Mixed Markets

- Hong Kong: Hang Seng closed UP +0.47%%

- China CSI 300 +0.43%

- Taiwan KOSPI +1.16%

- India Nifty 50 -0.35%

- Australia ASX -0.30%

- Japan Nikkei +1.73%

- European bourses in all in negative territory so far this morning

- USD up +0.14%

TOP 5 STORIES OVERNIGHT

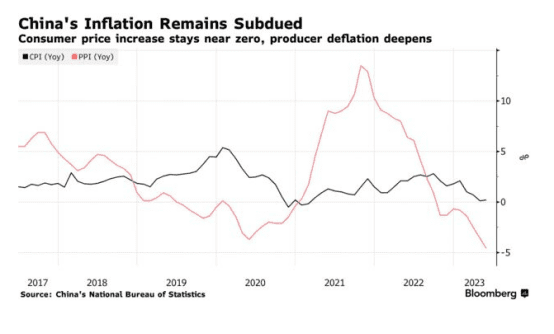

- China’s Deflation Risk Fuels Calls for Interest Rate Cuts -BBG

China’s inflation remained close to zero in May, sparking concerns on a falling spiral in prices and prompting the central bank to come out to downplay worries on the economic outlook.

Takeaway: China is going to have to start easing to spark this economy….will be good news for commodities if they do

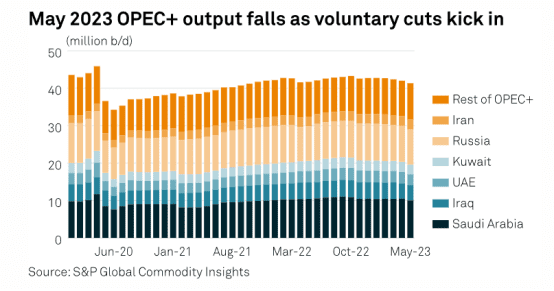

OPEC+ May crude output tumbles in first month of expanded voluntary cuts: Platts survey

Takeaway: This market is going to get very tight

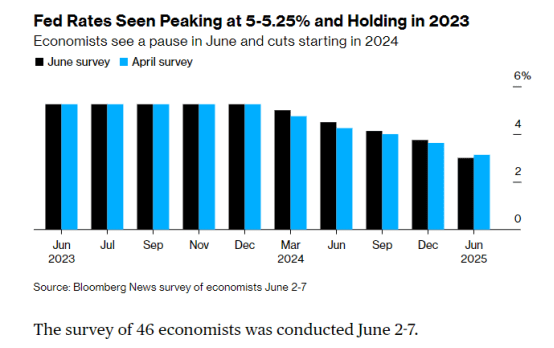

- Fed Seen Ending Its 15-Month Hiking Campaign in Economist Survey-BBG

They are likely to view the overall inflation outlook as unchanged at about 3.3% for this year, and 3.7% excluding food and energy, or 0.1 percentage point higher than March. The Fed targets 2% inflation measured by the personal consumption expenditures price index, which rose by 4.4% in April and has been higher and more persistent than forecast for much of the past year.

The economists are split on whether the Fed has reached its peak rate, with about a third expecting a quarter-point hike in July. A number of the more hawkish Fed officials have called for higher rates, including St. Louis President James Bullard and Cleveland’s Loretta Mester, and some have raised the possibility of skipping a meeting and tightening over the summer.

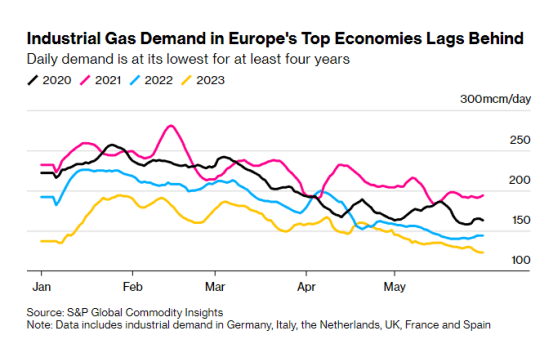

Weak European Industry Is Keeping Gas Demand Depressed

Takeaway: This is what deindustrialization looks like in real time. Manufacturing is leaving Europe due to insane energy policies.

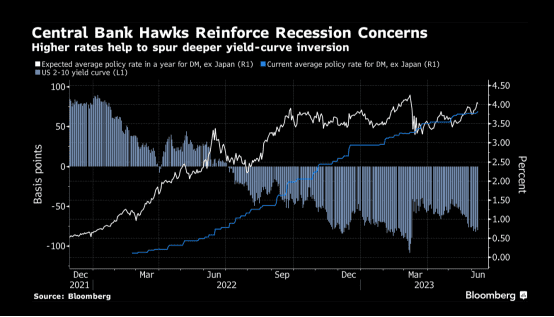

- Bond Market-BBG

Bond investors got hit with nasty surprises from both ends of the Earth this week as Australia and Canada hiked interest rates when the consensus was they would hold fire. Policymakers simply don’t share the market’s confidence that inflation will cool down — as JPMorgan Asset Management’s Karen Ward put it, investors got carried away by hopes for rapid rate cuts. That enhanced the slump that hit bonds this week as investors once more found they’d underestimated central banks’ hawkish mindset. That sets up more potential for turmoil given that traders are again looking extremely sure that the Federal Reserve will hold on June 14, while its European peer will hike by a quarter point.

Takeway: The battle between bonds and central banks looks set to extend as each burst of fresh rates aggression persuades investors that recessions are more and more likely

US DATA TODAY