Asia Mixed, Europe RED

- Hong Kong: Hang Seng closed UP +0.55%

- China CSI 300 +0.50%

- Taiwan KOSPI -0.85%

- India Nifty 50 -0.71%

- Australia ASX +0.22%

- Japan Nikkei +0.08%

- European bourses all in NEGATIVE territory so far this morning

- USD +0.20%

NOTABLE EARNINGS TODAY

$META$BA$IBM$NOW$TMO$TMUS$HLT$ALGN$ORLY$ODFL$ADP$CYH$ETD$NOVA$PI$CLS$GBX$VRT$COOP$QS$IMAX

TOP STORIES OVERNIGHT

China Signals Zero Tolerance For Sharp Economic Slowdown With Rare Steps-BBG

Chinese President Xi Jinping signaled that a sharp slowdown in growth and lingering deflationary risks won’t be tolerated, making a series of rare policy moves to boost the economy while refraining from massive stimulus.

The government increased its headline deficit on Tuesday to the largest in three decades and unveiled a sovereign debt package that marked a shift from its traditional model for fiscal support. Xi also made an unprecedented trip to the central bank — sending a strong message about his focus on the economy.

The one trillion yuan ($137 billion) budget boost and willingness to exceed a long-adhered to 3% limit to the deficit-to-GDP ratio suggests a determination by Beijing to shore up growth for 2024 and avoid complacency. It comes even after strong economic data published this month put the government on target for its goal of about 5% this year.

The unusual budget change is “a firm signal from policymakers that they intend to support growth,” said Peiqian Liu, Asia economist at Fidelity International. “Raising funds by central government leveraging is a strong sign that the government will not hesitate to expand its balance sheet when needed.”

COMMENTS: Looks like China is finally getting serious.

That should bode well for commodities once enacted.

China Developer Country Garden Deemed in Default on Dollar Bond for First Time-BBG

Chinese developer Country Garden Holdings Co. was deemed to be in default on a dollar bond for the first time, underscoring its fall into distress amid a broader property debt crisis that’s shaken the world’s second-biggest economy.

Country Garden’s failure to pay interest on the note within a grace period that ended last week “constitutes an event of default,” according to a notice to holders from trustee Citicorp International Ltd. seen by Bloomberg News. That means the trustee must declare principal and interest due immediately if holders of at least 25% in aggregate principal amount of the notes outstanding demand it. There is no indication that creditors have made any such demand yet.

The builder, among the world’s most indebted developers, didn’t pay $15.4 million of dollar bond interest by the end of a 30-day grace period after missing the initial deadline of Sept. 17. A default had appeared all but official after Country Garden told Bloomberg News last week that it didn’t expect to be able to meet all offshore payment obligations on time. The company is now likely headed for what would be one of the nation’s biggest-ever restructurings.

COMMENTS: One has to think China let this happen to restructure, or else the government would have bailed them out

Japan’s 10-year yield hits new decade high on BOJ tweak speculation-Reuters

Japan’s 10-year government bond yield touched a new decade-high on Wednesday on speculation that the Bank of Japan (BOJ) may raise its cap for the benchmark yield.

The 10-year JGB yield rose to 0.865% earlier in the session, its highest since July 2013. The yield retreated to 0.850%, up 1 basis point (bps) from the previous session.

A recent surge in global interest rates is heightening pressure on the BOJ to raise the existing cap on the 10-year bond yield at its policy meeting next week.

“If the BOJ raises the ceiling of the 10-year bond yield, that implies the BOJ’s stance to protect its yield curve control (YCC) is different from before,” said Naoya Hasegawa, senior bond strategist at Okasan Securities.

“When (Haruhiko) Kuroda was the governor, they conducted relentless bond buying to contain elevated yields. But according to what media has reported, the current administration is trying to raise the ceiling so that the BOJ can reduce the bond-buying amounts.”

The BOJ has conducted several unscheduled bond-buying operations recently, including the one in the previous session. Strategists have said the BOJ has not aggressively tried to contain yields based on the amounts they offered to buy.

