Asia Mixed …Europe Green

- Hong Kong: Hang Seng closed up +0.32%%

- China CSI 300 -0.31%

- Taiwan KOSPI +1.21%

- India Nifty 50 +0.31%

- Australia ASX flat

- Japan Nikkei -0.04%

- European bourses in positive territory so far this morning

- USD -0.13%

TOP STORIES OVERNIGHT

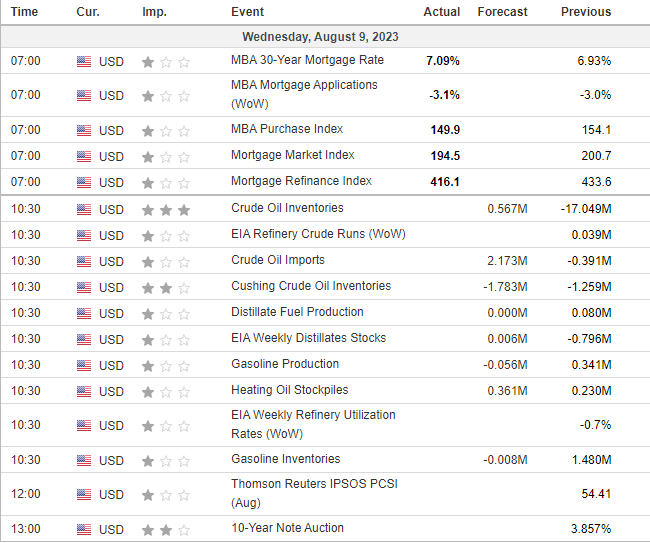

China Slides Into Deflation as Consumer, Factory Prices Drop-BBG

China slid into deflation in July, adding pressure on policymakers to step up monetary and fiscal support even as signs that the decline in prices is temporary may limit any stimulus.

The consumer price index dropped 0.3% last month from a year earlier, the National Bureau of Statistics said Wednesday, marking its first decline since February 2021. Economists surveyed by Bloomberg had predicted a 0.4% decline in prices.

Producer prices fell for a 10th consecutive month, contracting 4.4% in July from a year earlier, slightly worse than expected. It’s the first time since November 2020 that both consumer and producer prices registered contractions.

The Hang Seng China Enterprises Index trimmed earlier losses of as much as 0.9% to trade 0.2% lower as of 11:35 a.m. local time. The onshore benchmark CSI 300 Index of stocks also fell slightly by the mid-day break. The yuan traded offshore gained 0.2% to reach 7.2212 per dollar.

Investors are betting the weak inflation data will prompt the People’s Bank of China to add more monetary stimulus, like cutting interest rates. However, the central bank is facing several constraints that’s making it cautious, such as a weaker yuan and elevated debt levels in the economy. Fiscal support has also been moderate, given the financial pressures many local governments are facing.

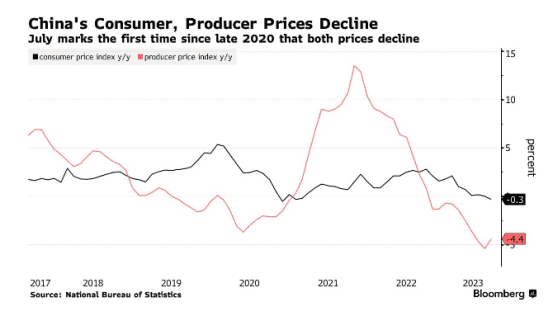

Hedge Funds Build Treasury Shorts as Yields Push to Year’s Highs-BBG

JPMorgan Treasury client short positions biggest since May 1

Asset managers add to longs, divergence with hedge funds grows

Hedge Fund, Asset Manager Division Extends

The disparity in short vs. long positioning between hedge funds and asset managers continues to grow, shown by latest CFTC positioning data with hedge funds adding 176,000 10-year futures equivalent to net short and asset managers taking the other side, adding 137,000 10-year futures equivalent to net long. To be sure, CFTC positioning data can also reflect participation in basis trades and therefore muddling a duration bias.

