Mostly GREEN

- Hong Kong: Hang Seng closed DOWN -0.75%

- China CSI 300 +0.14%

- Taiwan KOSPI +0.07%

- India Nifty 50 +0.13%

- Australia ASX -0.16%

- Japan Nikkei +2.46%

- European bourses in POSITIVE territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

BoJ stays with dovish stance-FX Street

The BoJ was widely anticipated to keep interest rates unchanged in the negative territory at 0.1% but the market was expecting that policymakers would unveil the roadmap stating how they would get exit from its decade-long ultra-loose policy stance.

BoJ said in a statement that it won’t hesitate in taking easing measures if necessary. Investors took the statement as absence of confidence among BoJ policymakers for shifting to normal policy stance. The BoJ is expected to not consider exiting expansionary policy until wages turn sufficient enough to keep inflation steady around 2%.

BoJ Governor Kazuo Ueda said in his monetary policy statement that the economy is gradually picking up and the likelihood for the price index gradually increasing toward target through FY2025 is improving.

COMMENTS: Nikkei loving this, Yen sinks

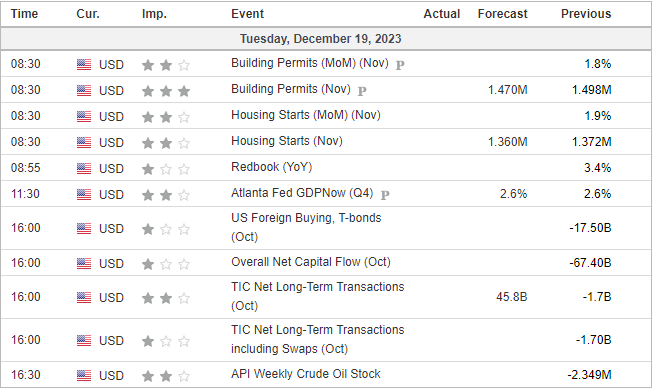

BofA Private Clients 4 week ETF Flows

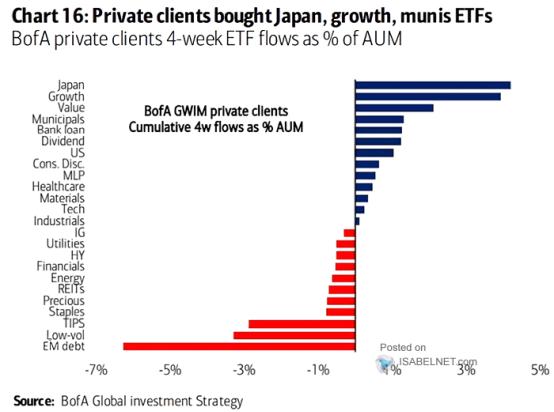

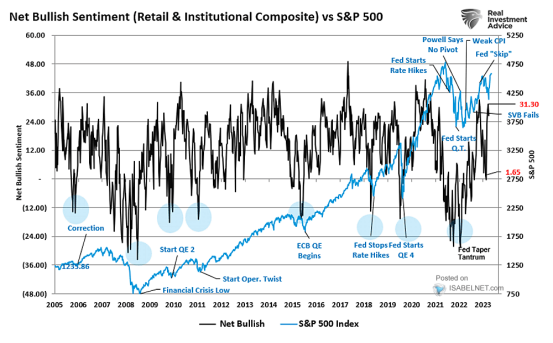

Market Sentiment-RIA

The sentiment of investors, which was characterized by a strong bearish outlook last year, is now wildly optimistic and extremely bullish

COMMENTS: Barring any news, this year likely ends on a high now, but caution late Q1 and early Q2, particularly is the Fed actually does cut rates. This will be a topic of conversation on my Wednesday spaces this week, so be sure to tune in!

With Houthis Menacing Fleet, Shipping’s Great Detour Around Africa Gathers Pace -BBG

Dozens of container ships bringing manufactured goods from Asia to Europe are setting off on arduous detours around Africa — snarling trade and delaying cargo deliveries — after a wave of attacks by Houthi militants on the merchant fleet.

A.P Moller-Maersk A/S, which owns a fleet of more than 300 container ships and controls many more, said Tuesday that it will divert its fleet around Africa. Iran-backed Houthi militants have vowed to attack any merchant vessel with a connection to Israel, in a move to support the Palestinians, but as violence escalates all ships are seen as potentially vulnerable.

Just hours before Maersk’s announcement, US Defense Secretary Lloyd Austin announced the creation of a task force to protect commercial vessels traveling through the area. The shipping giant’s decision shows it’s not banking on that bringing an immediate halt to attacks. The details are still being worked out, and it’s not clear when it will start work.

“Once we see what the effect of this increased security in the area will be for shipping, companies will then make an assessment based on that, but it’s very early days for that now,” International Chamber of Shipping Secretary-General Guy Platten told Bloomberg TV.

COMMENTS: This will affect shipping rates, so keep an eye on CONTAINER shippers. So far, this has not affected the tanker market with the exception of a pause from $BP and $FRO

Disruptions in Red Sea unlikely to have large effects on oil, LNG – Goldman-Reuters

The disruption to energy flows in the Red Sea is unlikely to have large effects on crude oil and liquefied natural gas (LNG) prices as vessel redirection opportunities imply that production should not be directly affected, Goldman Sachs said.

Oil prices advanced on Tuesday, extending gains from the previous session, as attacks by Yemen’s Iran-aligned Houthi militants on ships in the Red Sea disrupted maritime trade and forced companies to reroute vessels.

Oil major BP temporarily paused all transits through the Red Sea and oil tanker group Frontline said on Monday its vessels would avoid passage through the waterway, signaling that the crisis was broadening to include energy shipments.

“We do estimate that a hypothetical prolonged redirection of all 7 million barrels per day of gross (Northbound and Southbound) oil flows would raise spot crude prices relative to long-dated prices by $3-4/per barrel,” the investment bank said in a note dated Monday.

COMMENTS: This is why oil is not spiking, I have repeatedly said this would be the case, UNLESS the Houthis start lobbing missiles at Aramco again.

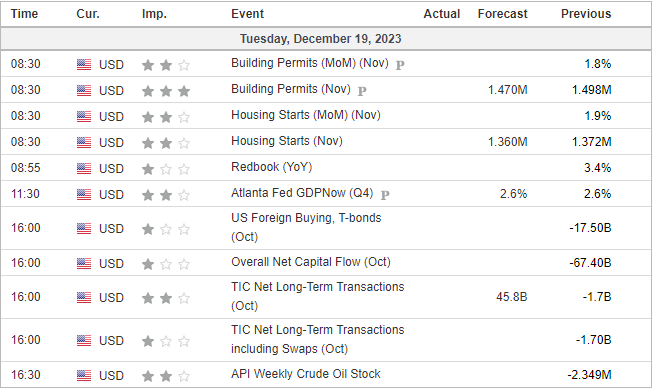

US DATA TODAY