Yet another RED day

- Hong Kong: Hang Seng closed due to Typhoon

- China CSI 300 -0.49%

- Taiwan KOSPI -0.02%

- India Nifty 50 +0.47%

- Australia ASX -1.16%

- Japan Nikkei -1.04%

- European bourses in negative territory so far this morning

- USD -0.1%

TOP STORIES OVERNIGHT

Strikes start at major Chevron Australia LNG projects, no talks planned-Reuters

Workers at Chevron’s (CVX.N) liquefied natural gas (LNG) projects in Australia went on strike on Friday after talks broke down, potentially disrupting output from facilities that account for over 5% of global supply.

No further talks were scheduled between the unions and the U.S. energy major, according to the website of the Fair Work Commission, Australia’s industrial umpire, which had mediated five days of negotiations.

Australia is the world’s biggest LNG exporter and its main buyers are in Asia. The dispute over wages and conditions at Chevron’s Gorgon and Wheatstone operations has supported British and European gas prices, as traders anticipate lower Australian supplies would intensify competition from other sources.

COMMENTS: European and US nat gas spiking today

Europe Stocks Sink in Longest Losing Run Since ‘16-BBG

Equities came under renewed pressure, with Europe’s Stoxx 600 sliding for an eighth day, the longest streak since 2016. The dollar slipped following dovish comments from Federal Reserve officials

The Stoxx 600 Index ceded earlier gains to shed as much as 0.6%, with industrials leading the retreat. Futures on the S&P 500 index and Nasdaq 100 fell 0.3%.

Stock markets have been hit this week by data hinting at a deepening economic downturn in Europe and China, as well as indications the Federal Reserve might not be able to cut interest rates next year as priced. The mood is especially pessimistic toward European markets, which saw a 26th straight week of investment outflows, according to a note from Bank of America Corp.

Meanwhile, the Bloomberg Dollar Spot Index retreated 0.1% on Friday. Traders pared back expectations on US interest rates following comments by Fed officials, in particular from Bank of New York President John Williams who said US monetary policy is “in a good place.”

“It’s clear that the Fed absolutely want to be done tightening and to convey the message they have done enough,” said Timothy Graf, head of EMEA macro strategy at State Street Bank & Trust Co. “They can’t say they will do no more for the rest of this year, but that’s the underlying reading-between-the-lines message.”

The Bloomberg Dollar Spot Index is still on track for an eighth consecutive week of gains, which would be the longest ever run of increases in data going back to 2005.

COMMENTS: Pay close attention to USD, we are back in an environment where this is affecting indices, placing downward pressure. A move below 104 would help greatly. (currently 105)

Copper set for worst week in four on firm dollar and higher stocks

-Reuters

Copper prices were on track for their biggest weekly drop in four weeks, after a firmer dollar and rising inventories pressured prices.

Three-month copper on the London Metal Exchange was down 0.5% at $8,283.50 per metric ton by 0304 GMT. On a weekly basis, the contract declined 2.6%, the worst weekly performance since Aug. 11.

The most-traded October copper contract on the Shanghai Futures Exchange fell 0.5% to 68,800 yuan ($9,369.47) a ton. The contract was also set for a weekly decline.

The dollar was headed for its longest weekly winning streak in nine years, making greenback-priced metals more expensive to holders of other currencies.

Copper inventories in LME-registered warehouses piled up to their highest level since October 2022 to 133,850 tons.

Weak Chinese economic data and property woes continued to dampen risk sentiment, though expectations of further policy support cushioned the fall in metal prices.

COMMENTS: Bigger picture, copper is still consolidating in the weekly triangle

Latest UK renewables auction fails to attract offshore wind bids-Reuters

Britain’s latest subsidy auction for new renewable energy projects awarded no contracts for offshore wind projects, the results published on Friday showed, drawing criticism from opposition politicians and environmental campaigners.

The absence of awards for both offshore and floating offshore wind was a result of the global rise in inflation and the impact on supply chains, which presented challenges for projects participating in this round, the Department for Energy Security and Net Zero said in a statement.

