Pretty RED out there AGAIN

- Hong Kong: Hang Seng closed down -2.46%

- China CSI 300 -2.13%

- Taiwan KOSPI -0.90%

- India Nifty 50 -0.30%

- Australia ASX +0.29%

- Japan Nikkei -0.24%

- European bourses in negative territory so far this morning

- USD +0.04%

TOP STORIES OVEERNIGHT

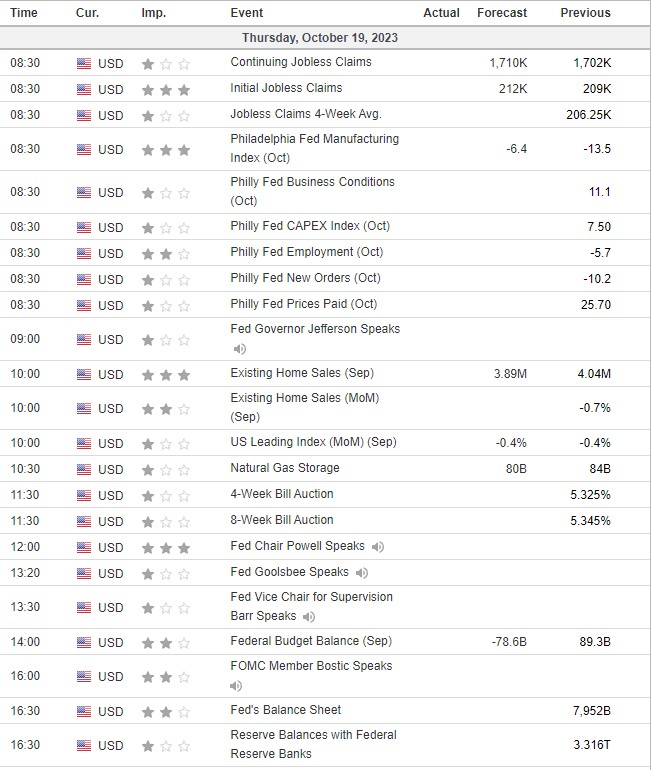

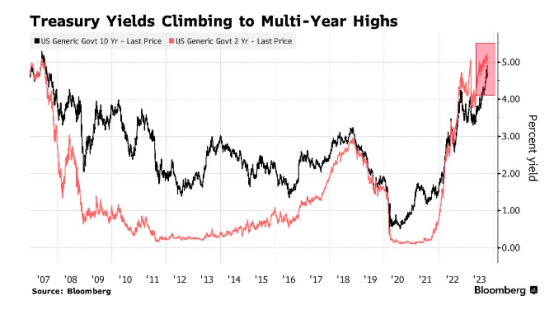

Emerging Market Losses Deepen as US Treasury Yields March to 5%-BBG

Losses in emerging-market stocks and bonds deepened as the rise in US Treasury yields and concern about a wider conflict in the Middle East pushed investors to unload riskier assets.

This week’s losses on the MSCI benchmark equity index have reached 2%, with most currencies trading weaker. Foreign-exchange markets most correlated with the global macroeconomic outlook – the South Korean won and the South African rand — led losses.

Yields on 10-year US government bonds gained for a fourth day, coming closer to reaching 5% for the first time since 2007. That is increasing the valuation pressure on emerging market assets, which typically lose their appeal when the US dollar strengthens and US rates rise.

“Being the benchmark rate for any investment, higher US Treasury yield increases the return expected for any other investment, either equities, real estate, or bonds,” said Omar Ghalloudi, head of emerging-market trading at KNG Securities. “Meeting these higher returns requires asset prices to adjust downward.”

This is renewing concern about debt defaults in emerging markets.

