Sea of RED

- Hong Kong: Hang Seng closed down -1.81%

- China CSI 300 -0.26%

- Taiwan KOSPI -0.26%

- India Nifty 50 -0.14%

- Australia ASX -0.21%

- Japan Nikkei -0.54%

- European bourses in negative territory so far this morning

- USD +0.54%

TOP STORIES OVERNIGHT

Disinflation Spreads Across Emerging Markets and Selloff Deepens-BBG

A selloff in emerging markets accelerated Tuesday after data releases from China to Hungary underscored the price nations are paying for disinflation: a deeper slowdown in economic growth than initially expected.

The MSCI Emerging Market Index of stocks headed for the lowest close in almost four weeks and looked to breach the support level at its 50-day moving average. Its currency-index counterpart also traded at the weakest level since July 10, with the South Korean won and Malaysian ringgit among the worst performers. Sovereign risk premiums widened as US Treasury yields fell.

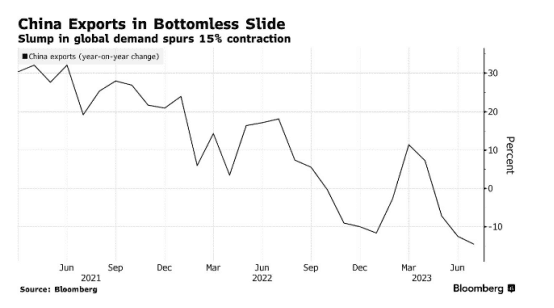

Much of the bullish case for emerging markets this year was predicated on a growth recovery led by China, which successive data releases have shown to be patchy at best and a non-starter at worst. Data released Tuesday showed exports in July tumbled almost 15% for the quickest contraction in a year, reflecting a slump in global demand. At the same time, imports sank at more than double the pace economists forecast, showing weakness in domestic consumer demand. The country is already battling deflation, the extent of which will be revealed in a report on Wednesday.

Chinese stocks listed in Hong Kong dropped, with both the technology index and broader enterprises index falling more than 2.2% each. That sent the emerging-market gauge lower for the fifth time in six days and closer to falling below the psychological 1,000 threshold.

In Hungary, which has the highest interest rate in the European Union, inflation dipped below 20% for the first time in 11 months. The government expects the rate to fall below 10% by October.

While that sounds like good news — and indeed the forint was the only emerging-market currency to gain against the dollar on Tuesday — the subtext is less reassuring. Hungarian consumer prices rose faster than expected on a month-on-month basis and the country is in recession, with three quarterly contractions already reported.

Ackman getting squeezed on that 30 yr UST short bet this morning

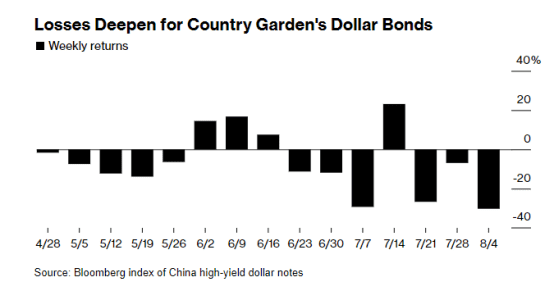

China’s Property Ills Worsen as Former Biggest Builder Wobbles-BBG

Chinese developer Country Garden Holdings Co.’s stock and bonds plunged as noteholders said they haven’t received coupon payments effectively due Monday, further darkening sentiment in the crisis-stricken property sector.

Some holders of two different notes said they didn’t receive coupon payments as of Tuesday afternoon. The investors asked not to be named as they’re not authorized to speak publicly. The company owed $10.5 million of interest on a dollar bond that matures in 2026 and $12 million on a note due 2030, according to data compiled by Bloomberg.

Both bonds have a 30-day grace period before a missed coupon payment can constitute a default, according to the notes’ prospectuses.

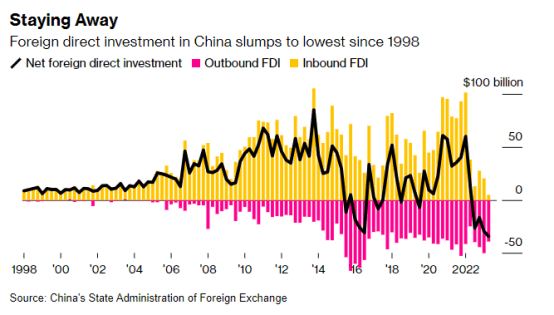

China’s Foreign Investment Gauge Declines to 25-Year Low-BBG

One measure of new foreign investment in China fell to the lowest level in 25 years in the second quarter, fueling concerns about how much geopolitical tensions and the economy’s slowing recovery can hurt business confidence.

