Mostly Green

- Hong Kong: Hang Seng closed up +1.41%%

- China CSI 300 -0.12%

- Taiwan KOSPI +0.44%

- India Nifty 50 -0.39%

- Australia ASX +0.85%

- Japan Nikkei +1.62%

- European bourses all in positive territory so far this morning

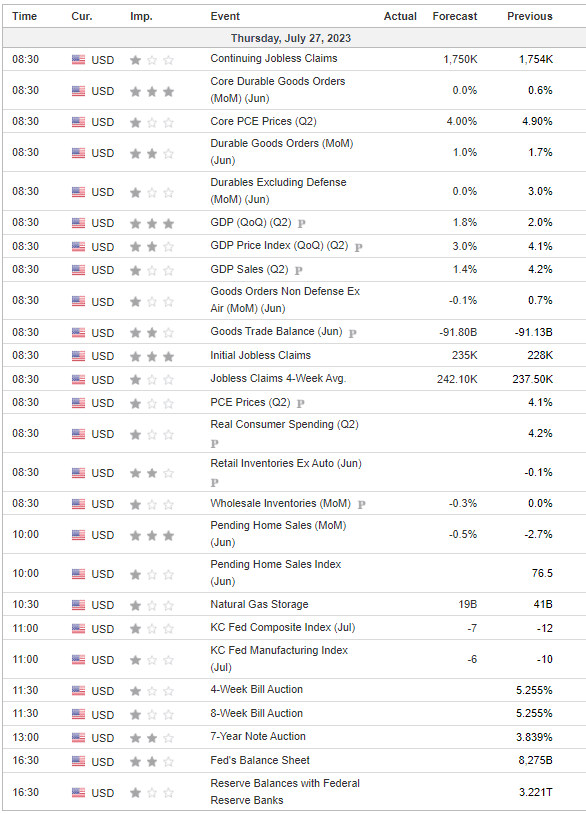

- USD -0.25%

TOP STORIES OVERNIGHT

- Global Stocks Soar on View Fed Rates Have Peaked-BBG

Global equities surged and the dollar retreated, as investors wagered the Federal Reserve has reached the end of its 16-month long policy-tightening cycle.

A raft of earnings beats from high-profile companies added to the bullish momentum, propelling the Stoxx Europe 600 index 1% higher to a two-month high, while US futures pointed to a strong Wall Street session. Contracts on the tech-heavy, policy-sensitive Nasdaq 100 were up 1.3%, led by an 8% premarket surge in Facebook parent Meta Platforms Inc.

The moves come after the Fed raised the federal funds rate to a 22-year high and while it signaled further hikes would be data dependent, many investors reckon it’s done hiking interest rates. They have trimmed bets on more increases this year, as Fed Chair Jerome Powell pointed to signs that higher borrowing costs are working to curb price pressures.

“There is belief that the Fed is probably done,” said Timothy Graf, head of EMEA macro strategy at State Street Bank & Trust Co. “Markets are also seeing a US economy that’s held up far better than the consensus outlook. They are pricing that we have achieved a landing that everyone thought would be impossible to achieve.”

What’s more, gloomy forecasts for an earnings recession have failed to materialise, according to Graf, with equity moves showing “people were under-invested in a lot of the big themes that generated returns this year.”

More than half of all companies have beat analyst estimates so far, and today stands to be the busiest of the second-quarter calendar. Among individual European movers, BNP Paribas SA, Nestle SA and Carrefour SA all rallied after topping estimates. On the downside, Shell Plc retreated despite pledging more buybacks as its profits fell from last year’s highs. Barclays Plc slumped on back of a 41% decline in quarterly trading revenue.

Meta stood out in US premarket trading, after issuing forecast-beating results and revenue forecasts. Chipmakers also advanced, led by Micron Technology Inc., which highlighted its development of high-bandwidth memory products.