COMMENTS: This is ungood and pressuring risk assets across the board

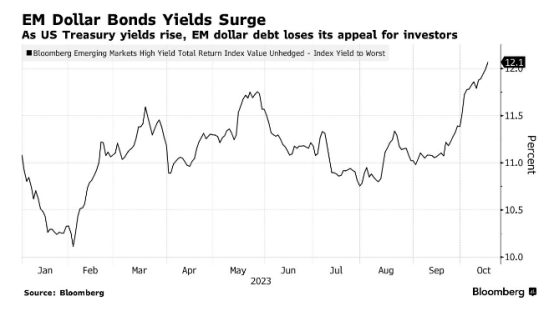

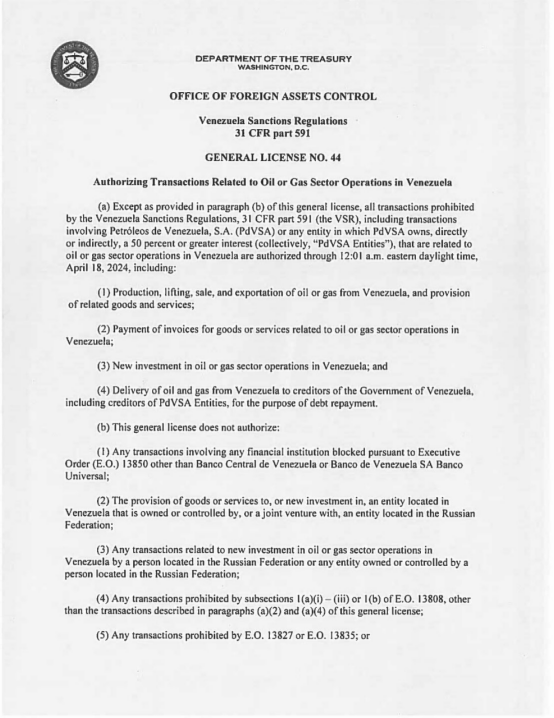

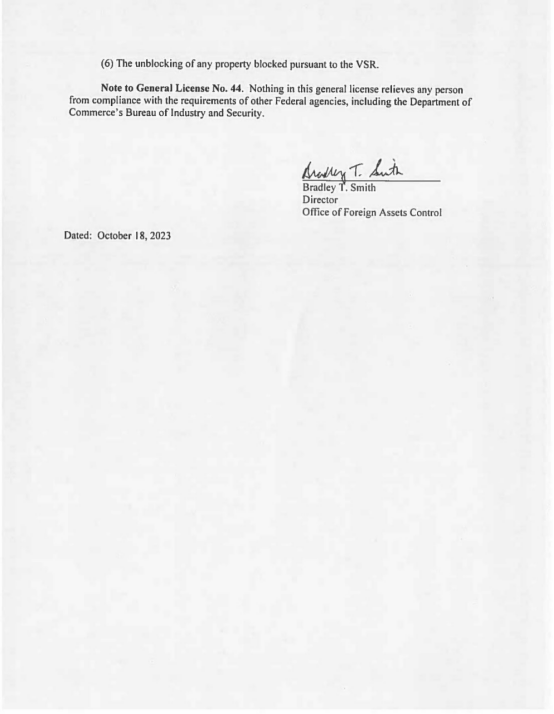

OIL SANCTIONS LIFTED ON VENEZUELA

Washington formally lifts for 6-months oil sanctions against Venezuela (via a so-called “general license); see below) allowing state-owned PDVSA to resume crude and fuel exports to the US

COMMENTS: This is pressuring oil today, but in reality, 6 months is a joke. You need years to rebuild VZ crumbling infrastructure to get any meaningful additional capacity out of VZ. They produce only 700K bpd, with most of that going to China to pay for debts. The US will get lucky if imports increase by 200K bpd max. Another foreign policy failure decision.

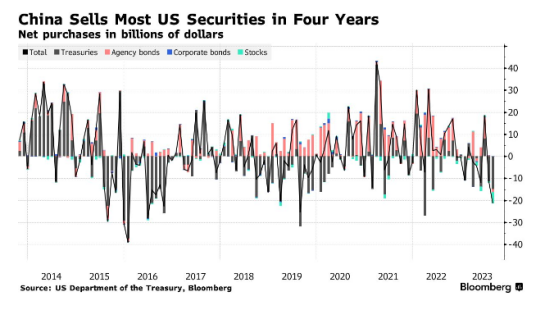

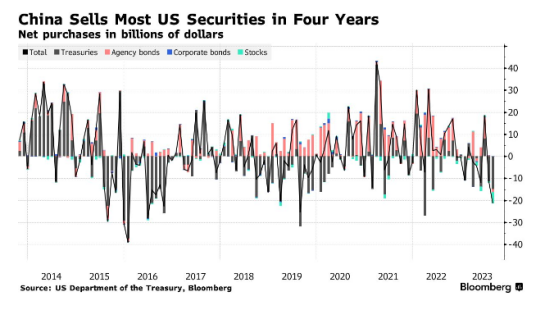

China Sells Most US Securities in Four Years Amid Yuan Weakness-BBG

Chinese investors offloaded the most US bonds and stocks in four years in August, fueling speculation the authorities may have moved to beef up their war chest to defend a weakening yuan.

The bulk of the $21.2 billion of sales were in Treasuries and US equities, with funds in the Asian nation also cutting holdings of agency debt, according to data from the US Department of the Treasury released on Wednesday. In August, the onshore yuan tumbled to its lowest against the dollar since November, prompting Beijing to tell state-owned banks to step up intervention in the currency market.