Direct investment liabilities — a gauge of foreign direct investment in China — slumped to just $4.9 billion in the April-June period, according to figures released by the State Administration of Foreign Exchange. That was down 87% from the same period last year and was the smallest amount in any quarter in data back to 1998.

“The plunge in the FDI measure is alarming,” said Michelle Lam, greater China economist at Societe Generale SA. “That could mean there is still new investment coming in, but some firms are re-investing less of their existing profits” as firms talk more about “supply chain diversification,” she added.

Ukraine declares war on Russia’s Black Sea shipping-Politico

Russian ports and ships on the Black Sea — including tankers carrying millions of barrels of oil to Europe — could justifiably be attacked by the Ukrainian military as part of efforts to weaken Moscow’s war machine, a senior Kyiv official warned Monday in the wake of two recent attacks on Russian vessels.

“Everything the Russians are moving back and forth on the Black Sea are our valid military targets,” Oleg Ustenko, an economic adviser to Ukrainian President Volodymyr Zelenskyy, told POLITICO, saying the move was retaliation for Russia withdrawing from the U.N.-brokered Black Sea grain deal and unleashing a series of missile attacks on agricultural stores and ports.

Over the weekend, Ukraine declared the waters around Russia’s Black Sea ports a “war risk area” from August 23 “until further notice.” The zone includes major Russian ports like Novorossiysk, Anapa, Gelendzhik, Tuapse, Sochi and Taman.

Huge geopolitical risk for oil and grains

Oil hedge funds place their bets on heat-fueled hurricane season-Rueters

Bullish gasoline positions have hit their highest since the day Russia invaded Ukraine and will almost certainly rise further if record Atlantic Ocean heat draws a hurricane into the Gulf of Mexico and disrupts refineries, investors and analysts said.

Money managers in the week to Aug. 1 boosted their net long holdings of NYMEX RBOB gasoline futures to the highest since late February 2022. On a seasonal basis, this position is at a three-year high, data from the Commodity Futures Trading Commission shows.

Look at the rally in gasoline and heating oil cracks over the last two or three weeks and you can see, everyone is positioned for a very interesting hurricane season,” said Brent Belote, who previously traded at JP Morgan’s oil desk and now runs his own $25-million hedge fund, Cayler Capital.

Italy hits banks with surprise windfall tax-FT

Shares in lenders drop after government announces planned levy of 40%

Italy’s rightwing coalition has surprised markets by announcing a 40 per cent “windfall” tax on bank profits generated by higher interest rates, sending shares in the country’s lenders tumbling.

Shares in Intesa Sanpaolo and UniCredit, the country’s two largest banks, dropped 8 per cent and 6.5 per cent respectively on Tuesday morning after Italy announced the levy on Monday night, saying it would use the expected €2bn to fund relief for families hit by higher interest rates.

Shares in state-owned Monte dei Paschi di Siena fell 7.4 per cent, while Banco BPM, the country’s third-largest bank, shed 8.2 per cent. BPER Banca, Mediobanca and Banca Generali were also down.

Prime Minister Giorgia Meloni’s government has been critical of banks for failing to pass on interest rate rises to small savers, even as they raise lending rates.

The 40 per cent tax, which was approved in a cabinet meeting late on Monday night alongside a flurry of other last-minute measures, will be applied to the net interest income generated from the gap between banks’ lending and deposit rates.

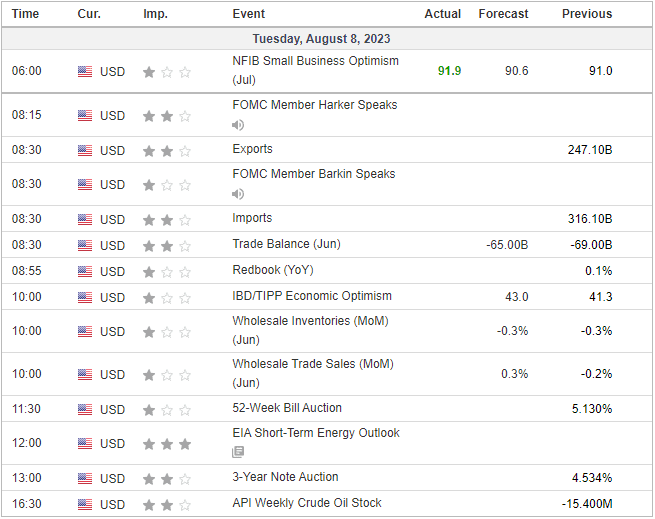

US DATA TODAY