Asia RED…Europe GREEN

- Hong Kong: Hang Seng closed down -1.69%

- China CSI 300 -0.36%

- Taiwan KOSPI -1.41%

- India Nifty 50 -0.30%

- Australia ASX -0.77%

- Japan Nikkei +2.19%

- European bourses in positive territory so far this morning

- USD -0.15%

TOP STORIES OVERNIGHT

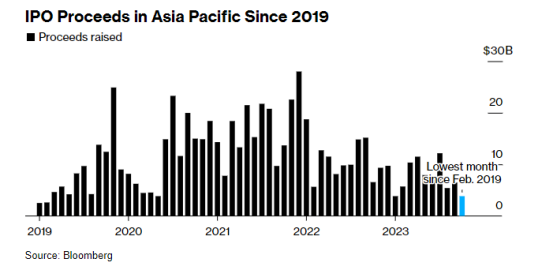

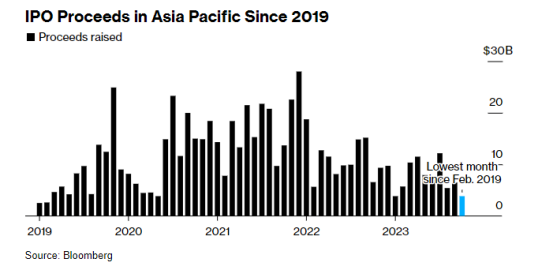

China Slump Turns October Into The Worst Month for Asia IPOs Since 2019 -BBG

Initial public offering proceeds in Asia Pacific slumped to the lowest in at least four years in October, hit mainly by slower capital-raising in mainland China.

Companies and their shareholders across the region raised about $3.89 billion through IPOs since the end of September, Bloomberg-compiled data shows. That’s a drop of 40% versus the same period last year, and the lowest monthly amount since February 2019.

Fundraising through new share sales in Shenzhen, Shanghai and Beijing combined plunged 71% to $1.1 billion in October from a year ago, the data shows. While China was one of the busiest corners in the world for listings last year, activity has slumped as the nation’s appeal fades amid fears of an economic slowdown

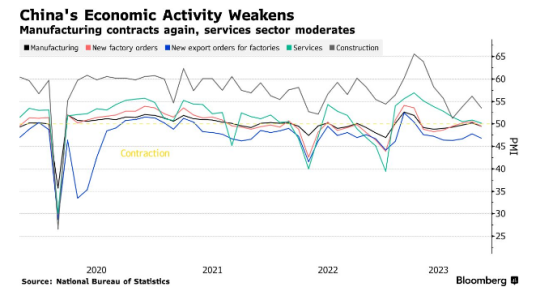

China’s Factory Activity Shrinks, Fueling Calls for More Support-BBG

China’s factory activity fell back into contraction in October, while an expansion of the services sector unexpectedly eased, signaling that the economy remains fragile and is in need of support.

The official manufacturing purchasing managers’ index slipped to 49.5 this month from 50.2 in September, according to a statement from the National Bureau of Statistics on Tuesday. That compares with an estimate of 50.2 in a Bloomberg survey of economists.

The non-manufacturing gauge, which measures activity in the construction and services sectors, declined to 50.6 from 51.7, lower than the forecast of 52. The 50 level separates growth from contraction.

COMMENTS: This is weighing on Asian markets today

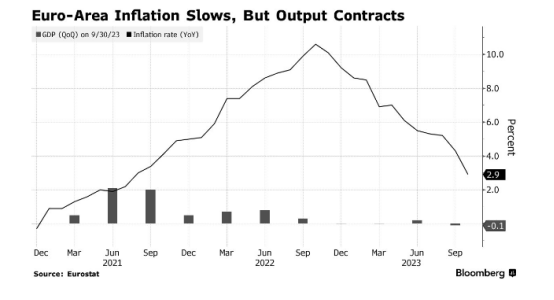

Euro-Zone Inflation Sinks to 2-Year Low as Economy Contracts-BBG

Euro-area inflation eased to its lowest level in more than two years as the bloc’s economy shrank following an unprecedented ramp-up in interest rates.

Consumer prices rose 2.9% in October — down from the previous month’s 4.3% and better than the 3.1% median estimate in a Bloomberg survey analysts. In a separate release, Eurostat said third-quarter gross domestic product fell 0.1% — missing estimates for stagnation.

Tuesday’s data show that while the European Central Bank’s 10 back-to-back rate hikes are helping to bring inflation back toward the 2% goal, they’re also taking a toll on households and firms by sending loan costs sharply higher.

COMMENTS: Markets liking this today as it seems the ECB will hit the pause button on rate hikes

BOJ Is Handing Back the Japanese Bond Market to Investors-BBG

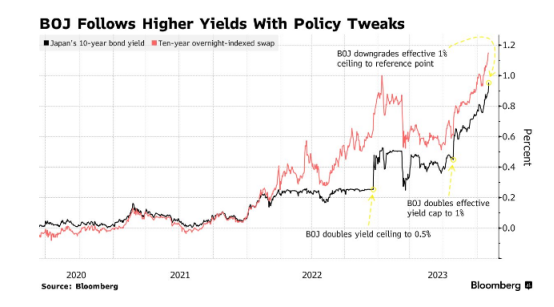

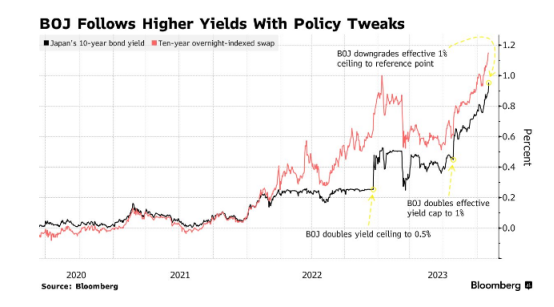

The Bank of Japan is bringing an end to its near monopoly of control over the nation’s bond market.