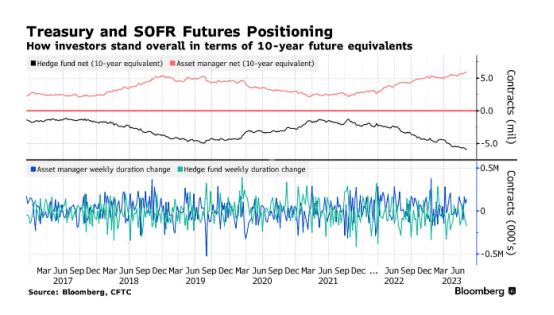

Rising Open Interest

Into last week’s Treasury market selloff, which saw 10-year yields peak through 4.20% and hit the cheapest levels since November, open interest (amount of risk held by investors) rose — an indication of new short positions.

This is going to end poorly for someone

Rice Soars to Highest Since 2008 on Rising Threats to Supply-BBG

Rice prices soared to the highest in almost 15 years in Asia on mounting concerns over global supplies as dry weather threatens production in Thailand and after top shipper India banned some exports.

Thai white rice 5% broken, an Asian benchmark, jumped to $648 a ton, the most expensive since October 2008, according to data from the Thai Rice Exporters Association on Wednesday. That brings the increase in prices to almost 50% in the past year.

Rice is vital to the diets of billions of people in Asia and Africa, and the surge in prices could add to inflationary pressures and boost import bills for buyers.

The latest threat to supply comes from Thailand, the second-biggest shipper. Authorities are encouraging farmers to switch to crops that need less water as the nation braces for drier conditions with the onset of El Niño.

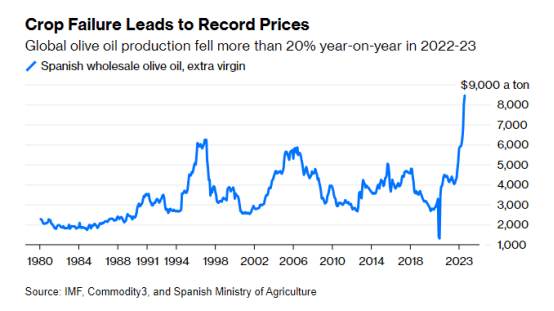

Olive Oil Price Shock-BBG

The price of olive oil has surged to an all-time high, double a year ago. A metric ton now costs more than 10 times a metric ton of crude oil. In 2019, before the pandemic, the ratio was less than five times.

How bad is it? Last week, the benchmark wholesale price of extra virgin olive oil surged to an all-time high of $8,500 per metric ton, about 125% higher than the 2000-2020 average. The previous record was set in 1996 at a little over $6,200 a ton.

In southern Europe and the Levant, olive oil is as much culture as food, a way of life around shared customs on the shores of the Mediterranean Sea. For many families in the region, its price has come to symbolize the struggle against rampant inflation.

The supply outlook is “critical,” says Oil World, the industry bible that has tracked the ups and downs of the market for the last 65 years. “Demand rationing is inevitable.”

Expect inflation or at least food inflation to remain higher for longer as CB’s can not fix supply problems and food demand is inelastic.

China’s major state-owned banks seen selling dollars to slow yuan declines – sources -Reuters

– China’s major state-owned banks were seen selling U.S. dollars to buy yuan in onshore spot foreign exchange market on Wednesday, three people with direct knowledge of the matter said, moves that would slow the pace of yuan declines.

The state banks usually act on behalf of China’s central bank in the country’s foreign exchange market, but they could also trade on their own behalf or execute their clients’ orders.

The dollar selling comes as China reported disappointing inflation data, which showed consumer prices posted their first annual decline in more than two years in July, while factory gate prices extended their falls, as lacklustre demand weighed on the economy.

In addition, China’s central bank set the yuan midpoint rate at a near one-month low, though not as weak as market forecasts – a sign investors interpreted as authorities’ discomfort toward excess weakness in the local unit.

The onshore yuan traded at 7.2076 per dollar as of 0335 GMT, 123 pips, or 0.17%, firmer than the previous late night close of 7.2199

China is losing control of the Yuan

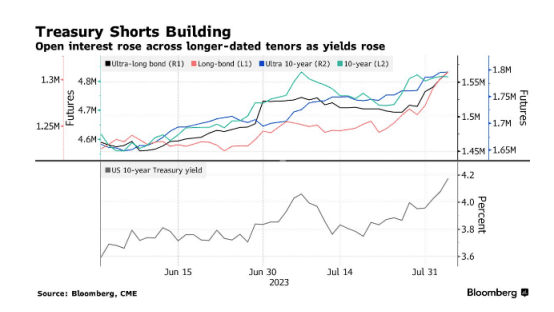

US DATA TODAY