMMENTS: The disappointing Chinese PMI figures are weighing heavily on European stock sectors exposed to the world’s No. 2 economy, with luxury and consumer names such as LVMH and Kering as well as sportswear maker Adidas losing more than 2%.

This was also putting pressure on US indices overnight.

Keep an eye on China exposed stocks on the open.

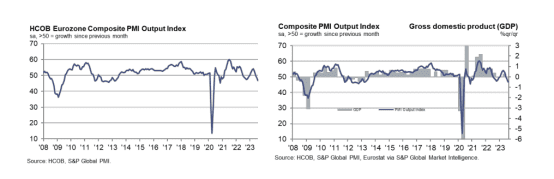

HCOB Eurozone Composite PMI® Eurozone economy contracts at faster pace in August as services activity tips into decline-S&P Global

Output in the eurozone economy declined at the fastest rate in nearly three years in August, latest HCOB PMI® survey data compiled by S&P Global showed. The overall retreat in activity was the fastest since November 2020, and broad-based across the manufacturing and services sectors as the latter contracted for the first time in 2023 so far. New orders also dropped the most since late-2020, leading to companies completing outstanding work at the fastest rate in over three years. This resulted in one of the softest 12-month outlook in 2023 so far and a near-stalling of jobs growth, with private sector employment rising at the slowest rate in the current 31-month sequence of increases.

COMMENTS: This data poor data has caused weakness in EUR . Why $DXY is up this morning

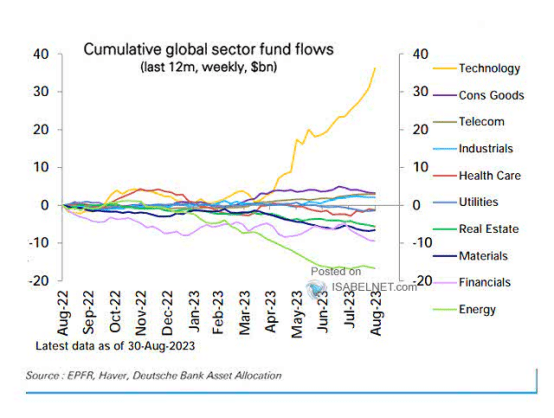

Fund flows into tech remain strong-Deutsche Bank

Week to August 30th

COMMENTS: Pile in continues.

Chevron Australia labour row escalates with two-week walkout plan-Reuters

Workers at Chevron’s (CVX.N) Gorgon and Wheatstone liquefied natural gas (LNG) projects in Australia plan a total strike for two weeks from Sept. 14, a union alliance said on Tuesday, in a significant escalation on disputes over pay and conditions.

The strike decision comes amid mediation talks hosted by the Fair Work Commission, Australia’s industrial arbitrator, which began on Monday and are scheduled to run every day this week, ahead of brief stoppages called by the union from Thursday.

Prolonged industrial action could disrupt LNG exports and likely increase competition for the super-chilled fuel, forcing Asian buyers to outbid European buyers to attract LNG cargo.

COMMENTS: This is 5% of global LNG capacity. Keep an eye on nat gas as this could be a catalyst to firm up prices.

US Senate races ahead of House on spending bills, aims to avoid gov’t shutdown-Reuters

Top Democrats in the U.S. Senate will look to gain the upper hand over House Republicans in talks over government funding when the chamber returns from summer recess on Tuesday, as the threat of an embarrassing October government shutdown looms.

COMMENTS: Here we go again!! We all know a shutdown will not happen, that said likely to be a million headlines out the longer it takes to come up with a resolution, if you remember back in the spring, this led to very volatile markets. Something to keep in mind.

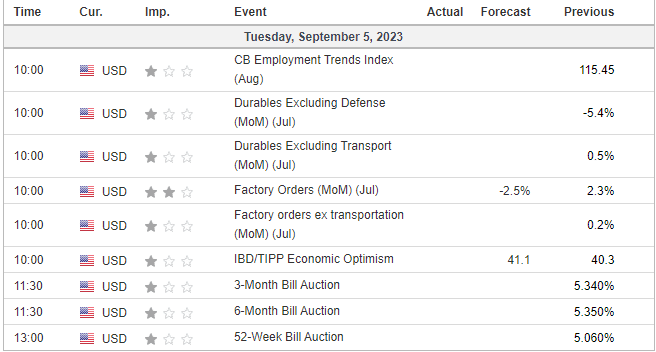

US DATA TODAY