SEA OF RED

- Hong Kong: Hang Seng closes down-0.63%

- China CSI 300 -0.35%

- Taiwan KOSPI -0.53%

- India Nifty 50 -0.93%

- Australia ASX -0.77%

- Japan Nikkei -0.50%

- All European bourses all in negative territory this morning so far

- US indices also in negative territory this morning in pre-market, USD also down -0.28%

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 6.9666 (prev fix 6.9525 prev close 6.9565)

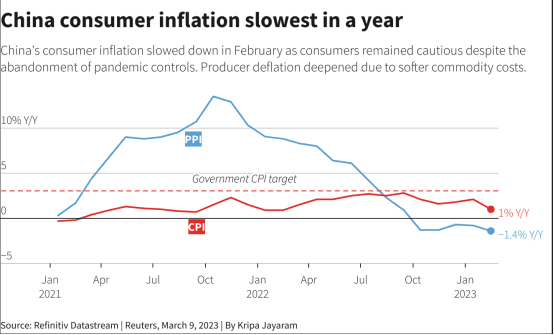

- Chinese CPI (Y/Y) Feb: 1.0% (exp 1.9%; prev 2.1%) -PPI (Y/Y) Feb: -1.4% (exp -1.3%; prev -0.8%)

- China consumer inflation slowest in a year, leaves room for more stimulus

– Feb CPI -0.5% m/m 1.0% y/y vs. expected 1.9% y/y

– Feb Food prices 2.6% y/y vs. Jan 6.2%;

– Feb Non-Food prices 0.6% y/y vs. 1.2%; Services 0.6% vs. 1.0%

– Feb PPI -1.4% y/y vs. expected -1.3% y/y (Jan -0.8%)

– Feb Mining PPI 0.3% y/y vs. Jan 2.0%; Raw Materials -1.3% vs. -0.1%

– Feb Consumer Goods PPI 1.1% y/y vs. 1.5%

– Inflation will not constrain supportive monetary policy - Japan’s Lower House Approves Appointment Of Ueda As Next BoJ Governor -Himino, Uchida Approved For Deputy BoJ Governors -Upper House To Vote On Nominations On Friday

- Japanese Machine Tool Orders (Y/Y) Feb P: -10.7% (prev -9.7%)

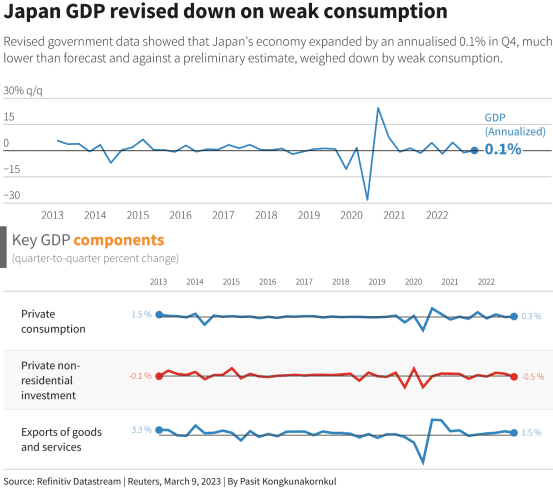

- Japan’s economy barely grew in Q4, weak consumption raises policy

challenge

– Oct-Dec GDP +0.1% annualised vs forecast +0.8%

– GDP growth slower than initially estimated +0.6%

– Consumption revised down to +0.3%, capex flat at -0.5%

– Weak consumption, capex cloud wage hike-led recovery prospect

– Japan Q4 GDP revised down on weak consumption - Swedish Industrial Orders (M/M) Jan: -20.2% (prevR 23.3%) – Industrial Orders (Y/Y) Jan: -10.5% (prevR 22.7%)

- Swedish GDP Indicator (M/M) Jan: 2.0% (est -0.1; prevR -0.7%) – GDP Indicator (Y/Y) Jan: 2.0% (prevR -1.6%) – Household Consumption (M/M) Jan: 0.5% (prev -0.8%) – Household Consumption (Y/Y) Jan: 0.5% (prev -1.8%)

- Investors Turn More Bearish On Asian FX Amid Return Of King Dollar – RTRS

- BofA’s CEO Moynihan: BofA Predicts Slight US Recession Starting In Q3 – BBG TV

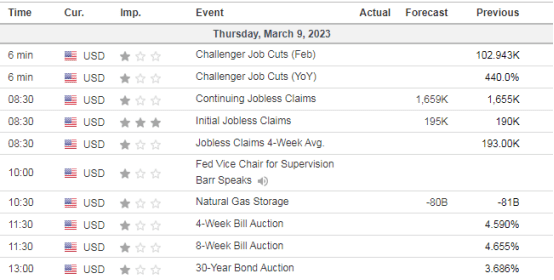

US DATA TODAY

COMMODITY HEADLINES OVERNIGHT

Metals

Gold prices move in narrow range as investors await US jobs data

London copper eases as dollar clings to 3-month high

CERAWEEK-Copper miners scramble for workers to supply green energy transition

BHP eyes copper, nickel projects as it bypasses lithium

Energy

Speculators raise U.S. crude oil net longs-CFTC

CERAWEEK-Southeast Asia’s growth, energy transition to rely on gas access

India oil demand +5.0% y/y to 18.488 million tons in February, +2.1% vs Feb 20

Russia, Saudi Arabia agree to keep coordinating steps as part of OPEC+, Lavrov says

Shell’s 2022 emissions dip about 10% on lower fuel sales