Pretty GREEN out there

- Hong Kong: Hang Seng closed up +2.51% !!!

- China CSI 300 market closed for holiday

- Taiwan KOSPI market closed for holiday

- India Nifty 50 +0.58%

- Australia ASX -0.10%

- Japan Nikkei +0.25%

- European bourses in positive territory so far this morning

- USD -0.50%

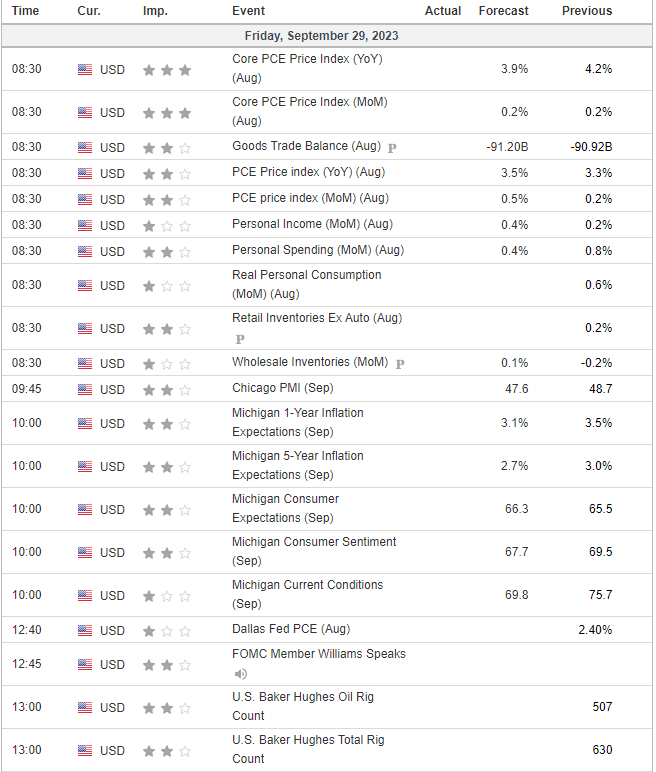

China’s Economy Improves in September, Satellite Data Show-BBG

China’s economy showed signs of a stronger recovery in September, according to several early indicators and a firm analyzing the global economy using satellite data.

Activity around Chinese shopping malls remained at relatively high levels in September following an increase in August, according to SpaceKnow, a US company that analyzes satellite images. A pickup in cement manufacturing, which began in June, was also sustained through this month, the data show.

“We are in the ‘early signs of recovery’ team,” said Jan Pintera, an economist at SpaceKnow. He said satellite imagery showed a “positive direction for the Chinese construction sector” and “renewed consumer confidence.”

Supporting the recovery story, traffic congestion in China surged in the week to September 27, reaching the highest level recorded for any week in 2022 and 2023, according to analysis of data from Baidu Inc. by Bloomberg New Energy Finance. The traffic gauge has been rising steadily since the start of August.

COMMENTS: This is good news for global markets

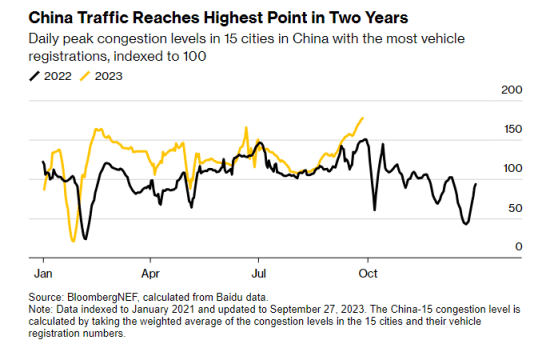

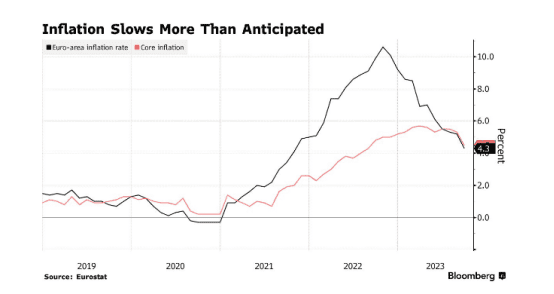

Euro-Zone Core Inflation Hits 1-Year Low, Backing ECB Pause-BBG

Euro-area core inflation eased to its slowest pace in a year, supporting expectations that the European Central Bank will keep interest rates on hold to gauge the impact of its unprecedented campaign of hikes.

Underlying price gains, which strip out energy and food costs, came in at 4.5% in September, Eurostat said Friday. That’s down from 5.3% in August and much less than the 4.8% median estimate in a Bloomberg survey of economists.

Headline inflation moderated to 4.3% from 5.2%, an almost two-year low that was also below expectations, led by a drop in energy costs but with services also slowing sharply.

German bonds extended gains after the release. The 10-year yield was down 8 basis points on the day, set for the biggest drop since August. The rally comes after the yield rose to almost 3% on Thursday — a level last reached in 2011 — amid concern the ECB will have to keep policy restrictive for longer to tame inflation.

COMMENTS: European equities liking this news this morning

Japan’s 30-Year Bond Yield Reaches Highest Level Since 2013-BBG

Japan’s 30-year government bonds dropped, sending the yield to the highest in a decade amid a selloff in global debt.

The yield rose one basis point to 1.73% as of 10:16 a.m. in Tokyo on Friday, a peak last seen in 2013, and follows the 20-year yield reaching the highest since 2014 on Thursday.

Japanese bonds face pressure on many fronts, from inflation above the central bank’s target to elevated Treasury yields and expectations the Federal Reserve will keep borrowing costs higher for longer.

