Mixed Markets

- Hong Kong: Hang Seng closed DOWN -1.91%

- China CSI 300 -1.90%

- Taiwan KOSPI -0.82%

- India Nifty 50 +0.81%

- Australia ASX +0.70%

- Japan Nikkei -0.83%

- European bourses in MIXED territory so far this morning

- USD +0.03%

TOP STORIES OVERNIGHT

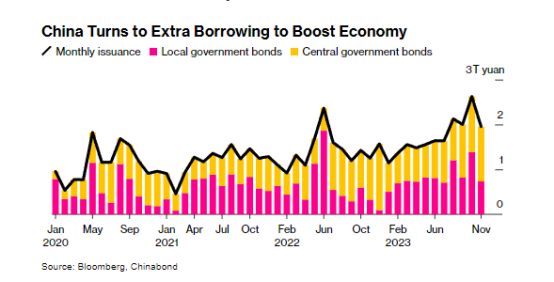

Moody’s Cuts China Credit Outlook to Negative on Rising Debt-BBG

Moody’s Investors Service cut its outlook for Chinese sovereign bonds to negative, underscoring deepening global concerns about the level of debt in the world’s second-largest economy.

Moody’s lowered its outlook to negative from stable while retaining a long-term rating of A1 on the nation’s sovereign bonds, according to a statement. China’s usage of fiscal stimulus to support local governments and its spiraling property downturn is posing risks to the nation’s economy, the grader said.

COMMENTS: Obviously this weighed heavily on China markets, which had a disastrous day.

Fall in euro zone business activity adds to recession expectations-Reuters

The downturn in euro zone business activity eased last month but still indicates the bloc’s economy will contract again this quarter as the dominant services industry continues to struggle to generate demand, a survey showed.

Last quarter the economy contracted 0.1%, according to official data, and Tuesday’s Composite Purchasing Managers’ Index (PMI) for November indicated the 20-country currency union is on track to do so again this quarter, meeting the technical definition of recession.

HCOB’s composite PMI, compiled by S&P Global and seen as a good guide of overall economic health, rose to 47.6 from October’s near three-year low of 46.5 and coming in above a 47.1 preliminary estimate.

That was its best reading since July but remained firmly below the 50 mark separating growth from contraction.

A PMI for the services sector rose to 48.7 from October’s 47.8.

“The service sector maintained its downward slide in November. The modest improvement of the activity index does not leave much room for optimism regarding a swift recovery in the immediate future,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

“The sombre outlook is reinforced by the fifth consecutive monthly shrinkage in new business. A fall in GDP is on the cards for the fourth quarter.”

COMMENTS: European markets mixed on this

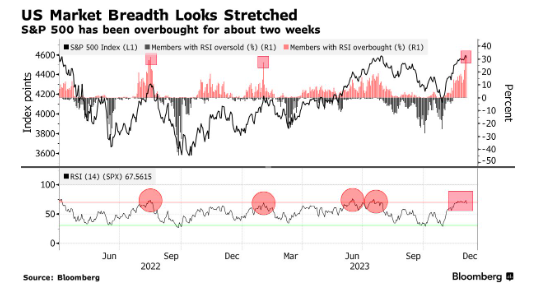

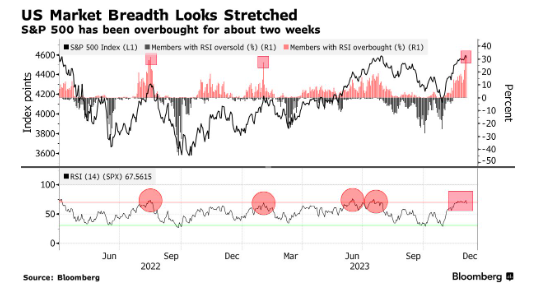

Goldman’s Rubner Says Stocks Rally Out of Gas After Record Rush-BBG

Brace for a pullback in stocks as the propellants powering last month’s rally are disappearing fast, according to a Goldman Sachs Group Inc. tactical specialist who tipped the November surge in markets.

After the S&P 500 raced to its second-best November in 40 years, the dynamics that caused “the everything rally” last month “have absolutely run out of gas right now,” Goldman’s Scott Rubner wrote in a note to clients, citing the flow of funds and the positioning of systematic investors.

The euphoria in stocks was largely driven by a sea change in expectations around Federal Reserve policy moves, with traders wagering on a 70% chance of a rate cut in the first quarter. Rubner noted this caused a rush toward equities by commodity trading advisers, or CTAs, who surf the momentum in asset prices and take long and short positions in futures markets.

“This is the fastest increase in exposure that we have ever seen,” he wrote, highlighting the $225 billion in buying during the past month. “CTA asymmetric skew is firmly to the down side,” as the funds would only buy $58 billion in an upward move, while in the case of a downward swing $210 billion could be offloaded, said Rubner, a managing director at the bank.