“This could be to liquidate some bond holdings to obtain US dollar cash in case it is needed later to defend the yuan via intervention operations,” said Gareth Berry, a currency and rates strategist at Macquarie Group Ltd. in Singapore. “The same reason may go for why they sold stocks.”

COMMENTS: Yuan as a reserve currency…LOL

US Treasuries at 5% Are a Buy, Says Morgan Stanley Investment-BBG

If 10-year US Treasury yields hit 5% or higher, that’s a good entry point for investors, according to Morgan Stanley Investment Management.

“Those will be great levels to get longer in your portfolio from a duration perspective” under current conditions, said Vishal Khanduja, money manager and co-head of the broad markets fixed-income team in Boston. “We’ll be superbly in that overshoot category” from the firm’s fair value levels for Treasuries should yields breach 5%.

Benchmark US yields are fast closing in on the 5% mark, fueling debate about how much further they can rise as Federal Reserve officials pledge to keep interest rates higher for longer. Traders trying to time an entry into the market have to weigh opposing factors, as the conflict in the Middle East fuels haven bids while a swelling US deficit boosts the supply of securities.

COMMENTS: Always interesting to see what banks are telling their customers.

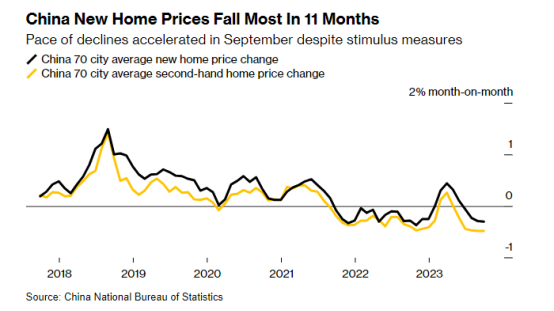

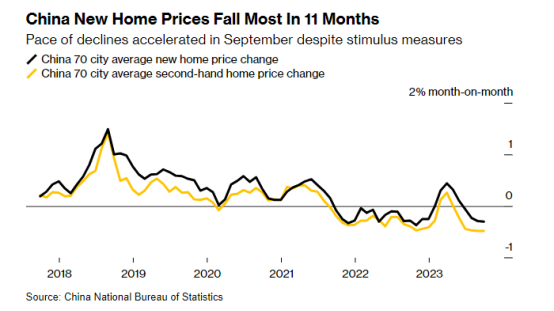

China’s Home Prices Drop at Faster Pace in Blow to Sentiment-BBG

China home prices fell at the fastest pace in almost a year in September, adding to doubts over whether Beijing’s steps to prop up the property market are enough to revive the sector.

New-home prices in 70 cities, excluding state-subsidized housing, declined 0.3% last month from August, when they slipped 0.29%, National Bureau of Statistics figures showed Thursday. That was the steepest month-on-month decline since October 2022.

Prices slid 0.48% in the secondary market, matching the previous month’s decline which was the largest recorded since 2014. The price cuts came even as major cities rolled out measures to stimulate the market, such as lowering mortgage rates and down payment requirements.

COMMENTS: This was pressuring China markets today and commodities

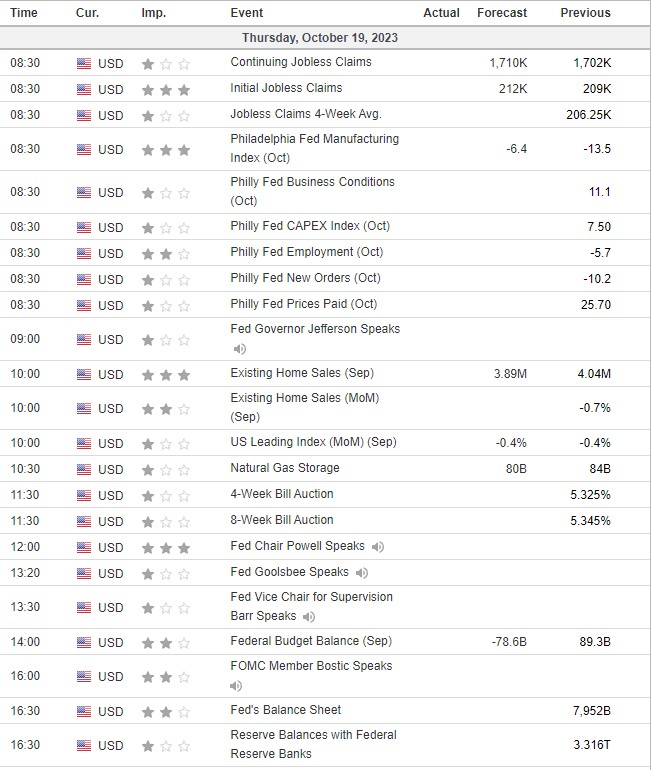

US DATA TODAY