Asia Mixed…Europe RED

- Hong Kong: Hang Seng closed Down -0.98%

- China CSI 300 +0.19%

- Taiwan KOSPI +1.05%

- India Nifty 50 +0.57%

- Australia ASX -0.71%

- Japan Nikkei -0.55%

- European bourses in NEGATIVE territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

US Warns of Evolving Threats to Ships Sailing Through Red Sea-BBG

A spate of attacks on merchant shipping near Yemen and Somalia, likely triggered by the war in Gaza, have prompted the US to warn vessel operators to be extra careful when navigating the region.

“Exercise caution when transiting these areas and remain cognizant of evolving threats in this region,” the US Department of Transportation Maritime Administration, or Marad as it’s better known, said in an alert on Monday.

Most insurers already charge extra premiums for sailing through those waters and those charges could increase further if the attacks continue, according to Munro Anderson, head of operations at Vessel Protect, a specialist marine war risks underwriter.

COMMENTS: This is giving a lift to shippers and insurance and oil today

Morning Bid: Treasuries gobbled up-Reuters

Benchmark Treasury yields fell back more than 10 basis points to 4.37% after a total of $109 billion of 2 and 5-year notes hit the Street on Monday without much disruption. Another weak U.S. housing readout, with sub-forecast new home sales last month, perhaps flattered the post-auction moves.

Either way, it helped calm any jitters about another heavy diary of debt sales – with some $39 billion of 7-year notes up for grabs later on Tuesday.

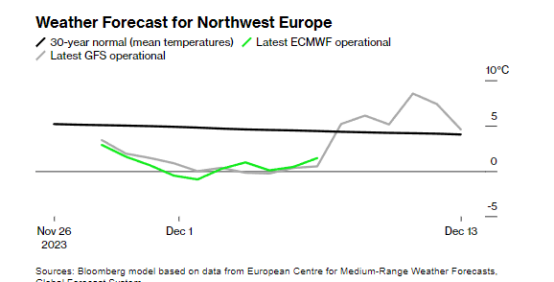

Cold Takes Hold of Europe With Snow Hitting Germany-BBG

Snow and ice severely disrupted daily life in parts of Germany as temperatures plummeted across much of Europe.

Unseasonably cold conditions will see parts of Scandinavia touch –20C, while Berlin will experience lows of -6C on Thursday, according to forecaster Maxar Technologies.

The authorities asked residents in some areas surrounding Frankfurt to stay home and avoid forested areas on Tuesday, due to a heightened risk to life.

In the UK, colder air from the north may bring wintry showers to areas along the North Sea coast as well as some inland parts of northern Britain, according to the Met Office. It also forecast some possibility of snow across the south towards the end of the week. Maxar said London and Manchester could see temperatures as low as -1.5C on Thursday and Friday.

COMMENTS: This will be Europe’s first test of gas supplies…keep an eye on this

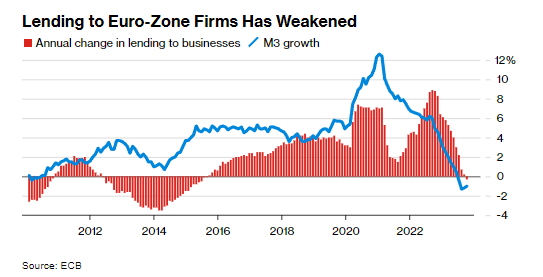

ECB Hikes Pull Business Lending Down for First Time Since 2015-BBG

Lending to euro-area businesses fell for the first time in eight years — adding to evidence that steep European Central Bank interest-rate hikes are weighing on the economy.

Credit to non-financial corporations shrank by an annual 0.3% in October, data showed Tuesday. That’s the first contraction since 2015, when longer-term ECB loans known as TLTROs, alongside the start of quantitative easing, ended three years of declines.

Meanwhile, M3 — a broad measure of money in circulation — retreated for a fourth month.

COMMENTS: This is recessionary…watch this data in the US

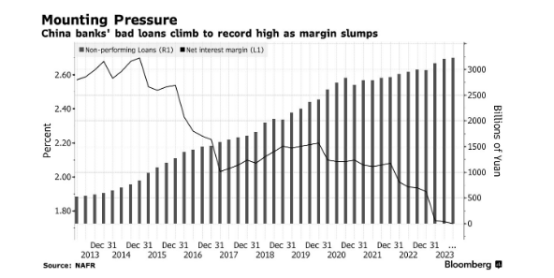

China’s Property Lifeline Exposes Banks to Big Losses, Job Cuts-BBG

China’s escalating push to have its banking behemoths backstop struggling property firms is adding to a maelstrom of woes for the $57 trillion sector.

Already stung by soaring bad loans and record low net interest margins, lenders such as Industrial and Commercial Bank of China Ltd. may soon be asked for the first time to provide unsecured loans to developers, many of whom are in default or teetering on the brink of collapsing.

The risky lifeline threatens to exacerbate an already bleak outlook. ICBC and 10 other major banks may next year need to set aside an additional $89 billion for bad real estate debt, or 21% of estimated pre-provisions profits in 2024, according to Bloomberg Intelligence. Lenders are now weighing lowering growth targets and cutting jobs among possible options, according to at least a dozen bankers who asked not to be named discussing internal matters.

COMMENTS: Clearly still a huge problem…again one has to ask if this is controlled demolition and China attempts at stimulus have still not helped the sector. This obviously puts pressure on commodities markets.

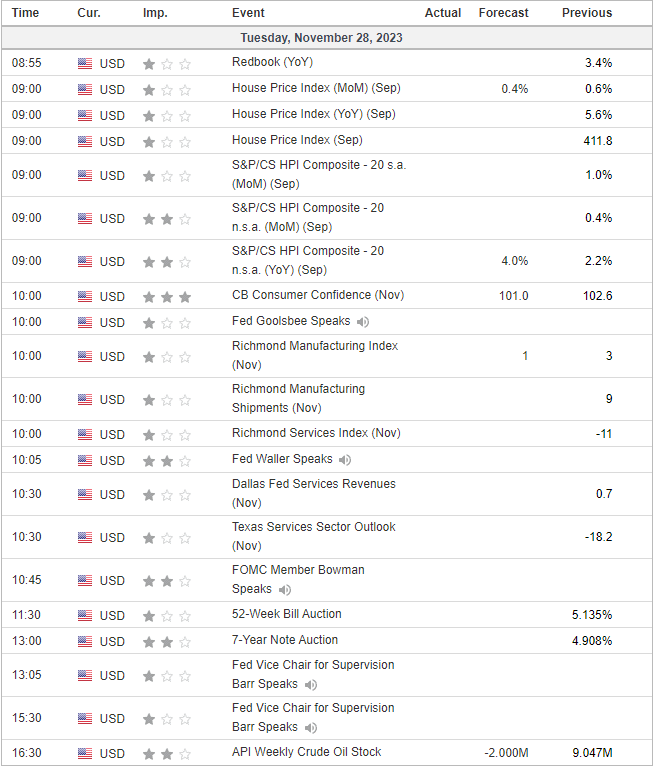

US DATA TODAY