*JEROME POWELL SPEAKS TODAY* 12:40 PM ET

Mixed Markets

- Hong Kong: Hang Seng closes up +0.36%

- China CSI 300 +0.18%

- Taiwan KOSPI +0.55%

- India Nifty 50 -0.24%%

- Australia ASX -0.33%

- Japan Nikkei -0.42%

- European bourses broadly up across the board with the exception of Germany, Germany tech, Spain, and Athens

- US indices mixed this morning ES and RTY flat, NQ slightly up and YM in negative territory, USD basically flat +0.07%

Overnight Data/News

- Germany Dec Industrial Production -3.1% m/m -3.9% y/y vs. forecast -0.8%/-1.6%

Manufacturing & Mining -2.1% m/m, Construction -8.0% m/m

Intermediate Goods -5.8% m/m, Capital Goods Flat m/m

Energy -2.3% m/m, Autos & Parts +3.3% m/m - U.K. retailers struggle but consumers spend on films and holidays

Jan BRC Like-For-Like Retail Sales 3.9% y/y vs. Dec 6.5%

Jan BRC Total Retail Sales 4.2% y/y vs. Dec 6.9%

Jan Barclaycard Consumer Spending 9.7% y/y, boosted by base effects, new year sales and holiday bookings

Jan Barclaycard Consumer Confidence 63%, best since July

UK house prices stabilise after four-month fall, Halifax says

- Japan confirms record interventions to support yen

Dec real wages rebound on one-off bonuses, household spending falls

Dec Labor Cash Earnings 4.8% y/y vs. expected 2.5%, largest gain since January 1997

Dec Real Cash Earnings 0.1% y/y vs. expected -1.5%

Dec Household Spending -1.3% y/y vs. f’cast -0.4% y/y

Dec Household Spending -2.1% m/m, biggest drop since Feb 20202

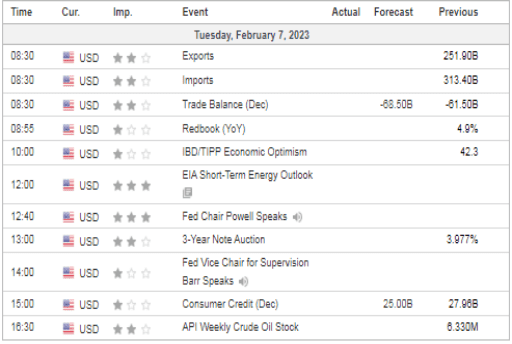

US DATA TODAY

*JEROME POWELL SPEAKS* 12:40 PM ET

Metals

London copper rebounds as dollar pauses in bullish run

Global copper smelting climbs in January to one-year peak – satellite data

Energy

Oil rises on China outlook, supply worries after Turkey earthquake

US natgas futures gain 2% on colder forecast for this week

BP profit soars to record $28 bln, dividend increased

Russia’s Sechin says Europe no longer sets Urals price

Australia’s Macquarie eyes possible record annual profit on energy volatility

Colombia oil output down by 49,500 bpd on roadblock, companies say