Sea of RED today

- Hong Kong: Hang Seng closed DOWN -0.71%

- China CSI 300 -0.24%

- Taiwan KOSPI -0.13%

- India Nifty 50 -0.12%

- Australia ASX +1.61%

- Japan Nikkei -2.27% !!!!

- European bourses in NEGATIVE territory so far this morning

- USD -0.29%

TOP STORIES OVERNIGHT

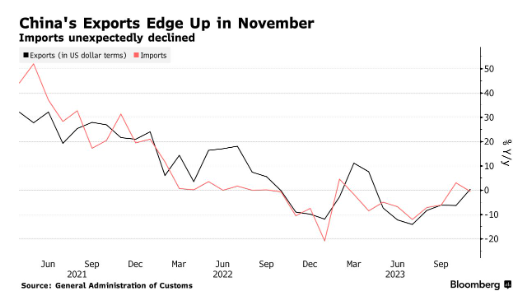

China’s imports unexpectedly shrank in November from a Covid-hit period a year ago, while exports edged up from a low base, suggesting the nation’s slowing economy still hasn’t bottomed out.

Imports in dollar terms declined 0.6% after clocking an improvement the previous month, according to official data released Thursday. That was worse than economists’ consensus forecast of a 3.9% gain.

Overseas shipments rose 0.5% from a year ago, slightly better than the consensus estimate of no change, and marked the first year-on-year expansion since April. The resulting trade surplus was $68.39 billion.

“Domestic demand is not really improving, even as we compared it to a low base last year,” said Woei Chen Ho, an economist at United Overseas Bank Ltd. “There is also no discernible improvement trend in exports despite a slightly better than expected export growth in November. Taken together, it suggests a weak recovery trend in China.”

COMMENTS: This weighed on China markets overnight

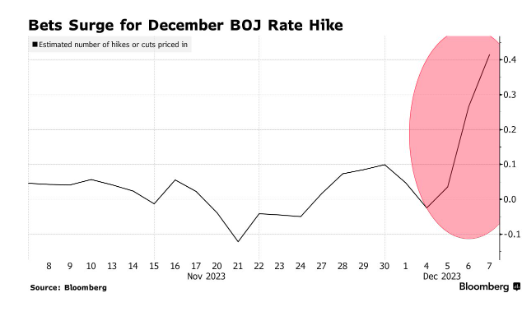

Traders Pile Into Bets That End of BOJ’s Negative Rate Is Near-BBG

Traders are rapidly increasing bets that the Bank of Japan will scrap the world’s last negative interest-rate regime as soon as this month after jumping on comments from the central bank’s leadership.

The selloff, fueled initially by comments from BOJ Governor Kazuo Ueda and one of his deputies, jolted financial markets in Tokyo and beyond, shattering a period of relative calm for Japan’s bonds.

A sharp strengthening of the yen and the biggest move in Japanese bond yields in a year served as a stark reminder to international investors that a major anchor for global borrowing costs may soon be dislodged.

Ueda told lawmakers in parliament that his job was going to get more challenging from the year-end, helping fuel speculation of a near-term scrapping of the sub-zero rate. While that comment came in response to questions, his subsequent visit to Prime Minister Fumio Kishida’s office to discuss his monetary policy stance seemed more like a staged move aimed at delivering a signal.

COMMENTS: what the Yen (carry trade) this is absolutely crushing the Nikkei today…trader have been piling into Japan all year….this could get ugly if we see an exodus.

Global small-cap stocks lure bargain hunters after sluggish 2023-Reuters

Shares of smaller companies that have lagged for most of 2023 are drawing investors on both sides of the Atlantic, as they weigh the benefits from an expected fall in interest rates next year against worries about a possible economic downturn.

In the U.S., the small-cap Russell 2000 has jumped over 13% from its October lows, while the MSCI Europe Small and Mid Cap Index is up 12% since late last month.

The recent surge in small caps stands in contrast to much of the year. While the S&P 500 is up 19% year-to-date, the Russell 2000 has climbed just 5%. Europe’s small caps, meanwhile, have risen over 6% in 2023, versus a 12% increase in the broader MSCI Europe equity index .

That underperformance has helped make small caps look cheaper than their larger peers when compared to their historical valuations.

