$NVDA reports today after the close

Mixed Markets

- Hong Kong: Hang Seng closed down -0.25%

- China CSI 300 +0.13%

- Taiwan KOSPI +0.77%

- India Nifty 50 +0.44%

- Australia ASX +0.11%

- Japan Nikkei -0.33%

- European bourses in mostly NEGATIVE territory so far this morning

- USD -0.10%

TOP STORIES OVERNIGHT

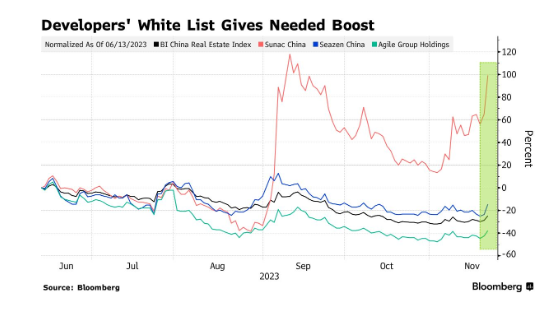

China Property Stocks Surge, With Sunac Rallying 27%, After Beijing Picks 50 Firms to Fund-BBG

Chinese developers’ bonds gained along with their shares after authorities began drafting a list of 50 real estate firms that would be eligible for a range of financing as Beijing sought to support the embattled property sector.

A Bloomberg gauge of China developer stocks gained as much as 7.6% to head for its biggest advance since September. Sunac China Holdings Ltd., the first major Chinese builder to reach a restructuring agreement, led the sector’s rise as it rallied as much as 27%. Seazen Group Ltd. and Agile Group Holdings Ltd. also climbed.

The so-called white list, which is intended to guide lenders as they weigh support for the industry via bank loans, debt and equity financing, may help alleviate fears of further contagion in China’s property sector. Still, it remains to be seen if the move will halt the industry’s long-running slump given that it does not represent a directive to banks to extend loans to real estate firms.

Cold Snap to Hit Europe From Weekend in First Winter Energy Test-BBG

London to reach zero on Saturday, while Nordic capitals freeze

A cold snap will spread across Europe from the weekend, testing the region’s energy systems for the first time this winter.

Helsinki is forecast to experience lows of -11.5C for four consecutive days from Saturday, while other Nordic capitals also freeze, according to Maxar Technologies Inc. The cold will also envelop Germany and the UK, with temperatures in London expected to reach as low as zero degrees on Saturday.

“Wintry showers, and strong winds are likely into northern and eastern areas, with the risk of overnight frosts increasing through the weekend,” the UK’s Met Office said.

COMMENTS: This will be an interesting test….watch TTF (European nat gas)

China’s state banks seen swapping and selling dollars for yuan-Reuters

China’s major state-owned banks were seen exchanging yuan for U.S. dollars in the onshore swap market and selling those dollars in spot currency markets this week, two sources told Reuters on Tuesday.

The yuan has gained 2% in the past week, to stand at levels of around 7.13 to the dollar – its highest in nearly 4 months – and the big state banks have continued to sell dollars for yuan this week, the sources said.

State banks are often suspected of stepping into the currency market on behalf of the authorities, but the timing is unusual as they would usually sell dollars when the yuan was under pressure to depreciate.

Their action over the past week came amid broad dollar weakness. The dollar index , which measures the currency’s value against major trading partners, has retreated more than 3% in November, as U.S. yields succumb to signs of a peak in Federal Reserve monetary tightening.

Some market participants said state banks might be trying to speed the yuan’s gains and spur exporters to convert more of their FX receipts into yuan. The Chinese currency is still down more than 3% against the dollar this year.

The selling of dollars by state banks caused the onshore spot yuan to briefly touch 7.1296 per dollar, firmer than its daily official guidance for the first time in four months.

The People’s Bank of China (PBOC) has also been lowering the dollar-yuan daily fixing rate this week. On Tuesday, it set the midpoint at a 3-1/2-month low of 7.1406 per dollar.

“It is surprising to see they keep lowering the fixing at this rate. To me, it looks like they are doing preparatory work ahead of a policy rate cut,” said Kiyong Seong, lead Asia macro strategist at Societe Generale.

“When the external environment is favourable, they appear to strengthen the CNY as much as possible.”

COMMENTS: Depreciation increases a country’s export activity as its products and services become cheaper to buy, whereas appreciation generally occurs when the government increases spending….so it seems as through China may be getting ready for some real stimulus measure…all eyes on the Yuan for clues on China policy.

Bond Managers of $2.5 Trillion Make Case for Leaving Cash Behind-BBG

For investors stashing record sums in cash, US bond managers overseeing a combined $2.5 trillion have a bit of advice: It’s time to put that money to work.

That’s the message from Capital Group, DoubleLine Capital, Pimco and TCW Group. And it comes as many fixed-income managers are still licking their wounds following a tough year that’s seen the bond market trail ultrasafe T-bills and money-funds carrying the highest rates in decades.

For these West Coast bond managers, this month shows the risk of staying in cash too long. Signs of ebbing inflation and softer growth have fueled a 3.4% surge in the Bloomberg US Aggregate Index in November, bringing it back to about flat for 2023 as of Nov. 17. That’s still well short of what cash has earned this year. But it shows what a real turning point could deliver after a year marked by head fakes over price pressures and Federal Reserve policy.

The asset managers said in interviews last week that they’re comfortable buying Treasuries and other high-quality bonds at levels they finally see as attractive. And they generally agreed on extending interest-rate risk as far as the five-year area of Treasuries, while also owning mortgage debt, which they consider cheap.

“My sense of things right now is that 4 1/2 to 5% is a safe place to be buying bonds,” said Greg Whiteley, head of government securities investing at DoubleLine.

He likes Treasuries due in around five years because he says the segment has scope to gain as traders price in more Fed cuts. The area is also less vulnerable than longer maturities given worries about US deficits and borrowing needs, as well as sticky inflation.

COMMENTS: Interesting Doubline likes the 5 year..usually tied to inflation. Also notable: Several firms — DoubleLine, Pimco and TCW — pointed to mortgage debt as a beaten-down area they expect to boost performance in 2024.

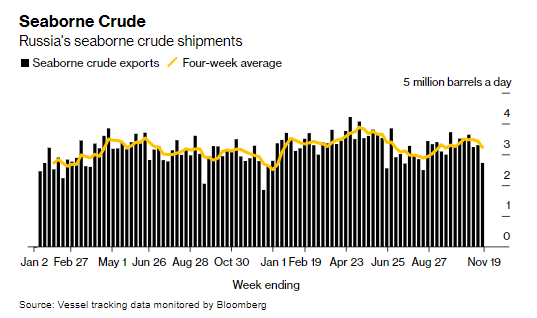

Russia Cuts Seaborne Crude Flows to Three-Month Low Before OPEC+-BBG

Russia cut back its seaborne crude exports to the lowest since August before a meeting of OPEC+ oil minsters this weekend when compliance with production cuts will be in sharp focus. The move came after shipments surged in October.

About 2.7 million barrels a day of crude was shipped from Russian ports in the week to Nov. 19, tanker-tracking data monitored by Bloomberg show. That was down by 580,000 barrels a day from the revised figure for the period to Nov. 12, the biggest week-on-week drop in more than four months.

COMMENTS: So everyone saying Russia was cheating…is proven wrong again

US DATA TODAY