Mixed Markets Asia-Europe Rather Red

- Hong Kong: Hang Seng closes down -2.35%

- China CSI 300 -0.36%

- Taiwan KOSPI -1.28%

- India Nifty 50 +0.24%

- Australia ASX +0.49%

- Japan Nikkei +1.24%%

- All European bourses broadly in Negative territory with the exception of UK and Germany

- US indices treading water in positive territory in pre-market, USD FLAT

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 6.9525 (prev fix 6.9156 prev close 6.9726)

- Chinese President Xi Asks China Military To Boost Power Against Strategic Risk – CC TV

- China logs nearly 40 million entry-exit trips in two months, up 112.4% yr/yr

- Japan BoJ Will End YCC In 2023 But Tweak This Week Unlikely, Economists Say – RTRS Poll

- Japanese Leading Index CI Jan P: 96.5 (exp 96.9; prev 97.2) -Coincident Index Jan P: 96.1 (exp 96.4; prev 99.1)

- German Retail Sales (M/M) Jan: -0.3% (est 2.3%; prevR -4.9%) – German Retail Sales NSA (Y/Y) Jan: -6.9% (est -5.0%; prevR -6.2%)

- German Industrial Production SA (M/M) Jan: 3.5% (est 1.4%; prevR -2.4%) – German Industrial Production WDA (Y/Y) Jan: -1.6% (est -3.7%; prevR -3.3%)

- Italian Retail Sales (M/M) Jan: 1.7% (est 0.2%; prev -0.2%) – Italian Retail Sales (Y/Y) Jan: 6.2% (prev 3.4%)

- UK BoE’s Dhingra: Inflation Is Expected To Fall In 2023 – Further Tightening Is A Bigger Risk To Output – Overtightening Is A Bigger Risk At This Point – The UK Economy Is Weak At The Moment – Previous Tightening Has Yet To Fully Impact UK

- ECB’s Visco: I Do Not Appreciate ECB Colleagues’ Statements On Future And Prolonged Increases In Interest Rates – ECB Council Has Agreed To Decide On Rates Meeting By Meeting Without Forward Guidance

- Eurozone GDP SA (Q/Q) Q4 F: 0.0% (est 0.0%; prev 0.1%) – Eurozone GDP SA (Y/Y) Q4 F: 1.8% (est 1.9%; prev 1.9%) – Eurozone Govt Expenditure (Q/Q) Q4: 0.7% (prevR -0.2%) – Eurozone Gross Fix Cap (Q/Q) Q4: -3.6% (prevR 3.9%)

- Eurozone Employment (Q/Q) Q4 F: 0.3% (prev 0.4%) – Eurozone Employment (Y/Y) Q4 F: 1.5% (prev 1.5%)

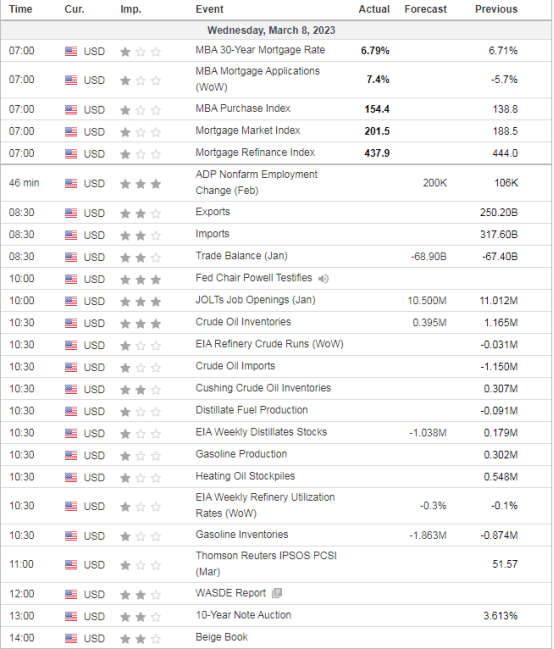

- US MBA Mortgage Applications: 7.4% (prevR -5.9%) – MBA 30-Years Mortgage Rate: 6.79% (prev 6.71%)

US DATA TODAY

COMMODITIES HEADLINES OVERNIGHT

Metals

CERAWEEK-Rio Tinto keeps working to build Indigenous support for Resolution mine

Energy

Oil extends declines on rate hike concerns

French strikes disrupt fuel deliveries, train and air traffic

Kazakhstan Wants Its Oil to Circumvent Russia

CERAWEEK-Russia wild card to keep oil markets on edge, execs warn

CERAWEEK-OPEC Sec Gen says China 2023 oil demand to grow 500,000-600,000 bpd

India’s oil deals with Russia dent decades-old dollar dominance

CERAWEEK-US plans no wider easing of sanctions on Venezuela, official says

US regulator orders lower pressure on Keystone pipeline system after spill