Pretty GREEN out there

- Hong Kong: Hang Seng closed FLAT

- China CSI 300 -1.02%

- Taiwan KOSPI +0.05%

- India Nifty 50 +0.14%

- Australia ASX +0.28%

- Japan Nikkei +1.01%

- European bourses in POSITIVE territory so far this morning

- USD +0.11%

TOP STORIES OVERNIGHT

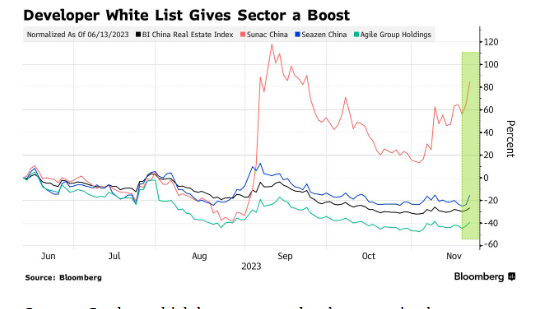

China Puts Country Garden on Draft List of Builders to Support-BBG

Country Garden Holdings Co. and Sino-Ocean Group have been included on China’s draft list of 50 developers eligible for a range of financing support, according to people familiar with the matter, signaling a pivot by Beijing to help some of the nation’s most distressed builders.

CIFI Holdings Group Co., another builder that has missed debt payments, was also included on the so-called white list, the people said, asking not to be identified because the matter is private. Regulators are set to finalize the roster and distribute it to banks and other financial institutions within days, the people said, adding that some details could change.

A Bloomberg Intelligence gauge of developer stocks has rallied this week on expectations that the financing help may alleviate fears of further contagion in China’s property sector. Still, some investors were concerned the list would mainly comprise state-owned firms and leave out distressed builders most in need of the support.

The full roster of names couldn’t immediately be determined.

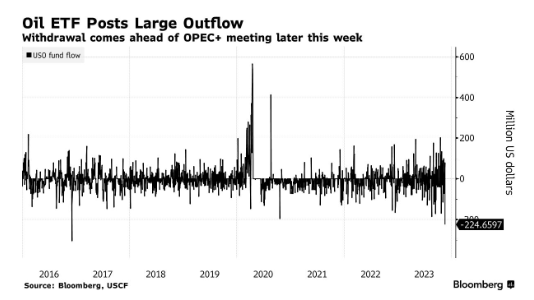

USO Oil ETF Sees Biggest Outflow Since 2016 Ahead of OPEC+ Talks-BBG

One of the oil market’s biggest exchange-traded funds registered its largest daily withdrawal in almost seven years, just days before a pivotal OPEC+ meeting on production policy.

The United States Oil Fund, ticker USO, posted a reduction of almost $225 million, its biggest one-day cash drop since December 2016. It follows a run of large inflows and outflows over recent weeks as volatility in crude prices has picked up. Two cross-commodity ETFs also saw large outbound flows.

COMMENTS: If OPEC extends cuts…we could see a giant pile in again…all eyes on the meeting this weekend. I love this type of positioning, if you are a bull, as the length has been taken out, giving upside room to run.

Big investors say US markets rally could prove short-lived-Reuters

The recent rally that has lifted U.S. stocks and bonds is more of a year-end rebound than a turning point, according to big money managers, who see fiscal and monetary policies, next year’s presidential election and recession fears as likely to start weighing on markets.

Since late October, the S&P 500 (.SPX) has rallied roughly 10% and the Nasdaq (.IXIC) has surged 13%, as investors increased bets that the Federal Reserve’s tightening cycle is over after signs of cooling inflation and job growth and a better-than-expected third-quarter earnings season.

Ten-year Treasury yields hit a 16-year high of 5.021% in late October, but have fallen back to 4.414%. Lower yields have driven a technology-fueled equities rally.

Some big investors and advisers believe, however, that reasons to cheer are short-lived and growing concerns over the economy will start weighting on asset prices early next year.

“We’ve started seeing some signs that things are a little weaker than what people may believe,” Ryan Israel, chief investment officer of Bill Ackman’s Pershing Square Capital Management, told clients last week, adding the main focus now is where the economy is heading.

Markets may have “gone too far in extrapolating” rate cuts in early 2024 from recent data suggesting that consumer inflation is falling and the U.S. labor market is weakening, said Mohamed El-Erian, an adviser to financial services firm Allianz SE (ALVG.DE).

COMMENTS: Seems Ackman is short….also one could argue that slowing data has already been priced in twice this year…let us see. That said hard landing camp believes that this data has not begin to show up yet, but could take much longer than most expect.

Crypto Traders Load Up on Bitcoin Topside Option Plays After Binance’s Guilty Plea-Coindesk

We have seen interest in loading up more topside with strong demand for the March 2024 expiry calls, one OTC desk said.

Binance chief Changpeng “CZ” Zhao on Tuesday stepped down and pleaded guilty to violating U.S. anti-money laundering laws as part of a $4.3 billion settlement, in what may come across as the most significant blow to the crypto market since the collapse of Sam Bankman-Fried’s exchange FTX last year.

But that’s certainly different from how traders look at the events.

According to over-the-counter institutional cryptocurrency trading network Paradigm, the options market has increased activity in topside bitcoin call options in the aftermath of the Binance news, a sign of persistent bullish sentiment.

“In the options space, after the initial two-way flow, we have seen interest in loading up more topside with strong demand for the March 2024 expiry calls,” Patrick Chu, head of institutional sales coverage at Paradigm, told CoinDesk.

Nvidia Fails to Satisfy Lofty Investor Expectations for AI Boom-BBG

Nvidia Corp. investors gave a cool reaction to its latest quarterly report, which blew past average analysts’ estimates but failed to satisfy the loftier expectations of shareholders who have bet heavily on an artificial intelligence boom.

Revenue in the current period will be about $20 billion, the world’s most valuable chipmaker said Tuesday in a statement. Though that topped the average Wall Street prediction of $17.9 billion, some projections reached as high as $21 billion.

After sliding as much as 6.3% in late trading, the shares settled down to a decline of about 1%.

While Nvidia posted another quarter of impressive growth, some investors were clearly anticipating more. They have poured money into the stock this year — sending it up 242% — on the hopes that the AI industry will continue to bring explosive sales gains for Nvidia. That means Nvidia shares were priced at a level that required an absolutely perfect outcome, analysts have said.

COMMENTS: Watch tech stocks today…could set the tone for the entire market, particularly on a day before a holiday and light trading volumes

US DATA TODAY