Another pretty RED day

- Hong Kong: Hang Seng closes down -1.34%

- China CSI 300 -1.40%

- Taiwan KOSPI -0.59%

- India Nifty 50 +0.57%

- Australia ASX -0.74%

- Japan Nikkei -0.35%

- European bourses in mostly in negative territory so far this morning

- USD +0.19%

TOP STORIES OVERNIGHT

US Futures Fall as Dollar Climbs to Six-Month High-BBG

China’s yuan sank to its weakest level in 16 years.

The dollar extended its rise to a six-month high as investors focused on the robust growth picture in the US, which released forecast-beating services activity data on Wednesday. The Bloomberg dollar index is on track for an eighth consecutive week of gains, which would be the longest ever run of increases in data going back to 2005.

Meanhwile, China’s onshore yuan fell as pessimism grew toward its economy and financial markets. The currency slid by about 0.2% to 7.3294 per dollar and declined by a similar magnitude in the offshore market.

The weakness came even after the People’s Bank of China set its daily reference rate at a stronger-than-expected level for a 54th straight day on Thursday, the longest streak since Bloomberg started a survey of estimates for the so-called fixing in 2018.

COMMENTS: In my opinion, Yellen is letting the dollar move higher oil prices skyrocket in order to try and counteract inflation.

China Seeks to Broaden iPhone Ban to State Firms, Agencies-BBG

China plans to expand a ban on the use of iPhones in sensitive departments to government-backed agencies and state companies, a sign of growing challenges for Apple Inc. in its biggest foreign market and global production base.

Several agencies have begun instructing staff not to bring their iPhones to work, people familiar with the matter said, affirming a previous report from the Wall Street Journal. In addition, Beijing intends to extend that restriction far more broadly to a plethora of state-owned enterprises and other government-controlled organizations, the people said, asking not to be identified discussing a sensitive matter.

If Beijing goes ahead, the unprecedented blockade will be the culmination of a yearslong effort to root out foreign technology use in sensitive environments, coinciding with Beijing’s effort to reduce its reliance on American software and circuitry. It threatens to erode Apple’s position in a market that yields about a fifth of its revenue, and from where it makes the majority of the world’s iPhones through sprawling factories that employ millions of Chinese.

COMMENTS: $AAPL is down 2% in premarket on this news, bringing indicies down with it.

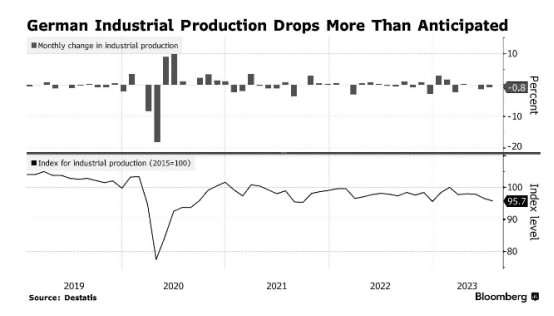

German Industry Output Falls for Third Month as Woes Linger-BBG

German industrial output fell again in July, further holding back Europe’s biggest economy and casting a pall over the start of the third quarter.

Production declined 0.8% from June, led by capital and consumer goods, according to the statistics office in Wiesbaden. The median prediction in a Bloomberg survey of economists was for a drop of 0.4%. The index for output showed the lowest level since December.

COMMENTS: This is dragging down European markets today.

China’s oil imports surge in August as fuel exports, inventories rise-Reuters

China’s crude oil imports surged in August, customs data showed on Thursday, as refiners built inventories and increased processing to benefit from higher profits from exporting fuel.

Shipments last month to the world’s biggest oil importer were 52.8 million metric tons, or 12.43 million barrels per day (bpd), the data from the General Administration of Customs showed. The daily rate is the third-highest ever, according to Reuters calculations.

Imports climbed by 20.9% from July and were up 30.9% from a year earlier, the data showed. For the first eight months of the year, imports rose by 14.7% from the same period a year earlier to 379 million tons.

COMMENTS: Demand is still strong from China even with higher prices.

‘There’s No Plan B’: Oil Chiefs Sound Alarm on Refining Woes-BBG

A lack of spare crude-processing capacity due to under-investment, and shutdowns happening more frequently with refiners ramping up on better margins and deferring planned work were common themes at the APPEC by S&P Global Insights conference in Singapore this week.

There have been unplanned plant shutdowns almost every week or two in Europe, Frederic Lasserre, global head of research & analysis at Gunvor Group Ltd., said in an interview. Many refiners have postponed regular maintenance, leaving them open to technical issues that lead to surprise outages, he said.

“The market is overly sensitive to any unexpected supply disruption anywhere,” Lasserre said. “Everyone knows there’s no plan B. We have no stocks, and we have no excess capacity anywhere.”

COMMENTS: Higher for longer. Refiners not looking terrible here.

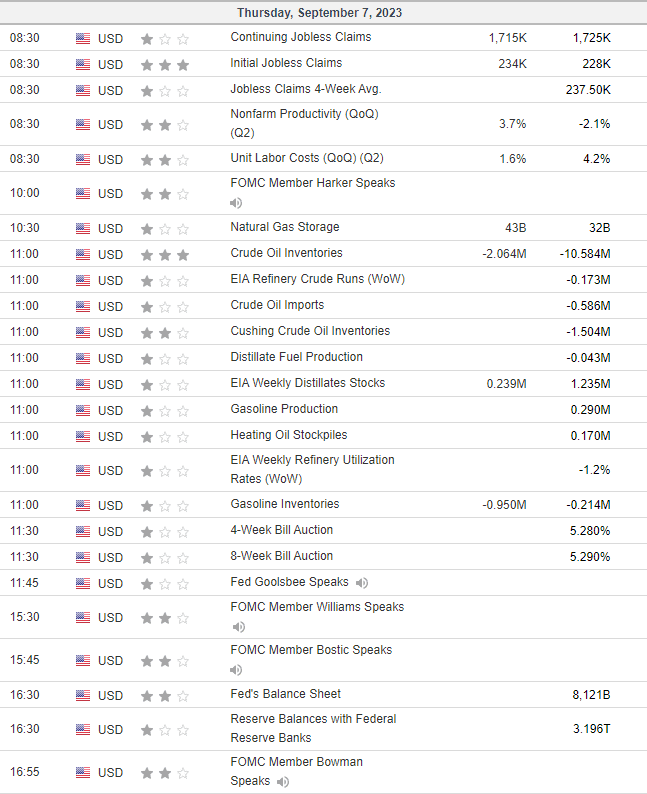

US DATA TODAY