- China Asks Banks to Bankroll Tech in Latest Private Sector Boost -BBG

China’s central bank called on the financial sector to help fund technology research and M&A deals, the latest in a string of promises to revive a private sector devastated by a two-year regulatory crackdown.

A plethora of Beijing officials have in recent weeks talked about measures to prop up private firms, regarded as key to resuscitating a sputtering economy. On Thursday, the central bank asked lenders and financial markets to provide more support for innovation and tech-related acquisitions, and to boost investment in startups.

In one of the more concrete measures outlined, China will explore the creation of a platform through which smaller tech firms can borrow via high-yield bonds, confirming a Bloomberg News report from June.

China will “push for more financial resources to be poured into the real economy and innovative areas, in order to facilitate building the country into a technology power and achieve tech self-reliance and self-improvement,” said Zhang Qingsong, deputy governor of the People’s Bank of China, during a briefing.

More China stimulus

Goldman Says Hedge Funds Bought China Stocks on Aid Pledge-BBG

Net purchases rose at fastest pace in nine months ]

Nine out of 11 industries were net bought, says Goldman

Goldman Sachs Group Inc.’s hedge fund clients net bought Chinese stocks at the fastest pace in nine months on Tuesday, bolstered by recent government support policies, the Wall Street bank said in a note on Wednesday.

Hedge fund long-buys outweighed short covers for Chinese equities by a ratio of 3.5 to 1 on July 25. It was led by purchases of yuan-denominated A-shares listed in mainland China, followed by Chinese stocks listed in Hong Kong. The buying was muted for American depository receipts, according to a note from Goldman’s prime brokerage team.

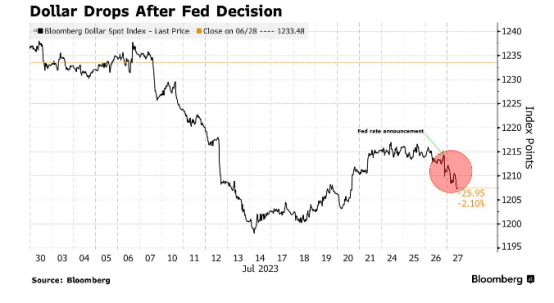

- Oil majors Shell and TotalEnergies reported this morning

Shell and TotalEnergies profits slump as oil and gas prices cool-Reuters

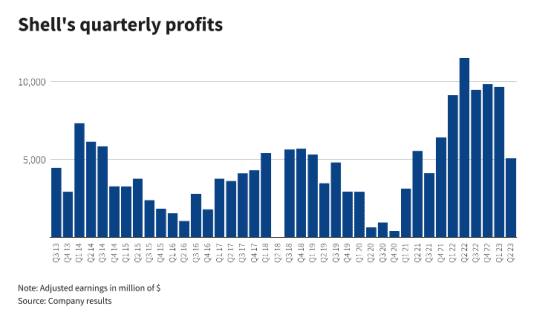

Shell (SHEL.L) and TotalEnergies (TTEF.PA) reported sharp falls in second-quarter profit from bumper 2022 earnings as oil and gas prices, refining margins and trading results all weakened.

Oil and gas prices soared last year in the wake of Russia’s invasion of Ukraine but energy prices have dropped sharply this year as fears of shortages eased amid global economic challenges.

Both companies missed earnings forecasts on Thursday, recording headline profit for April-June of around $5 billion each, down 56% year-on-year at Shell and 49% at TotalEnergies. Still, this was broadly in line with Shell’s performance in 2021, while TotalEnergies outperformed its pre-invasion results.

Shell’s shares were down 1.9% at 0755 GMT and TotalEnergies’ slipped 0.4%, compared with a 1% decline in the European index of oil and gas companies (.SXEP).

