Markets

Top 5 stories

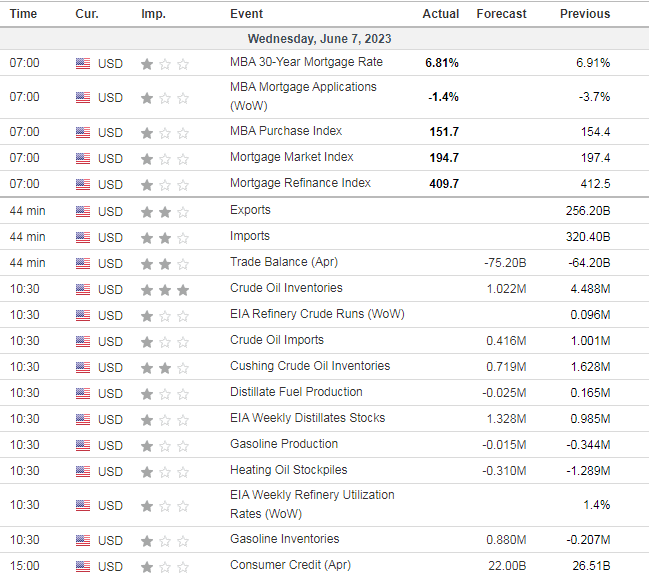

US data

ASIA

After reaching a 33 year high yesterday, Japan is DOWN -2.44% !!

- Hong Kong: Hang Seng closed up +0.80%

- China CSI 300 -0.49%

- Taiwan KOSPI +0.01%

- India Nifty 50 +0.70%

- Australia ASX -1.10%

- Japan Nikkei -2.45%!!!!

- European bourses in mixed territory so far this morning

- US indices pretty flat so far in pre-market, USD down -0.22%

TOP 5 STORIES OVERNIGHT

- Japan’s Nikkei posts sharpest fall in 12 weeks after 4-day rally-RTRS

Japan’s Nikkei share average fell in its biggest decline in 12 weeks on Wednesday as investors turned cautious about a rally, while there were sell-offs ahead of the fixing of special quotation prices at the end of the week.

“Investors turned cautious after Nikkei’s gain on Tuesday, which prompted them to sell stocks. That drove more selloffs and sent the index lower,” said Shoichi Arisawa, general manager of the investment research department at IwaiCosmo Securities.

Also, ahead of June 9’s setting of special quotation prices, investors sold stocks to keep the level lower, added Arisawa.

The closely watched settlement price, known in Japan as special quotation (SQ), is calculated from the opening prices of the 225 shares in the Nikkei share average on the second Friday of the month. They are used to set values on index options and futures.

Looks like a lot of profit-taking.

- UK house prices fall for the first time in more than a decade-RTRS

House prices in the United Kingdom have fallen for the first time in 11 years, as rising borrowing costs affect buyers, according to data released by the mortgage lender Halifax.

In May, average property prices fell 1 percent compared with the same month last year and were 7,500 pounds ($9,330) lower than their peak in August, Halifax said on Wednesday.

Kim Kinnaird, director of mortgages at Halifax, said higher interest rates were likely to increase pressure on house prices.

“The brief upturn we saw in the housing market in the first quarter of this year has faded, with the impact of higher interest rates gradually feeding through to household budgets, and in particular those with fixed rate mortgage deals coming to an end,” Kinnaird said in a statement.

Something to watch…will this be a contagion effect? Are US housing prices next? Canada? Australia?

- China’s Gold Binge Extends to Seventh Month as Holdings Climb-BBG

China increased its gold reserves for a seventh straight month, signaling ongoing strong demand for the precious metal from the world’s central banks.

China raised its gold holdings by about 16 tons in May, according to data from the People’s Bank of China on Wednesday. Total stockpiles now sit at about 2,092 tons, after adding a total of 144 tons from November through last month.

This is definitely helping to keep gold prices elevated.

- IEA Exec Director Fatih Birol: IEA Sees Tight Second Half Of Year In Oil Market – BBG TV

This market is going to get very tight, I estimate a 2.3M barrel deficit a day starting in Q3.

- Treasury’s $1 Trillion Debt Deluge Threatens Market Calm-WSJ

U.S. government could face borrowing at rates near 6%, up from 0.1% less than two years ago

Investors are bracing for a flood of more than $1 trillion of Treasury bills in the wake of the debt-ceiling fight, potentially sparking a new bout of volatility in financial markets.

Just a heads up…this is still dominating the headlines. That said when everyone is worried about something…..perhaps it does not happen? Let’s see…..

US DATA TODAY