COMMENTS: Keep an eye on the Yen

Deficit Doubling as US Economy Grows Shows Why Yields Are at 5%-BBG

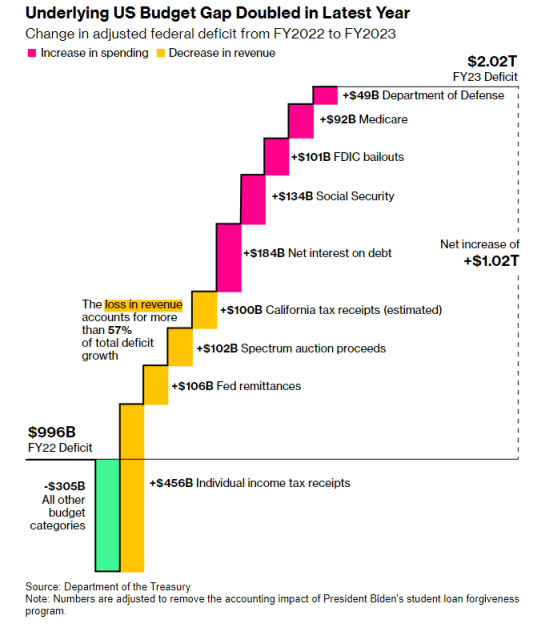

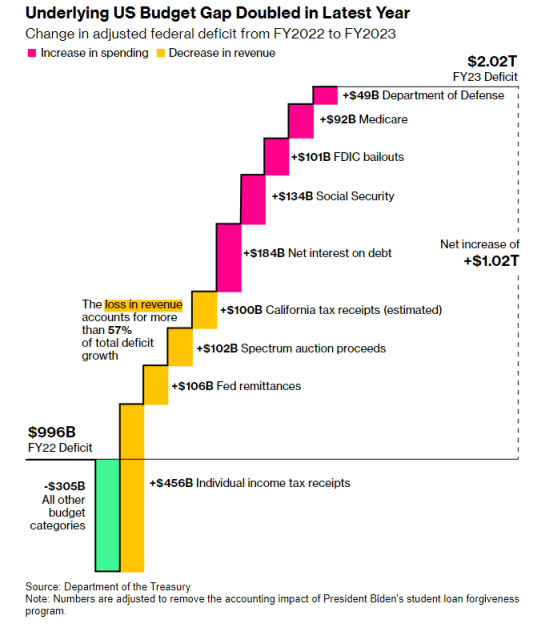

In a year when the US economy exceeded almost everybody’s expectations, the underlying federal deficit roughly doubled, spotlighting a dire fiscal trajectory likely to only worsen the partisan budget battles in Washington.

The government ran a $2.02 trillion deficit for the fiscal year through September, after adjustments to remove the impact of President Joe Biden’s student-loan forgiveness program, which was scotched by the Supreme Court. The gap is $1.02 trillion more than the prior year.

The surge is a powerful illustration of a fiscal path that’s triggered warnings from economists, politicians and credit rating agencies. It also helps explain why yields on longer-term US Treasuries are reaching highs unseen since before the global financial crisis, with the government needing to issue ever more debt to cover the shortfall of revenues relative to spending. Ten-year yields surpassed 5% on Monday.

COMMENTS: EEK!

Honda, GM scrap plan to co-develop cheaper EVs-Reuters

Honda Motor (7267.T) and General Motors (GM) are scrapping a plan to jointly develop affordable electric vehicles (EVs), the Japanese company said on Wednesday, just a year after they agreed to work together in a bid to beat Tesla in sales.

The decision underscores GM’s (GM.N) strategic shift to slow the launch of several EV models to focus on profitability, as it grapples with the rising costs of United Auto Workers strikes, which surged to $200 million per week this month.

“After conducting some research and analyses, both parties decided to end the development,” Honda said. “Each company will continue to work towards offering affordable models to the EV market.”

COMMENTS: The fact is they are just not selling in the US

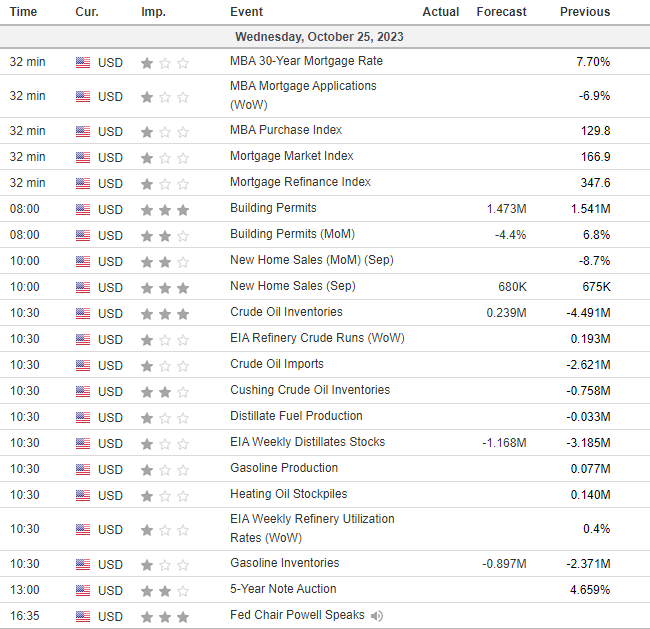

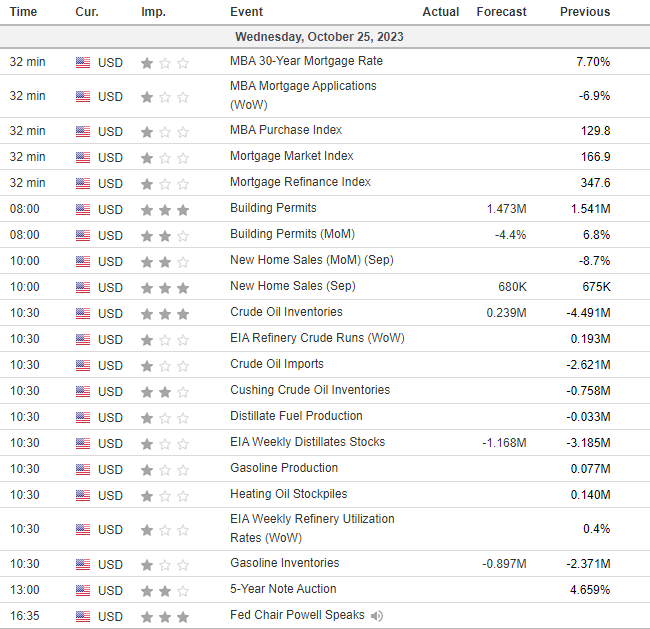

US DATA TODAY