Not really a shocker with oil and gas prices lower ..markets likely rebound this week as they look past this

- IEA Coal Report

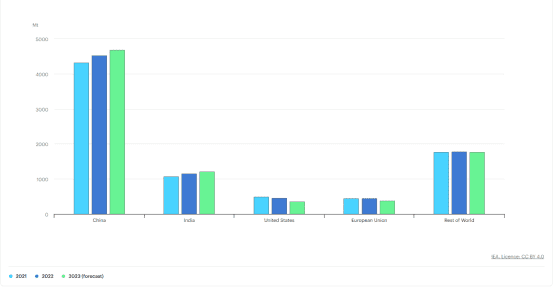

As projected in the Coal 2022 report last December, global coal demand reached a new all-time high in 2022, rising above 8.3 billion tonnes (bt). It rose despite a weaker global economy, mainly driven by being more readily available and relatively cheaper than gas in many parts of the world. The turn to coal-fired generation was further supported by overall weak nuclear power and hydropower production, contributing to a new record global high of 10 440 TWh being generated from coal, representing 36% of the world’s electricity generation, up one percentage point compared to 2021. In addition, final 2021 demand numbers for coal were revised upward, particularly in China, meaning that 2022’s increased demand was coming off an even higher base.

In China, coal demand grew by 4.6% in 2022 to a new all-time high of 4 519 Mt. Demand was higher than expected in last year’s Coal Report for two reasons. First, the calorific value (CV) of coal produced in China was lower, resulting in higher-than-expected volumes. Second, more coal than expected was gasified to produce synthetic liquid fuels, plastics and fertilizers. As a result, we estimate that coal demand for non-power uses grew by 7%, despite economic growth of only 3% and a sluggish real-estate sector.

India’s economy performed very well in 2022 with growth of 6.9%, resulting in coal demand increasing by more than 8% to a total 1 155 Mt, become the only country besides China to cross the 1.1 bt mark.

Coal demand set to grow again in 2023 even with declines in Europe and the US

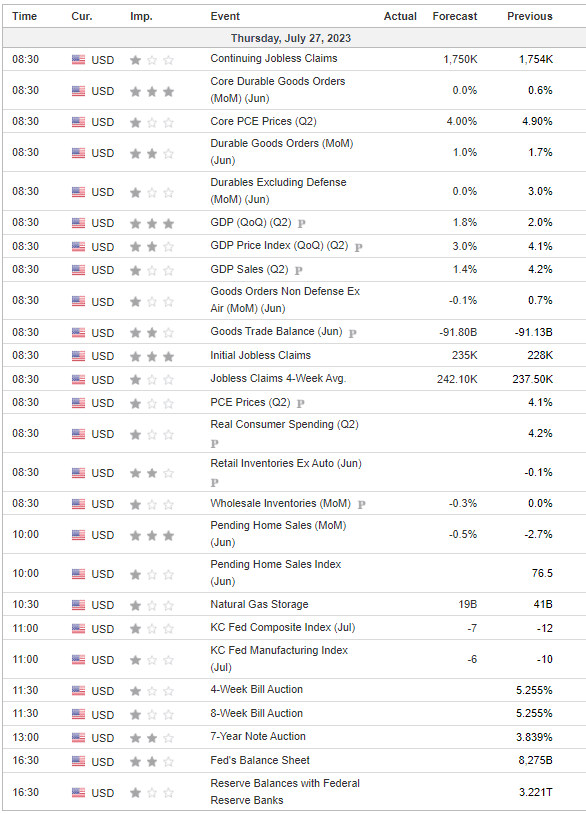

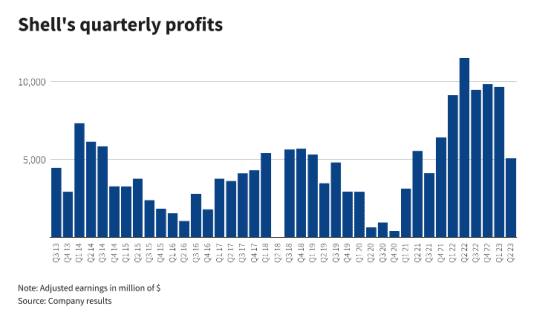

USD DATA TODAY