COMMMENTS: Stay nimble

OPEC+ Oil Production Cuts Can Continue Past March If Needed, Saudi Prince Says-BBG

The OPEC+ oil production cuts can “absolutely” continue past the first quarter if needed, Saudi Energy Minister Prince Abdulaziz bin Salman said, as he pledged the curbs would be delivered in full.

The supply reductions announced last week of more than 2 million barrels a day — about half of which are coming from Saudi Arabia — will only be withdrawn after consideration of market conditions and using a “phased-in approach,” he said.

“I honestly believe that the delivery of the 2.2 million will happen,” he said in an interview in Riyadh on Monday. “I honestly believe that 2.2 million will overcome even the usual inventory build that usually happens in the first quarter.” There are already signs that demand is improving, he said.

As traders try to gauge the real impact of the agreement between the Organization of Petroleum Exporting Countries and its allies, one of the biggest questions is about Russia. Its contribution comes from export curbs, not outright production cuts as is the case for other OPEC members.

Prince Abdulaziz said he would have preferred to see a reduction in output, but couldn’t convince his Russian counterpart. Moscow has long argued that freezing weather and other geological conditions make it more difficult to curb production in the first few months of the year.

“We did try,” Prince Abdulaziz said. “We also know it’s extremely tough for Russia to cut production in the winter.”

COMMENTS: It is true about Russia, most of their production is in Siberia and the Arctic, you damage pipelines and equipment irreparably if you turn the taps off

FTSE 100 Live: UK Stocks Slide as LSE Outages Disrupt Trading-BBG

The London Stock Exchange has been hit by outages disrupting trading in UK-listed stocks, with a first incident resolved but then followed by a second

London Stock Exchange Group Plc suffered a third outage in a few months as trading was halted in about 2,000 smaller shares.

Trading in the affected stocks was interrupted shortly after 9:15am local time and again in late morning after a brief resumption, according to the bourse operator.

In October, trading in hundreds of smaller shares was halted in the final 80 minutes of a session. And last month, LSEG’s FTSE Russell indexes suffered a 40-minute outage, disrupting trades in the UK, Italy and South Africa.

Well, having resolved the earlier outage just over an hour ago, the London Stock Exchange said it is now investigating another issue.

Similar to earlier, it said only the FTSE 100, FTSE 250 and the International Order Book are currently trading.

Bloomberg data shows several smaller stocks have been halted again.

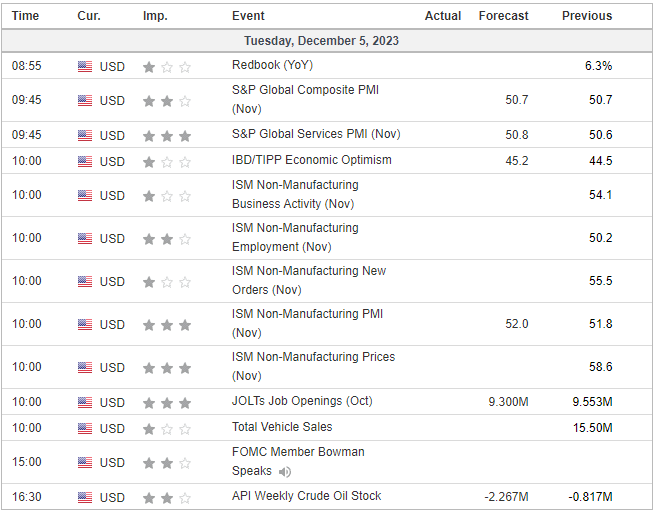

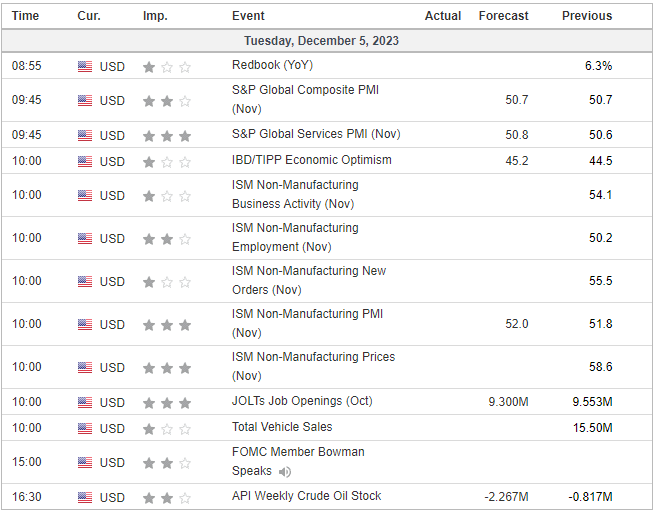

US DATA TODAY