COMMENTS: Good news for value stocks, watch RTY closely, there may be some good moves as this index has lagged for almost 2.5 years now

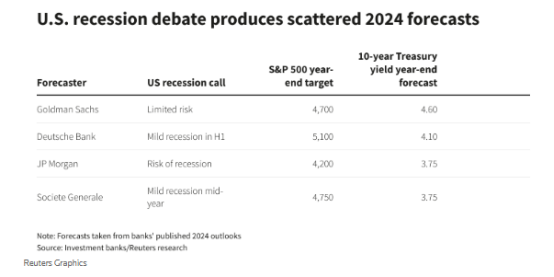

Market bets for 2024 thrown into chaos by US recession conundrum-Reuters

Investment banks and asset managers have wildly varying stock market and currency calls for 2024, reflecting deep division over whether the U.S. economy will enter a long-heralded recession and drag the world with it.

The lack of consensus among forecasters is a stark contrast to a year ago, when most predicted a U.S. recession and rapid rate cuts that failed to materialise. The world’s largest economy expanded by 5.2% in the third quarter of this year.

The divisions this year have produced a scattergram of projections for the U.S. interest rate path and how global assets that are influenced by the Federal Reserve’s actions will perform.

Market participants are therefore bracing for a bumpy start to the new year after a strong rally last month for both stocks and bonds based on a short-term consensus that inflation and interest rates are on a firm downward path.

“Whether the U.S. has a hard landing or a soft landing will dominate the market,” said Sonja Laud, chief investment officer at Legal & General Investment Management.

“The narrative isn’t clear yet,” she added, noting that if current interest rate forecasts “were to shift significantly that creates significant volatility” .

Options trading data shows that investors are becoming increasingly interested in protecting their portfolios from heightened stock market volatility ahead.

COMMENTS: Great news for traders, this should fuel some volatility…bumpy ride for investors

Russia pledges more oil data to ship trackers to soothe OPEC+ –Reuters

Russia has pledged to disclose more data about the volume of its fuel refining and exports after OPEC+ asked Moscow for more transparency on classified fuel shipments from the many export points across the vast country, sources at OPEC+ and ship-tracking firms told Reuters.

Russia is the only member of OPEC+ which contributes to export cuts rather than production cuts as part of its participation in the group’s agreement to curb supplies. Market analysts have struggled to verify the exact volumes of cuts achieved by Moscow.

Under an earlier deal with OPEC+, Russia pledged to reduce its oil exports by 300,000 bpd until the end of 2023. The latest deal calls on Russia to additionally cut its fuel exports by 200,000 bpd in the first quarter of 2024.

Saudi Energy Minister Prince Abdulaziz bin Salman said in an interview with Bloomberg that OPEC+ wanted more assurances from Moscow it would deliver on its pledge. He said Russia would be meeting with the ship tracking firms every month to provide data but gave no further detail.

Prince Abdulaziz said he would have preferred to see Russia cutting oil output rather than exports.

But he added he understood the challenges Russia was facing with cutting oil output in winter months because doing so in freezing temperatures can damage reservoirs.

COMMENTS: oil staging a small rally today amid headlines of Putin’s talks with the Saudis. The market is very oversold as well.

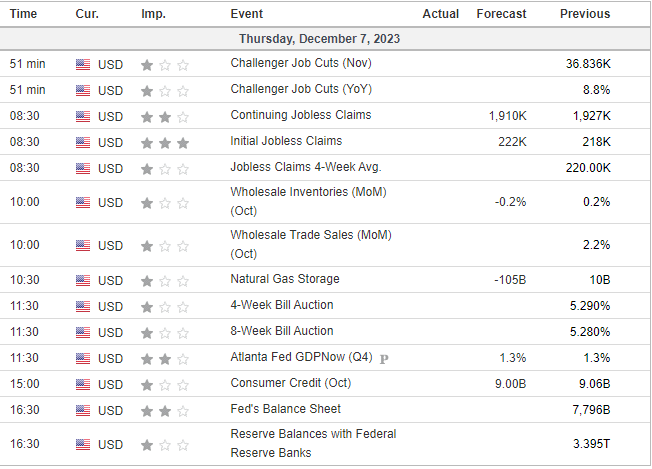

US DATA TODAY