HAPPY CPI DAY!

Sea of GREEN

- Hong Kong: Hang Seng closed up +1.93%

- China CSI 300 +0.95%

- Taiwan KOSPI +1.21%

- India Nifty 50 -0.14%

- Australia ASX +0.69%

- Japan Nikkei +1.99%

- European bourses in positive territory so far this morning

- USD -0.12%

TOP STORIES OVERNIGHT

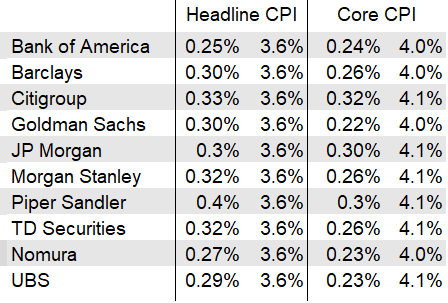

CPI Forecasts

Wall Street forecasters expect the September CPI to show the headline index rose 0.3% from August, lowering the 12-month rate to 3.6% from 3.7% They see core CPI up 0.3%, lowering the 12-month rate to 4.1% from 4.3

Accelerating US Core Inflation Set to Muddy Rate Picture for Fed-BBG

A monthly report on US consumer prices due Thursday is set to muddy the picture for Federal Reserve officials trying to decide whether to hike interest rates again, especially as escalating conflict in the Middle East adds uncertainty, according to Bloomberg Economics.

The consumer price index will probably show that headline inflation moderated in September. But core inflation — which excludes food and energy categories — likely crept up to between 3% and 4% on an annualized basis, thanks to a jump in used-car prices, Bloomberg economists Anna Wong and Stuart Paul wrote Wednesday in a preview of the release.

“If the risks between inflation and growth have become more balanced in the past few months, the Israel-Hamas conflict has now tipped the balance once again toward upside inflation risks – just as pandemic supply bottlenecks have subsided,” Wong and Paul said.

“Our baseline is for the Fed to hold rates steady for the rest of the year, but we see non-negligible risks of another rate hike, something the market is probably underpricing.”

Wong and Paul warned increasing tensions in the Middle East may spur supply shocks and boost energy prices. If oil prices reach $100 a barrel, for example, headline CPI inflation could reach 4% by the end of this year, the economists said.

“As long as inflation expectations appear to be anchored, the Fed likely will look through the price increase,” Wong and Paul wrote. “However, a sustained and larger oil shock could increase the risk that inflation expectations un-anchor, ultimately pushing the Fed to continue hiking rates.”

Saudi energy minister: we need to be proactive on oil market-Reuters

Saudi Arabia and Russia have agreed to continue with voluntary oil supply cuts of a combined 1.3 million barrels of oil per day, or more than 1% of global demand, to the end of the year.

The Saudi minister said the need to act on the oil market depended on its volatility. He also said, however, that attempts to target prices had failed in the 1980s.

Russian Deputy Prime Minister Alexander Novak, speaking in the same interview, said Russia’s deal with OPEC+ had had a stabilising effect.

Abdulaziz said the terms of the deal would be evaluated every month.

COMMENTS: Key takeaway here is voluntary cuts will continue to the end of year as set forth

China bans new offshore brokerage accounts in capital control move-Reuters

China has for the first time issued a notice prohibiting domestic brokerages and their overseas units from taking on new mainland clients for offshore trading, according to an official document seen by Reuters and confirmed by four sources.

New investments by existing mainland clients are also to be “strictly monitored” to prevent investors from bypassing China’s foreign exchange controls, said the notice. The news was first reported by Reuters.

The actions, which will restrict capital outflows, come as faltering growth for the world’s second-largest economy has spurred investment overseas, weighing on the yuan and prompting authorities to ramp up efforts to stabilise the currency.

COMMENTS: You can not be a reserve currency with capital controls like this. Reason #23435 why the Yuan will not overtake USD as a reserve currency

IEA cuts forecast for growth in oil demand in 2024-Reuters

The International Energy Agency (IEA) on Thursday lowered its forecast for growth in oil demand in 2024, suggesting harsher global economic conditions and progress on energy efficiency will weigh on consumption.

In its monthly report, the IEA forecast demand for oil will rise by 880,000 barrels per day (bpd) in 2024, down from its previous forecast of 1 million bpd, based on broader economic concerns and a faster adoption of electric vehicles among other energy efficiency measures.

However, the Paris-based agency that advises the United States and other industrialised countries, raised its 2023 demand forecast to 2.3 million bpd, from a previous estimate of 2.2 million.

COMMENTS: This agency has been off the mark for so long, I take none of their numbers seriously. Remember this is the same agency that predicted harsh Western sanctions would lead to a collapse in Russian energy exports.

US DATA TODAY