Mixed Markets

- Hong Kong: Hang Seng closed down -1.36%

- China CSI 300 -0.97%

- Taiwan KOSPI +0.06%

- India Nifty 50 +0,44%

- Australia ASX +1.52%

- Japan Nikkei +0.28%

- European bourses in MIXED territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

Investment funds stocking up on US farmland in safe-haven bet-Reuters

Investment funds have become voracious buyers of U.S. farmland, amassing over a million acres as they seek a hedge against inflation and aim to benefit from the growing global demand for food, according to data reviewed by Reuters and interviews with fund executives.

The trend worries some U.S. lawmakers who fear corporate interest will make agricultural land unaffordable for the next generation of farmers. Those lawmakers are floating a bill in Congress that would impose restrictions on the industry’s purchases.

The number of properties owned by such firms increased 231% between 2008 and the second quarter of 2023, and the value of those holdings rose more than 800% to around $16.2 billion, according to NCREIF’s quarterly farmland index, which tracks the holdings of the seven largest firms in farmland investment.

COMMENTS: the second half of this decades and into 2030’s is going to be all about hard assets

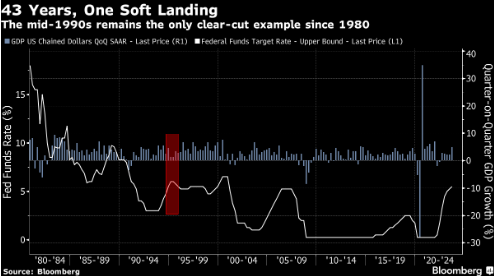

Bonds Are for Turning, and Turning Again-BBG

There are many definitions, but if we say that a soft landing is a period of rising rates that doesn’t lead to even a quarter of negative economic growth, then there has been precisely one in the post-Volcker era. That came in the mid-1990s, after the Fed under Alan Greenspan hiked unexpectedly hard in 1994, created a brief but brutal bond bear market, and sparked a series of credit and devaluation crises in the emerging markets. In the US, however, growth never went negative:

That soft landing came while globalization was taking hold as the Clinton administration feasted on the “peace dividend” from the end of the Cold War and moved the federal budget into surplus. None of those things apply now, so a soft landing looks implausible.

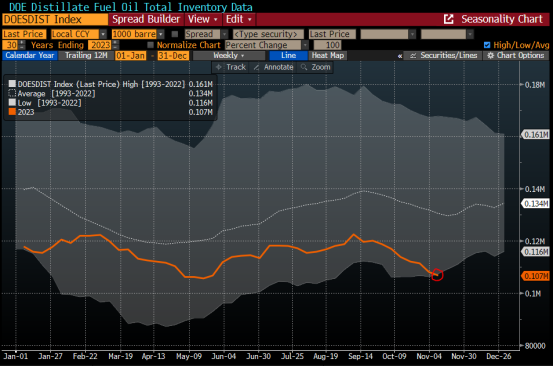

CHART OF THE DAY-Javier Blas

Let’s hope the US economy is truly slowing down — particularly manufacturing –, and that the winter is mild. US stocks of distillate fuel (diesel and heating oil) are ending the fall season at their lowest **seasonal** level in data since 1982

COMMENTS: I have been talking about this distillate problem for months now…diesel refiners starting to look good

China’s home prices dip for 4th month, may weaken further-Reuters

China’s new home prices fell for the fourth straight month with dozens of cities hit by declines, the most since the peak of the COVID-19 pandemic last year, suggesting a broader weakening in the sector that could drag on the country’s overall recovery.

New home prices in October dropped 0.3% month-on-month after a 0.2% dip in September, according to Reuters calculations based on National Bureau of Statistics (NBS) data.

Once a key engine of economic growth accounting for around a quarter of China’s economic activity, a regulatory crackdown since 2020 to curb debt has tightened liquidity and raised default risks for developers, delaying many projects.

Authorities have rolled out a flurry of measures to prop up the pivotal sector, including relaxing curbs on home purchases and cutting borrowing costs but homebuyers remain cautious.

“The most important reason for the bearish home prices is that demand is weak, buyers don’t know if pre-sold homes they buy will be delivered on the dates promised by the developers,” said Ma Hong, senior analyst at Zhixin Investment Research Institute.

Bearish home prices follow data on Wednesday showing some improvement in industrial output and retail sales, which both beat expectations in October, but overall investment growth was tepid and property sales and investment slumped sharply.

COMMENTS: We talked about this sector in yesterdays Place Your Trades spaces, if you missed it you can catch the replay on the website.

Dollar steadies as economic data muddies Fed expectations-Reuters

The dollar held its ground on Thursday after a volatile two days that saw sharp declines followed by a rebound as traders took incoming economic data as signalling the Federal Reserve will wait longer before cutting interest rates.

The dollar index – which tracks the U.S. currency against six other units – was steady at 104.33. It gained 0.31% on Wednesday, following a 1.51% plunge the previous day – its largest drop for a single trading day in a year.

The euro was up around 0.1% at $1.0857, as was the yen at 151.16. Against sterling the dollar was flat at $1.24085.

The dollar drew support from better-than-expected retail sales numbers combined with more signs of cooling inflation, feeding into the narrative for an economic ‘soft landing’, which would allow the Fed more time before cutting rates.

“We’re seeing the dollar trading weaker versus other currencies today, off the back of those retail sales that are putting a dampener on those hopes that, potentially, we could see a rate cut sooner rather than later,” Hargreaves Landsdown strategist Susannah Steeter said.

“Session by session, sentiment is really fluctuating on this. The Fed has said it’s driven by the data so that is what is driving the market specifically.”

US DATA TODAY