Mixed Markets

- China and Hong Kong markets closed for Chinese New Year

- South Korea +1.39% after reopening from New Year Holiday

- Japan Nikkei +0.09%

- Australia ASX +0.47%

- India Nifty 50 -1.25%

- European bourses in negative territory across the board with the exception of Spain

- USD is slightly up +0.11% benefiting from the decline in sentiment in Europe

- US indices are also under pressure this morning

Overnight data/headlines

- UK Dec PPI Output -0.8% m/m 14.7% y/y; core Output PPI +0.1% m/m

Dec PPI Input -1.1% m/m 16.5% y/y - Australia Inflation surges further in Q4, more rate hikes loom

AUD jumps as shock inflation data sends yields higher

Dec CPI 8.45 y/y vs. expected 7.7%

Q4 CPI 1.9% m/m 7.8% y/y vs. expected 1.6%/7.5% - Singapore Dec CPI 0.2% m/m 6.5% y/y vs. expected 6.6% y/y

Dec Core CPI 5.1% y/yvs. expected 5.0%

Canada BOC rate decision today

The Bank of Canada is expected to hike a further 25 bps to 4.50%, though markets are only pricing an 80% probability, and with all eyes on whether it signals a pause, given that it was already quite conditional about hiking today at its previous meeting

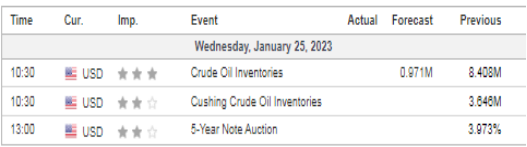

US DATA TODAY

COMMODITY HEADLINES OVERNIGHT

Metals

Copper edges higher in China holiday-thinned trade

Gold retreats as traders lock in profits before U.S. data

Energy

Halliburton tops Wall Street estimates as equipment remains fully booked

China’s diesel exports rebound easing global shortage: Kemp

US oil & gas M&A hit 17-year low; big firms dominate deals-report

Norway offers up to 92 new oil and gas exploration blocks

Argentina pumps record shale oil as Vaca Muerta takes off

Mexico’s newest oil refinery to begin crude processing in July -energy minister

Brazil’s Petrobras hikes gasoline prices ahead of board vote on Lula’s CEO pick

Brazil’s Petrobras cancels sale of fertilizer plant

US issues license to Trinidad & Tobago to develop Venezuela offshore gas field

OPEC+ panel unlikely to tweak oil policy at Feb. 1 meeting, sources say

US natgas drops 6% on milder forecasts, lengthy Freeport restart