Japan’s central bank has tightly overseen the government debt market since it introduced yield-curve control in September 2016, with its ownership of outstanding bonds surpassing 50%. But with the authority now suggesting it’s ready to let the benchmark 10-year yield rise beyond 1%, investors look set to take back the helm.

It’s the third time since December that the BOJ adjusted the effective ceiling for the 10-year yield, underscoring the challenges the bank has faced in maintaining YCC. Less clear guidance will put more pressure on yields to rise, reflecting inflation in Japan that’s near a four-decade high and hawkish policy stances maintained by other major central banks.

“We can see the bigger picture that YCC is being dismantled, and that the market is back,” said Tom Nash, a portfolio manager at UBS Asset Management. “Now, 1% is no longer a hard limit requiring unlimited firepower but a reference point, so JGBs will test that level in the coming weeks.”

Ten-year overnight-indexed swaps, which investors use to bet on or hedge against higher bond yields, trade 15 basis points above the BOJ’s 1% reference point.

The BOJ upgraded its inflation projections, saying it now expects a key price gauge to stay well above its 2% target for three consecutive years. The nation hasn’t seen such steady price growth since 1992.

COMMENTS: Yen went nuts overnight, plummeting against the dollar, now back above 150 giving up gains from yesterday.

Caterpillar Tops Estimates on Higher Prices and Strong Sales-BBG

Caterpillar Inc. earnings were buoyed by higher prices and strong sales in the third quarter, helping the machinery maker sidestep concerns of a global economic slowdown with profit that beat analysts’ expectations.

The company known for its iconic yellow bulldozers reported adjusted earnings of $5.52 a share, beating the $4.77 average estimate of 23 analysts polled by Bloomberg. Caterpillar posted better-than-expected revenue in its construction equipment business, while sales from mining as well as its energy and transportation businesses were weaker than analysts’ anticipated.

COMMENTS: Caterpillar is viewed as an economic bellwether because its machines dot construction, mining and energy sites around the world. Earnings from the Irving, Texas-based company come as economists worry of a general slowdown in economic growth across the world, driven by higher borrowing costs and a deceleration in consumer appetites.

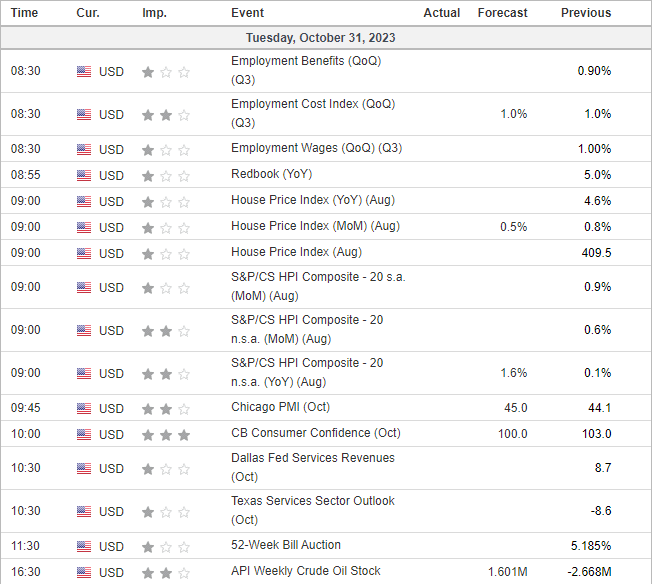

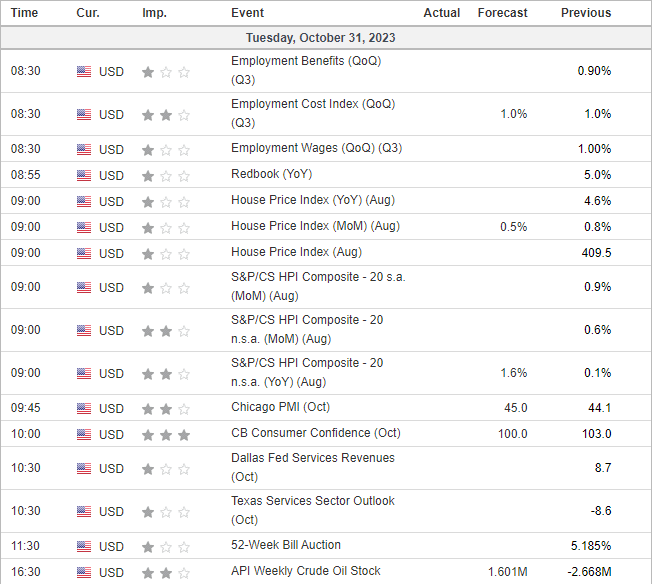

US DATA TODAY