Consumer price gains in Japan have remained above the central bank’s 2% goal for an extended period, partly fueled by the depreciation of the yen and the wide yield gap with the US. Data Friday showed core consumer prices in Tokyo, which excludes fresh food, climbed 2.5% in September on year.

COMMENTS: investors and policymakers are keeping a close eye on the possible shift in the Japanese monetary policy because higher yields at home may encourage repatriation of funds by local investors who own debt from the US to Europe to Australia

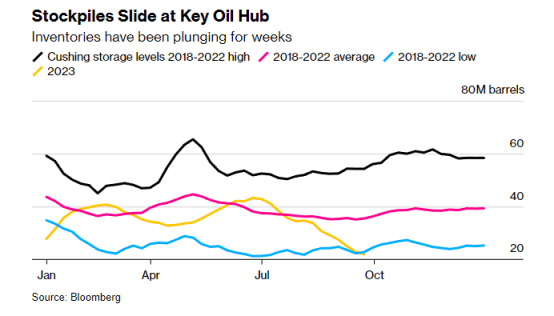

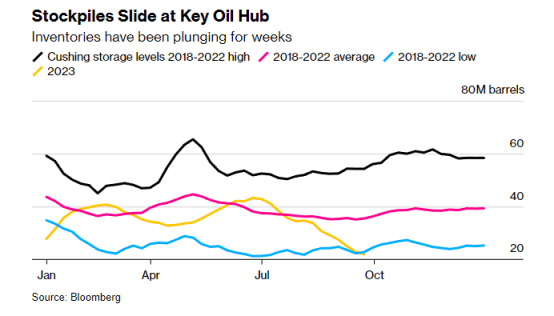

Plunging US Oil Supply Is Driving Up Prices Around the World-BBG

Oil buyers across the planet are facing some of the highest premiums for supplies they’ve seen in months — or longer — as dwindling stockpiles at the largest US storage hub reverberate through markets from Asia to the Middle East to Europe.

Flagship US crude cargoes on offer in Asia are coming in at the costliest premium this year. The spread between Brent and Middle East oil has jumped to the highest since February, while the premium for near-term US supply is close to the highest since July 2022.

At the center of the story is Cushing, Oklahoma, the delivery point for benchmark US crude futures, which helps to set the price of oil across the Americas and beyond. Inventories at the hub are now sitting just above seasonal lows last seen in 2014. That’s happening just as the world was already facing a tight supply situation with Saudi Arabia and Russia cutting output.

COMMENTS: Cushing is the actual CME group WTI contract that you are trading

Silver to benefit from solar sector demand once rates peak-Reuters

Robust demand from the solar industry and limited supply growth from mines will buoy silver prices once the period of higher global interest rates is over, analysts said.

Silver is both an investment and is consumed in the manufacture of jewellery, electronics and electric vehicles, as well as solar panels which has been gaining traction amid the global green energy transition.

However, silver prices , at $23 per troy ounce, are down 4% so far this year as elevated global interest rates discourage investment in precious metals, which do not offer interest. The U.S. Federal Reserve hardened its hawkish posture on interest rates last week.

“Once the peak of Fed tightening is confidently in place, silver should become attractive again,” said Ed Moya, senior market analyst at brokerage OANDA. He expects silver to finish this year above $24 per ounce.

“Silver might see its biggest deficit in over a decade as mining production cannot keep up with demand. The solar industry has seen surging demand,” he added.

COMMENTS: Fundamentals are strong, as I keep saying:)

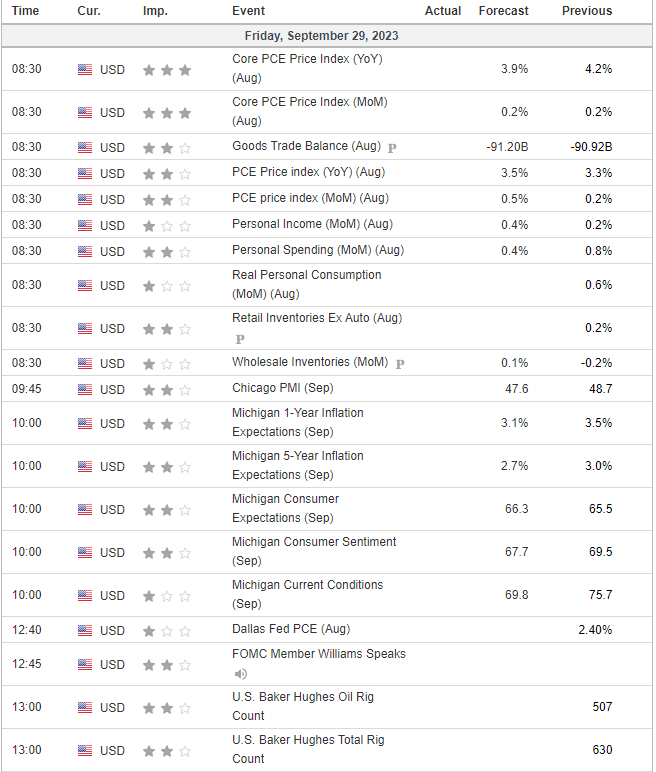

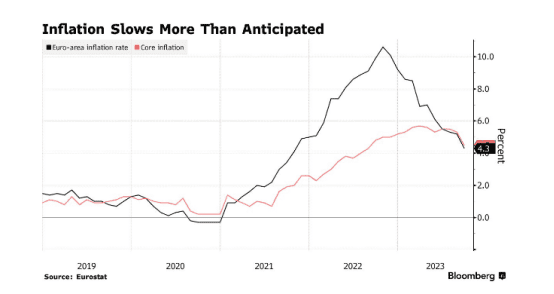

US DATA TODAY