The cost of offshore wind projects has risen by some 40%, developers such Germany’s RWE and Sweden’s Vattenfall have said, with the latter pausing development of a project that was awarded a CfD in last year’s round.

COMMENTS: Reality is these projects are too costly, cost/benefit is just not there. Steer clear of wind stocks.

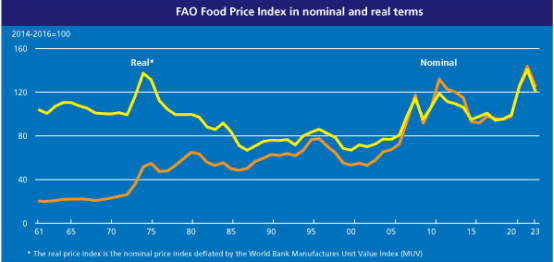

FAO Food Price Index declines in August

Strong supply conditions push international commodity quotations lower except for rice and sugar

The FAO Food Price Index, which tracks monthly changes in the international prices of globally-traded food commodities, averaged 121.4 points in August, down 2.1 percent from July and as much as 24 percent below its March 2022 peak.

The FAO Vegetable Oil Price Index decreased by 3.1 percent in August, partly reversing a sharp 12.1 percent upward move in July. World prices of sunflower oil declined by nearly 8 percent during the month amid weakening global import demand and abundant offers from major exporters. World quotations for soy oil dropped owing to improving soybean crop conditions in the United States of America, while those for palm oil fell moderately amid seasonally rising outputs in leading producing countries in Southeast Asia.

The FAO Cereal Price Index declined by 0.7 percent from July. International wheat prices fell by 3.8 percent in August amid higher seasonal availabilities from several leading exporters, while international coarse grain prices fell by 3.4 percent amid ample global supplies of maize from a record harvest in Brazil and the imminent start of the harvest in the USA.

In stark contrast, the FAO All Rice Price Index rose by 9.8 percent from July to reach a 15-year nominal high, reflecting trade disruptions in the aftermath of a ban on Indica white rice exports by India, the world’s largest rice exporter. Uncertainty about the ban’s duration and concerns over export restrictions caused supply-chain actors to hold-on to stocks, re-negotiate contracts or stop making price offers, thereby limiting most trade to small volumes and previously concluded sales.

The FAO Dairy Price Index declined by 4.0 percent from July, led by international quotations for whole milk powder, in abundant supply from Oceania. International butter and cheese prices also dropped, due in part to lackluster market activities associated with the summer holidays in Europe.

The FAO Meat Price Index dipped by 3.0 percent. World ovine prices fell the most, underpinned by a surge in export availabilities mainly from Australia and weaker demand from China. Robust supplies also nudged downwards the prices of pig, poultry and bovine meats.

The FAO Sugar Price Index rose by 1.3 percent from July, averaging in August as much as 34.1 percent higher than its value a year ago. The increase was mainly triggered by heightened concerns over the impact of the El Niño phenomenon on sugarcane crops, along with below-average rains in August and persistent dry weather conditions in Thailand. The large crop currently being harvested in Brazil limited the upward pressure on international sugar quotations, as did lower ethanol prices and the weakening of the Brazilian Real.

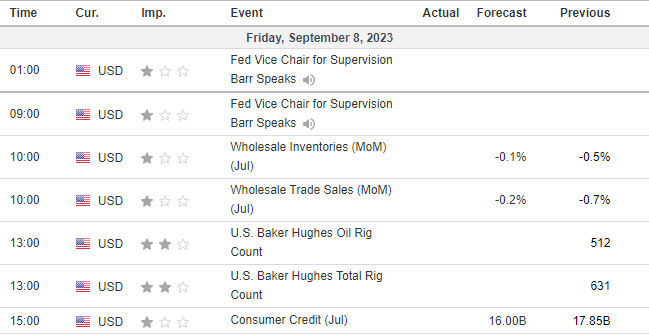

US DATA TODAY