Non-Farm Payroll Day!

Asia RED Europe Mixed

- Hong Kong: Hang Seng closed down -0.90%

- China CSI 300 -0.44%

- Taiwan KOSPI -1.16%

- India Nifty 50 -0.89%

- Australia ASX -1.18%

- Japan Nikkei -0.20%

- European bourses in mixed territory so far this morning

- USD -0.17%

TOP 5 STORIES OVERNIGHT

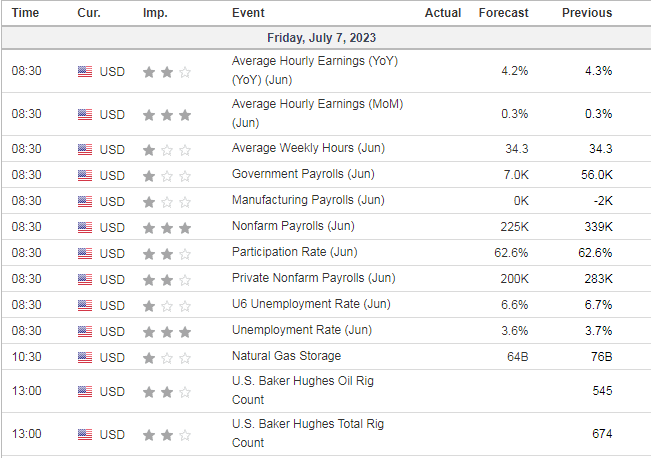

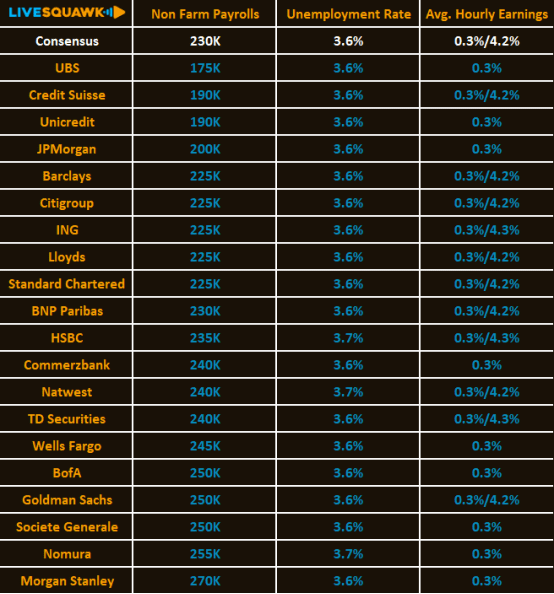

PREVIEW: June US Nonfarm Payrolls Expected to Fall To 230,000; Unemployment Rate to Drop to 3.6% Take A Look At What The Top Economists Are Forecasting In Today’s US Jobs Report:

- China’s Market Slump Heaps Pressure on Xi to Deliver Support-BBG

Premier Li vows to roll out targeted stimulus, no specifics

Chinese authorities are facing pressure to back up their reassuring rhetoric on the economy with more substantive action.

Shares in China are headed for their third straight week of losses, the yuan is trading near an eight-month low and angst in the nation’s credit market is growing. While Premier Li Qiang pledged on Thursday to “spare no time” in implementing targeted stimulus, he offered none

Expect pressure to continue

- UK house prices post biggest annual drop since 2011: Halifax-Reuters

British house prices fell last month in annual terms at the fastest rate in 12 years and soaring interest rates are likely to herald more weakness in the housing market, mortgage lender Halifax said on Friday.

House prices dropped 2.6% year-on-year in June, after a 1.1% fall in May, Halifax said. It was the largest such fall since June 2011.

On the month, prices fell 0.1% after a 0.2% monthly drop in May.

Notable as this market has been extremely resilient..sign for other markets?

- Bank of Japan likely to forgo yield curve control tweak in July despite broadening inflation, former central-bank official says -Reuters

The Bank of Japan may revise up this year’s inflation forecast but will likely hold off on tweaking its yield curve control (YCC) policy in July to await more evidence that wages will keep rising, its former top economist Seisaku Kameda told Reuters.

The BOJ will release new quarterly forecasts at its next meeting on July 27-28, which will include estimates for core consumer inflation excluding the effect of fresh food, and so-called “core-core” inflation that also strips away fuel costs.

Given the distortions caused by volatile fuel prices, the core-core inflation forecasts are better indicators of how the BOJ views inflation trends, Kameda said.

With cost-push inflation lasting longer than expected and service prices creeping up, the BOJ will likely revise up its core-core inflation forecast for the current fiscal year ending in March 2024 from the 2.5% projection made in April, he said.

Under current projections made in April, the BOJ expects core-core inflation to hit 1.7% in fiscal 2024 and 1.8% in 2025.

While a July policy shift is unlikely, the BOJ could tweak yield curve control later this year if it sees clearer signs a demand-driven inflation, accompanied by wage gains, will take hold, said Kameda, who now serves as an economist at a think tank affiliated with Japan’s Sompo holdings.

With inflation exceeding 2% for more than a year, markets are simmering with speculation the BOJ will tweak YCC – a policy that guides short-term rates at -0.1% and the 10-year bond yield around 0%.

- Some Oil Buyers Seek Less Supply From Saudis After Price Hike

At least four purchasers of kingdom’s crude aim to lift less

Some key buyers of Saudi Arabia’s crude in Asia and Europe are seeking reduced volumes for next month after the kingdom hiked official prices and extended output cuts.

At least four term-supply customers want to take less August-shipped oil, according to traders with knowledge of the matter. If buyers are then allocated smaller volumes, they may turn to the spot market for replacement supply, potentially strengthening the physical market, they said.

Saudis raised prices to Europe and Asia, there is a method to their madness as they try to strengthen the physical market.

US DATA TODAY