Pretty RED out there

- Hong Kong: Hang Seng closed down -2.69%

- China CSI 300 market closed for holiday

- Taiwan KOSPI +0.09%

- India Nifty 50 -0.59%

- Australia ASX -0.20%

- Japan Nikkei -1.27%

- European bourses in negative territory so far this morning

- USD +0.18%

TOP STORIES OVERNIGHT

Stock market today: Asian markets sink, with Hong Kong down 3% on heavy selling of property stocks-AP

Asian markets declined Tuesday following a mixed session on Wall Street, where buying was pressured by rising bond yields.

Hong Kong’s Hang Seng dropped more than 3% as investors unloaded property shares.

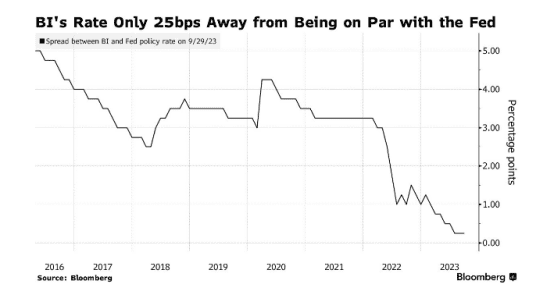

Asia’s Last Holdout Against Strong Dollar Falls-BBG

The dollar’s relentless rally has finally toppled the last Asian currency standing, with the Indonesian rupiah joining regional peers in erasing this year’s gains against the greenback.

The rupiah succumbed via a modest weakening Tuesday, even after the central bank said it intervened to shore up the exchange rate. All other Asian currencies have already retreated this year against their US peer, which has advanced in 10 of the last 11 weeks.

COMMENTS: USD wreaking havoc everywhere

Bond sell-off takes breather with German 10-year yield near multi-year highs-Market Screener

The yield on Germany’s 10-year government bond was little changed on Tuesday, holding close to last week’s 12-year high as policymakers continue to rule out interest rate cuts in the face of stubbornly high inflation.

The German 10-year yield, the euro area’s benchmark, was last down less than 1 basis point (bp) at 2.91%. On Thursday it reached 2.98%, its highest level since July 2011.

U.S. policymakers have sounded even more hawkish, suggesting rate hikes could still be needed to bring inflation back down to the 2% target and that policy will need to stay restrictive for some time.

“Yields are significantly higher and the curve has been bear-steepening again,” said Anders Svendsen, chief analyst at Nordea.

“Markets are seeing this as an indication that interest rates are going to be staying higher for longer,” Svendsen added.

Germany’s policy-sensitive two-year yield was down less than one bp to 3.218%.

Markets are no longer pricing in any more rate hikes from the European Central Bank, with the first rate cut priced by July next year, LSEG data showed.

Italy’s 10-year government bond yield, the benchmark for the euro area’s periphery, was up 1 bps at 4.81%, just off its highest level in almost 11 years reached last week of 4.96%.

This pushed the closely watched yield gap between German and Italian 10-year yields, a gauge of risk premium for holding Italian debt over German, to 190 bps. On Friday it touched the psychological 200 basis points level for the first time since March as Italy cut its growth forecasts and hiked its budget deficit targets.

“The BTP-Bund spread is vital and this will be one of the biggest things for the next ECB meetings,” Nordea’s Svendsen said.

“If the spread stays here or even widens further, the ECB will struggle to let its PEPP (pandemic emergency purchase programme) run-off.”

COMMENTS: keep an eye on US bonds today, likely this affects equities

China Evergrande Shares Soar as Trade Resumes Amid Police Probe-BBG

China Evergrande Group soared as it returned from a trading halt, driven by what appeared to be speculative bets on a penny stock even as the developer’s fate hangs in the balance amid an official probe into its billionaire founder.

The property group’s shares jumped as much as 42% in early Tuesday trade before paring half of the gains. Unit Evergrande Property Services Group Ltd. rose nearly 14% earlier but has since turned lower, losing over 8% at one point.

COMMENTS: This is just nuts

OPEC+ Shows No Sign of Easing Oil Squeeze as Ministers Meet-BBG

As OPEC+ ministers prepare to review global oil markets, the group is showing no signs of cooling a rally that brought prices near $100 a barrel.

Yet delegates from the Organization of Petroleum Exporting Countries and its partners don’t expect Wednesday’s meeting of the Joint Ministerial Monitoring Committee to recommend any policy changes. United Arab Emirates Energy Minister Suhail al Mazrouei said on Monday that OPEC+ has “the right policy.”

High prices are bringing a windfall for Saudi Crown Prince Mohammed bin Salman as his kingdom splashes out on everything from futuristic cities and international telecommunications deals to top-flight footballers and golfers. They are also a vital source of extra revenue for President Vladimir Putin as his country wages war on Ukraine.

“The oil market is getting squeezed and getting squeezed hard — but there’s more tightness to come,” Bob McNally, president of Rapidan Energy Group and a former White House official, told Bloomberg television. “Everything depends really on what Saudi Arabia does.”

COMMENTS: JMMC meeting is tomorrow, I also expect no recommendation to change course. Before OPEC+ decides anything, Saudi Arabia will change their voluntary 1M bpd cuts (which go to the end of December)

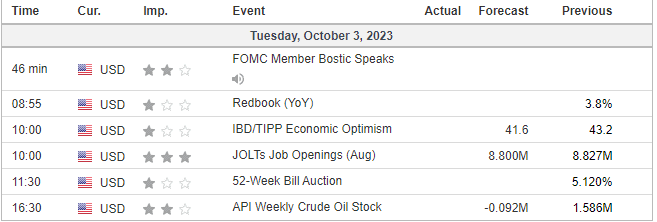

US DATA TODAY